Blockchain networks collect nearly $7b in fees in 2024, data shows

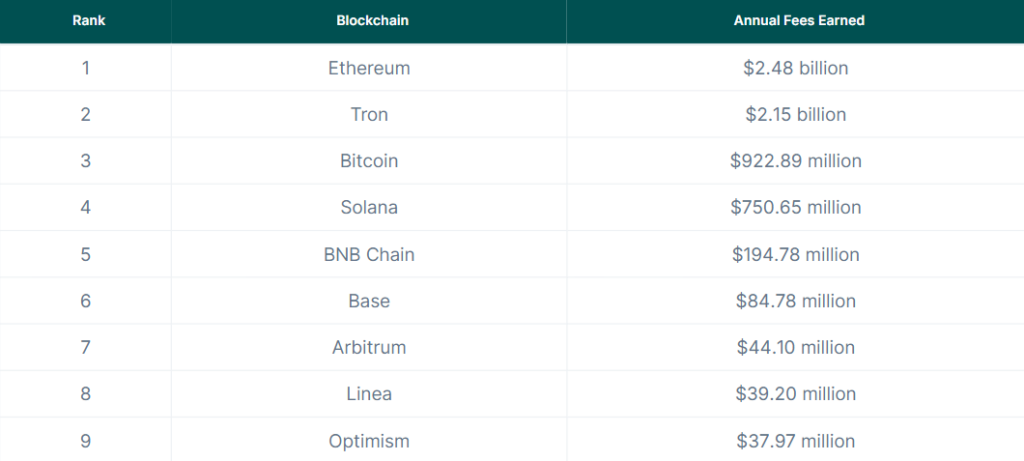

Ethereum’s dominance in fee earnings remained unchallenged in 2024, with a total of almost $2.5 billion, more than double that of TRON.

As blockchain activity exploded last year, fees went through the roof, hitting $6.89 billion, according to a CoinGecko report. Ethereum (ETH) stayed way ahead of the pack, pulling in a massive $2.48 billion in gas fees.

TRON (TRX) wasn’t far behind, pulling in $2.15 billion in fees, a huge leap from 2023. CoinGecko analysts point to TRON’s strong grip on the stablecoin market as the main driver, with monthly earnings steadily climbing throughout the year. On average, Ethereum made $6.79 million daily, while TRON followed with $5.89 million.

CoinGecko says the study examined blockchain fees from Jan. 1, 2023 to Dec. 31, 2024, based on TokenTerminal and Artemis data, excluding blockchains with insufficient publicly available fee data.

Solana (SOL), popular for meme coins, also saw a massive surge in fee earnings. The network’s earnings jumped by a jaw-dropping 2,838% to reach $750.65 million. Meanwhile, Bitcoin (BTC), with its 15.9% growth in fees, earned $922.89 million in total. CoinGecko says the surge was driven by “increased activity from Ordinal NFTs, BRC-20 and Rune tokens, as well as rapidly growing interest to build on Bitcoin.”

In the layer-2 space, Coinbase’s network Base led the charge, earning $84.78 million in fees in 2024, marking a 548.2% increase from the previous year. While Ethereum still dominates fee earnings, other layer-2s like Arbitrum, Linea, and Optimism are making their mark with $44.10 million, $39.20 million, and $37.97 million, respectively.

CoinGecko says that fluctuations in layer-2 fee earnings “for now seem to mainly reflect on-chain activity driven by token airdrop and incentive marketing programs,” adding that “it remains to be seen how much fees layer-2 chains can earn in the long term.”