BONE sees 25% weekly gains as daily addresses surge

Bone ShibaSwap (BONE), the governance token for the ShibaSwap DEX and one of the Shiba Inu ecosystem tokens, has skyrocketed 25% over the past week.

The impressive run has been supported by a noticeable surge in daily active addresses since July 28.

BONE failed to capitalize on the altcoin rally within the broader market on July 13, triggered by the favorable ruling in the Ripple case.

Despite a marked uptick registered by several altcoins, BONE saw a meager 5.42% increase.

Notably, the bears quickly erased the asset’s modest gains, leading to a 12% decline five days later. The bearish situation coincided with a significant drop in daily active addresses, as investors’ interest declined drastically amid exhaustion of an earlier rally.

BONE registers bullish momentum

However, BONE embarked on a solo rally following the dip on July 18, registering intermittent gains on the heels of a renewal of interest among investors.

BONE rallied from a price of $1.2368 on Jul. 26 to its current value of $1.5398 at the time of reporting. This marks a 24.91% increase in six days.

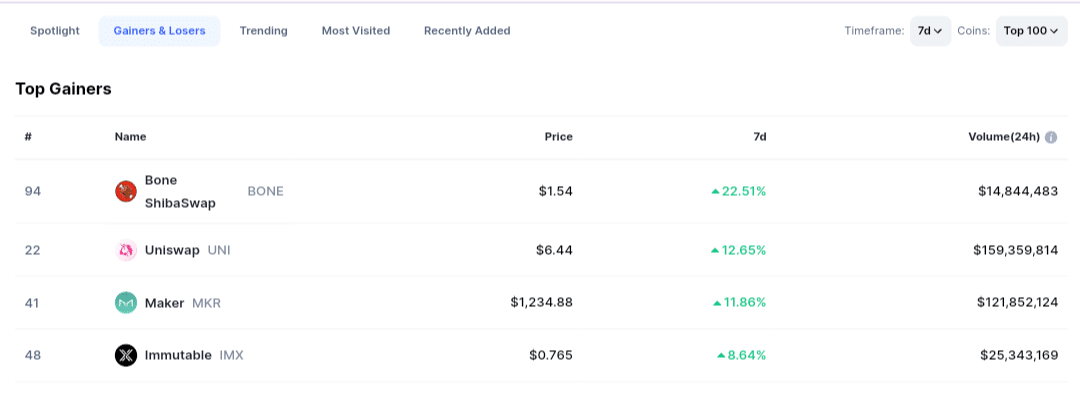

The remarkable price surge has positioned BONE as the top gainers among the top 100 assets in the past seven days. With a 22.51% weekly increase, BONE towers over other notable assets, such as Uniswap (UNI) and Maker (MKR), on the gainers’ list.

BONE is currently trading at a four-month high, looking to leverage the recent momentum to seal its position above the $1.54 price territory. The asset has now soared above the 50-day EMA ($1.1752) and 200-day EMA ($1.0746) on the daily timeframe. This signals bullish prospects in the near and long term.

Moreover, the 50-day EMA recently moved above the 200-day EMA, confirming the formation of a golden cross. A golden cross occurs when a shorter-term moving average crosses above a longer-term moving average, indicating a potential upward trend reversal.

The last two times BONE witnessed a golden cross on the daily timeframe was in January this year and August 2022. Each time the cross occurred, an impressive rally in BONE’s value immediately followed, confirming the bullish momentum. However, past successes do not guarantee future performance, and investors should tread carefully regardless.

Surge in active addresses

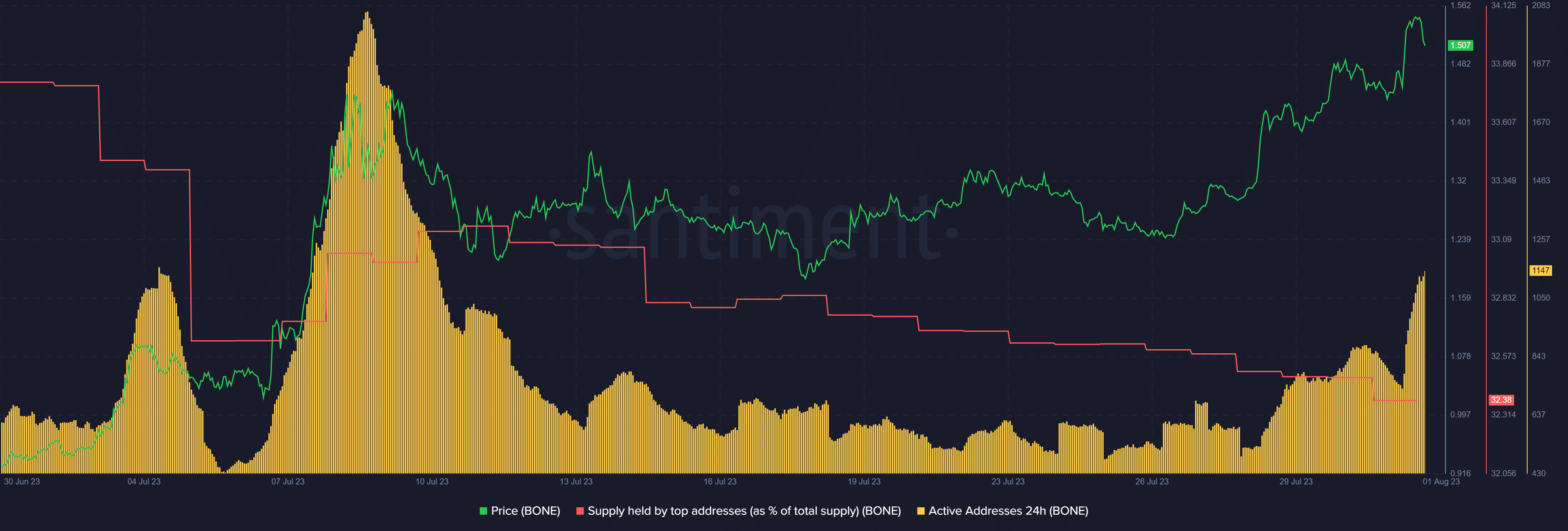

Interestingly, the recent rally from BONE coincides with a surge in daily active addresses. Data from market intelligence provider Santiment highlights a surge, suggesting a renewal of investors’ interest.

Active address count on the 24-hour timeframe has seen a remarkable and sustained increase since Jul. 28. Owing to this upsurge, daily active addresses currently stand at 1,147. This value represents the highest figure recorded since mid-July.

Notably, BONE observed a much higher surge in daily active addresses from early July. Similarly, this surge compounded the asset’s bullish momentum, leading to a rally that helped BONE reclaim the $1 psychological price territory for the first time in two months.

BONE builds on the previous gains, aiming to recover the $2 price point. The latest rally has persisted amid a gradual decline in the supply held by top addresses. Notably, these large addresses’ holdings as a percentage of the asset’s circulating supply has now dropped to 32.38%.