Cake DeFi – A Platform that Institutional Investors Can Trust

As high-interest rates bring more focus from institutional investors and VCs to the DeFi space, there has been a growing concern over the sustainability and viability of platforms offering such lofty returns.

After all, funds have fiduciary responsibilities to protect their LP’s capital and to conduct proper due diligence. However, DeFi platforms are forking in all directions and coming to market at breakneck speed. Many newly launched projects have anonymous teams and unaudited code, thereby raising legitimate concern from institutional investors.

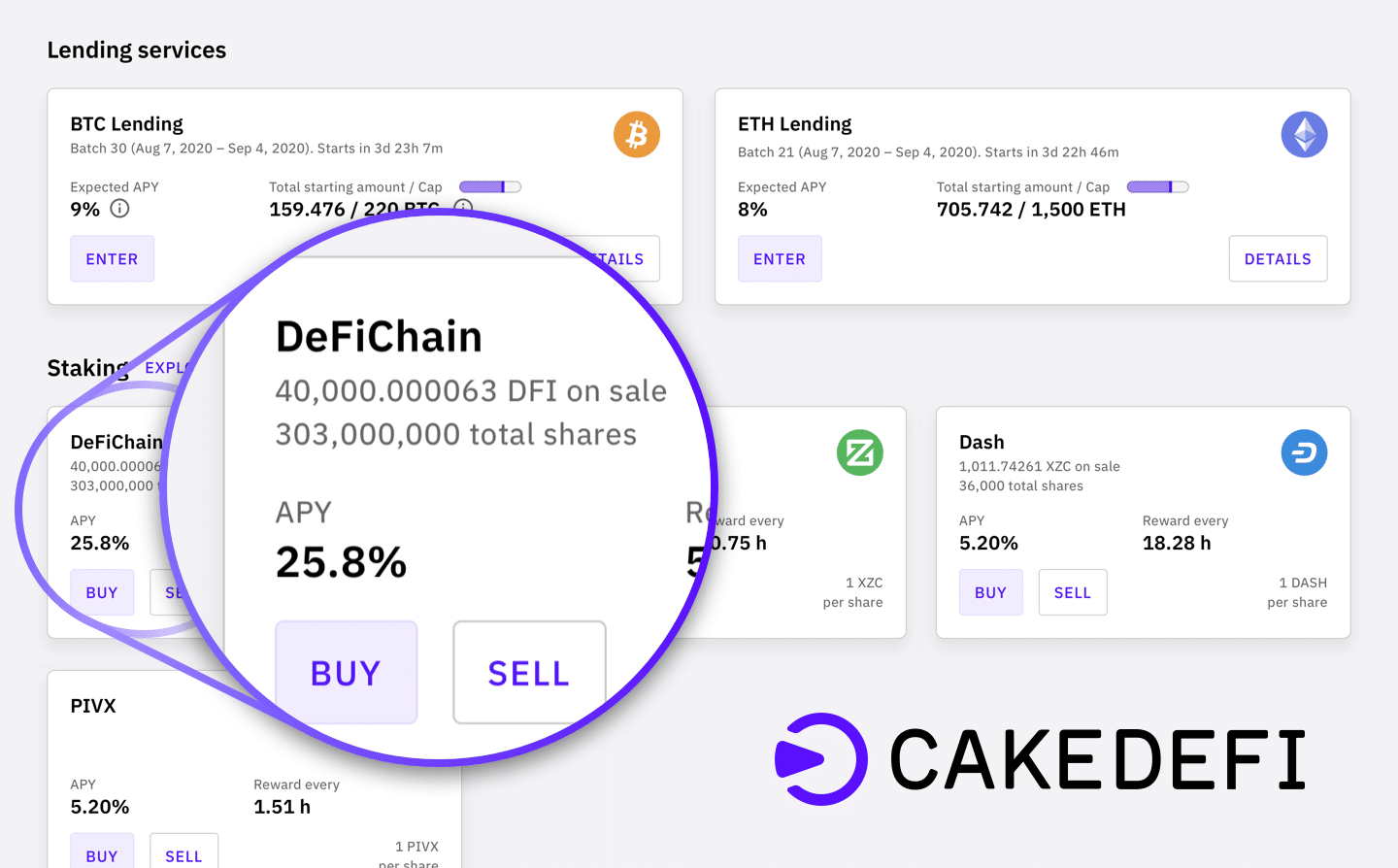

Enter Cake DeFi – a fully transparent and regulated platform that offers 9% on BTC and 8% on ETH. The company is growing rapidly at 10% week on week, and has hired key appointments including Ezra Tay, the new General Counsel & Head of Compliance. Tay has experience as General Counsel at Capital Match, and Industrial and Commercial Bank of China, and Legal Consultant at Credit Suisse and Duane Morris. Tay holds a Masters of Law from National University of Singapore and Bachelor of Laws from University of Southampton.

“As one of the most innovative blockchain startups, Cake DeFi forges the path ahead with our groundbreaking products and services. But Cake’s primary focus is our users. We want our users to understand what we do for them and what the risks are,” said Tay.

Cake DeFi’s Differentiation From Competitors

Cake, based out of Singapore, is located in a jurisdiction where regulators are committed to upholding FATF standards. Cake DeFi will serve as one of the largest proponents of innovating within the bounds of the legal and compliance framework of Singapore.

Cake has applied for a Payment Service Provider Licence with the MAS, which has adopted a new framework for regulating payment services, including cryptocurrency exchanges and service providers. The company is a verified member of the Singapore Fintech Association, and is also a member of the The Association of Cryptocurrency Enterprises and Start-ups Singapore (ACCESS) – a group comprising over 400 crypto and blockchain-related businesses allowing Cake to have better knowledge of industry standards and practice for the cryptocurrency and blockchain industry in Singapore.

Cake DeFi is one of the few cryptocurrency platforms that has a full-time General Counsel and Compliance professional with a wealth of financial services experience, differentiating the platform from competitors. The fact that the company has hired a full-time General Counsel shows that the Company is not an experimental and unaudited project such as YAM that was launched without the necessary checks and safeguards. The Company is incorporated and has competent hires listed publicly on its website as opposed to being anonymous and open-source. This should give institutional funds further assurance that their crypto assets are in good hands.

Cake’s leadership has deep knowledge of the cryptocurrency industry through co-founder U-Zyn Chua’s experience as one of the early contributors to the Bitcoin and Dash ecosystems. U-Zyn’s experience also includes being the blockchain architect at Sparrow Exchange in Singapore, and blockchain advisor to various entities within the Singapore Government.

Co-Founder and CEO Dr. Julian Hosp is a serial entrepreneur, and a frequently featured speaker at blockchain summits and conferences. Hosp’s experience boosts the company’s rapid growth via his pre-established network of know-how and business contacts. Having the largest influence in the German speaking cryptocurrency world, Hosp provides a significant advantage in Cake’s international expansion plans.

For investors looking for a rising crypto project that features strong regulatory compliance and full transparency of its operations and products, Cake DeFi stands out as the sound platform.