Bitwise: Bitcoin price may see a ‘significant rally’ soon

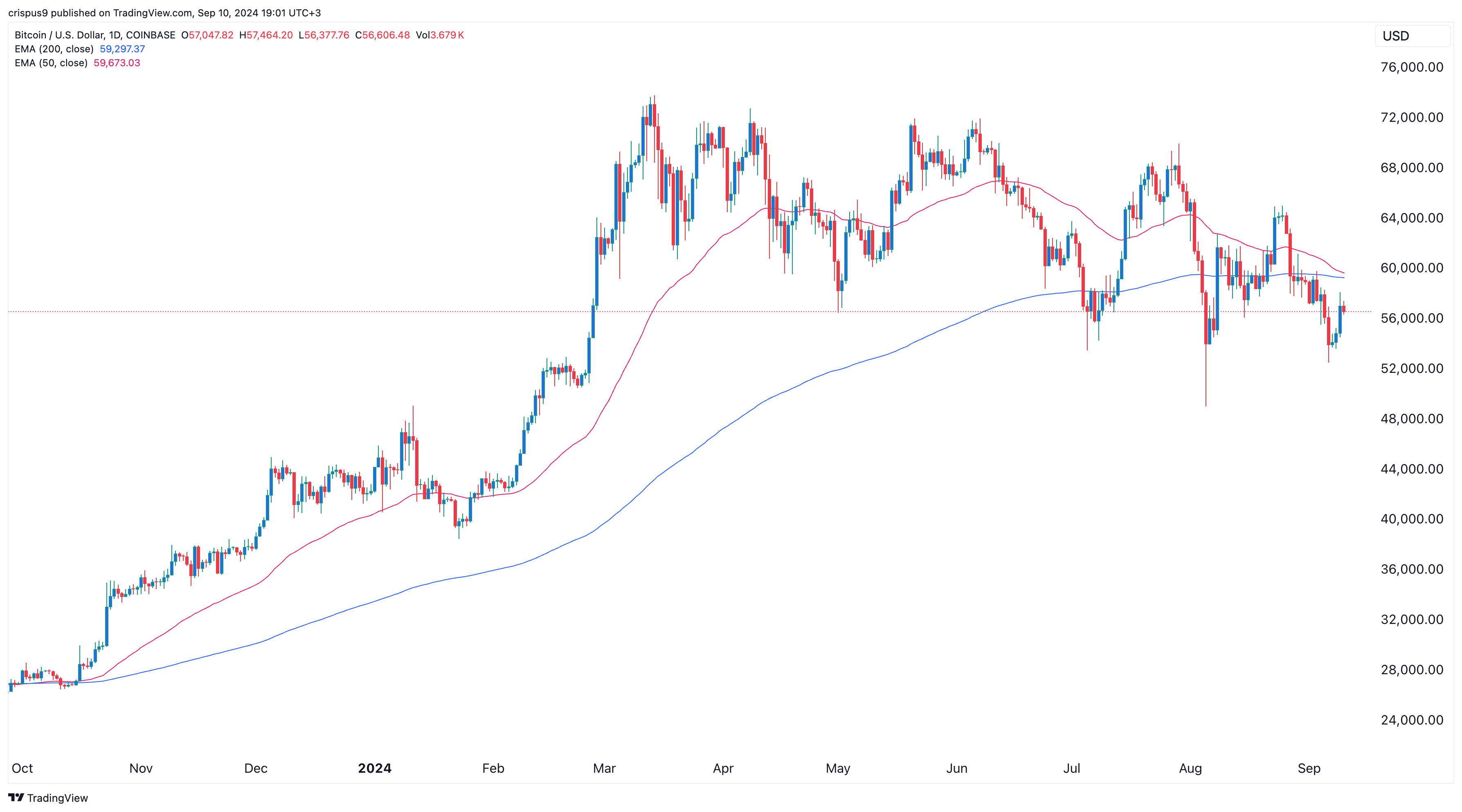

Bitcoin price continued to consolidate this week as traders awaited the upcoming U.S. Consumer Price Index report.

Bitcoin (BTC) was trading at $57,000, significantly higher than last Friday’s low of $52,000. Its price action has correlated well with American stocks, as the Nasdaq 100 and Dow Jones rose on Monday and wavered on Tuesday, Sept. 10.

Bitwise explains why Bitcoin will rally

In a note, the Chief Investment Officer at Bitwise, a leading crypto investment company with over $4 billion in assets, said that Bitcoin may see a “significant rally” in the next few months.

He cited three key reasons for this. First, he explained that Bitcoin and other risky assets, like technology stocks, tend to perform poorly in September, followed by a rebound.

According to his study, which analyzed data from 2010 to 2024, September was the worst month for Bitcoin, with an average return of minus 4.5%. He also noted that it was the worst month for the tech-heavy Nasdaq 100 index, which typically sees a 6% drop.

For this year, Matt Hougan identified three catalysts that could push Bitcoin higher in the coming months. First, the Federal Reserve is expected to start cutting interest rates in September and deliver two more cuts by the end of the year. He predicts the bank will implement 125 bps worth of cuts by December, which could push risky assets higher.

Second, Hougan expects Bitcoin to rebound as the market gains more clarity on the outcome of the general election. Polymarket suggests that Donald Trump has a higher chance of defeating Kamala Harris, although other mainstream polls show the two candidates are quite close and within the margin of error.

Third, he highlighted ETF inflows as being strong despite previous outflows. Most notably, he believes that investment advisors are adopting Bitcoin funds faster than “any new ETF in history.” In fact, some of the biggest hedge funds, such as Citadel, Millennium, and Bridgewater Associates, have invested in Bitcoin.

Bitcoin price faces risks

Still, the bullish case for Bitcoin comes with some risks. The most notable one is that Bitcoin is about to form a death cross, as the gap between the 200-day and 50-day Exponential Moving Averages continues to narrow.

It has moved from 4% last week to less than 1%. In most periods, Bitcoin tends to drop sharply after this crossover happens.

Another risk is that Bitcoin currently lacks a clear catalyst or narrative going forward. The last bull run was primarily driven by anticipation of halving and ETF approvals.