Blockchain-powered private loans jump by over 55% to $581m in 2023

Blockchain-based private credit is gaining traction in 2023 as companies seek financing in a high-interest-rate environment.

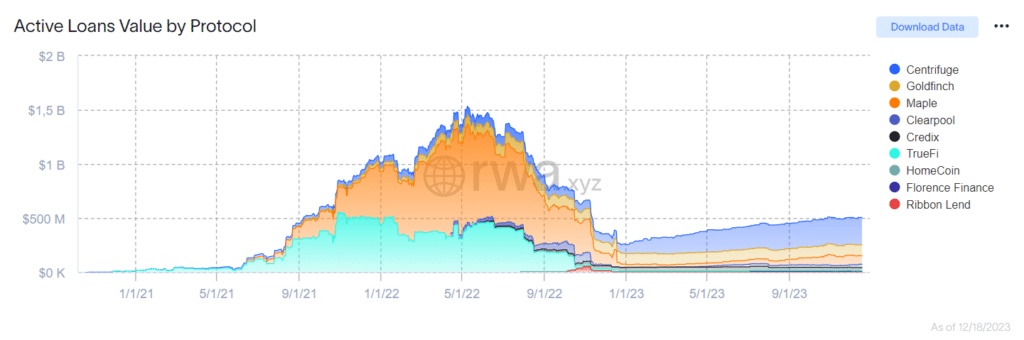

According to data from RWA.xyz, blockchain-powered private loans have surged by 55%, reaching approximately $581.6 million as of Dec. 18. While this figure is below the peak of nearly $1.5 billion in June 2022, it represents a noteworthy shift as the total loans value surpassed the $4.5 billion mark.

As reported by Bloomberg, the traditional private credit market remains dominant with a value of $1.6 trillion, dwarfing the emerging blockchain-based private credit sector.

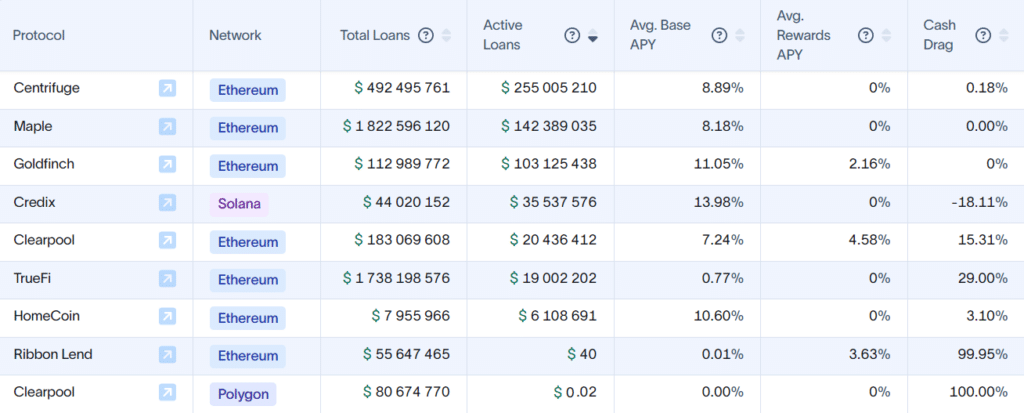

Among nine RWA protocols, only one extends its services beyond Ethereum to Solana, while another operates on Ethereum’s sidechain, Polygon. Currently, Centrifuge leads in active value, boasting over $255 million in active loans and a total loan value exceeding $492 million, according to RWA.xyz data.

Blockchain lending, leveraging increased transparency and smart contracts, is acknowledged for reducing risks and lowering borrowing rates compared to the slower and more opaque traditional private credit market. This evolving landscape is enticing for investors, with blockchain protocols charging borrowers less than 10% APR, a significant contrast to the 15% to 20% rates prevalent in traditional finance.

Crypto giants are also entering the blockchain-based private credit space with new developments, such as Project Diamond by Coinbase Asset Management. As crypto.news earlier reported, the new product leverages Ethereum’s layer-2 scaling network, Base, and integrates Coinbase’s components, including the exchange’s Prime’s services as well as web3 crypto wallet, and Circle’s USDC stablecoin.

Currently, Project Diamond is accessible to registered institutional users outside the U.S. The launch occurs amid intense competition to integrate traditional financial assets like bonds and credit into blockchain systems. This process, known as the tokenization of real-world assets, is believed to enhance settlement speeds, reduce operational costs, and increase transparency.