CAKE rebounds as PancakeSwap flips Raydium, Uniswap

PancakeSwap’s price has rebounded, rising for three consecutive days, and reaching its highest level since Jan. 25.

PancakeSwap (CAKE) token rose to a high of $2.1600, up by over 75% from its lowest level this month, bringing its market cap to $556 million.

The CAKE token rallied as investors anticipated more volume after the DEX network expanded its advanced trading tools on Arbitrum, Linea, and Base protocols. These tools, like dLIMIT, which have existed on the BSC Chain, will help with order execution.

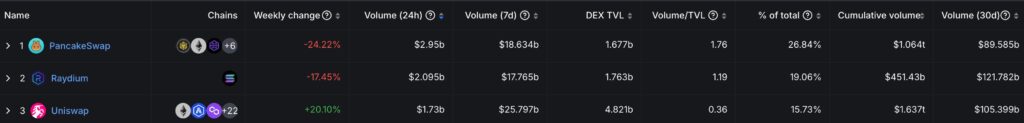

PancakeSwap has also maintained its market share in the decentralized exchange industry. DeFi Llama data shows that it handled the most volume in the last 24 hours, flipping top DEX networks like Raydium and Uniswap.

Its volume was $2.95 billion, while the other two had $2.09 billion and $1.73 billion, respectively.

PancakeSwap has handled DEX volume worth $90 billion in the last 30 days, making it a major place in decentralized finance. Most of its volume happens in the BSC Chain, followed by Base and Arbitrum.

PancakeSwap significantly differs from other DEX networks like Uniswap and Raydium in offering more services. In addition to its swap services, it offers yield farming solutions that have over $1.67 billion in assets. It also offers a prediction market where traders bet on the direction of crypto assets.

PancakeSwap price forecast

The daily chart shows that the CAKE price bottomed at $1.1380 last week as most cryptocurrencies crashed. It formed a hammer candlestick pattern, comprising a small body and a long lower shadow.

A hammer is a popular bullish reversal pattern, which explains why it has rebounded recently.

PancakeSwap, which was launched in September 2020 by anonymous developers, has moved above the 78.6% Fibonacci Retracement level. This retracement is drawn by connecting the lowest level in August last year and the highest point in December.

The challenge, however, is that PancakeSwap price has remained below the 50-day Exponential Moving Average. It has also failed to move above the descending trendline that connects the highest swing since Jan. 4.

Therefore, the downward trend will likely continue as long as the token remains below these key resistance levels.

On the other hand, a rebound above these levels will point to more gains, possibly to the 50% Fibonacci Retracement point at $2.90.

PancakeSwap operates on the Binance Smart Chain and is governed partially by its community.