BTC jump to $44k cost traders almost $270m

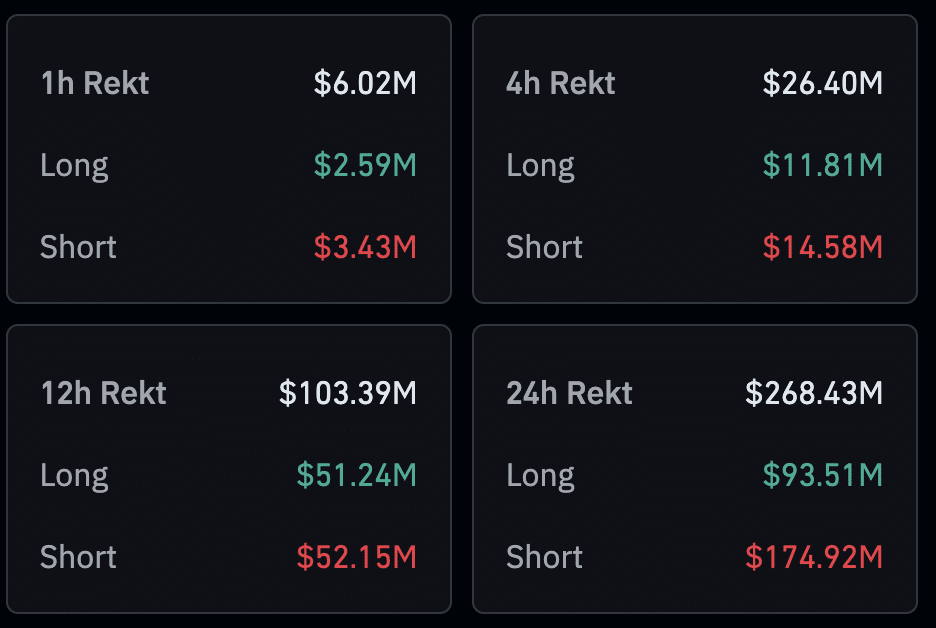

The total amount of liquidations on the crypto market over the past 24 hours approached $269 million.

Most of the forced closings were in Bitcoin (BTC) and Ethereum (ETH), according to Coinglass data.

The sharp rise in BTC price to a new yearly high of $44,313 cost short sellers $174.91 million. Market participants who opened short positions in Ethereum also suffered significant losses – the jump in the price of the second largest cryptocurrency by capitalization to $2,300 cost them $34.21 million.

The leaders in liquidations among altcoins were ORDI, BIGTIME and several other tokens.

More than 90% of the liquidations were distributed among OKX, Bybit, Binance, and Huobi. The largest order was executed by OKX – the exchange closed a long BTCUSDT in the amount of $8.86 million.

The price of BTC updated its annual maximum, exceeding $44,000. The rate of the main cryptocurrency, fueled by speculation around the imminent approval of applications for a spot Bitcoin ETF, has been growing for several weeks in a row without significant corrections. At the time of writing, BTC is trading at $43,990.

A few days earlier, traders liquidated almost $193 million after the BTC price crossed the $41,000 mark. The largest number of positions were liquidated on Binance.