Can BNB price hit $1,100 as staking yield hits 12%?

Binance Coin price continued to consolidate at a key resistance level as its recent rally showed signs of losing momentum.

The Binance Coin (BNB), the native token for the BSC network, was trading at $655 on Nov. 29. It has risen by 223% from its lowest level in 2023 and by 9% in November, underperforming most major cryptocurrencies.

The BNB coin has strong fundamentals and technical indicators pointing to potential further gains in December. The BSC ecosystem has been performing well, with the total value locked in its DeFi ecosystem increasing by 18% to $5.53 billion over the past 30 days.

Similarly, the volume of cryptocurrencies traded on its DEX protocols, such as PancakeSwap (CAKE) and Uniswap, rose to over $34 billion in the same period, with PancakeSwap contributing nearly $30 billion.

Data also shows that the network continues to reduce coin circulation through burning. Over the last seven days, 652 coins worth $429,000 were burned. In total, the network has eliminated coins worth $160 million, aiming to reduce the total supply from 144 million to 100 million, a measure designed to curb inflation.

The ongoing burn, along with rising network revenue, has significantly boosted its staking yield, which stands at 12.5%. This means a $100,000 investment in BNB could yield approximately $12,500 annually.

BNB price technicals mean $1,100 is reachable

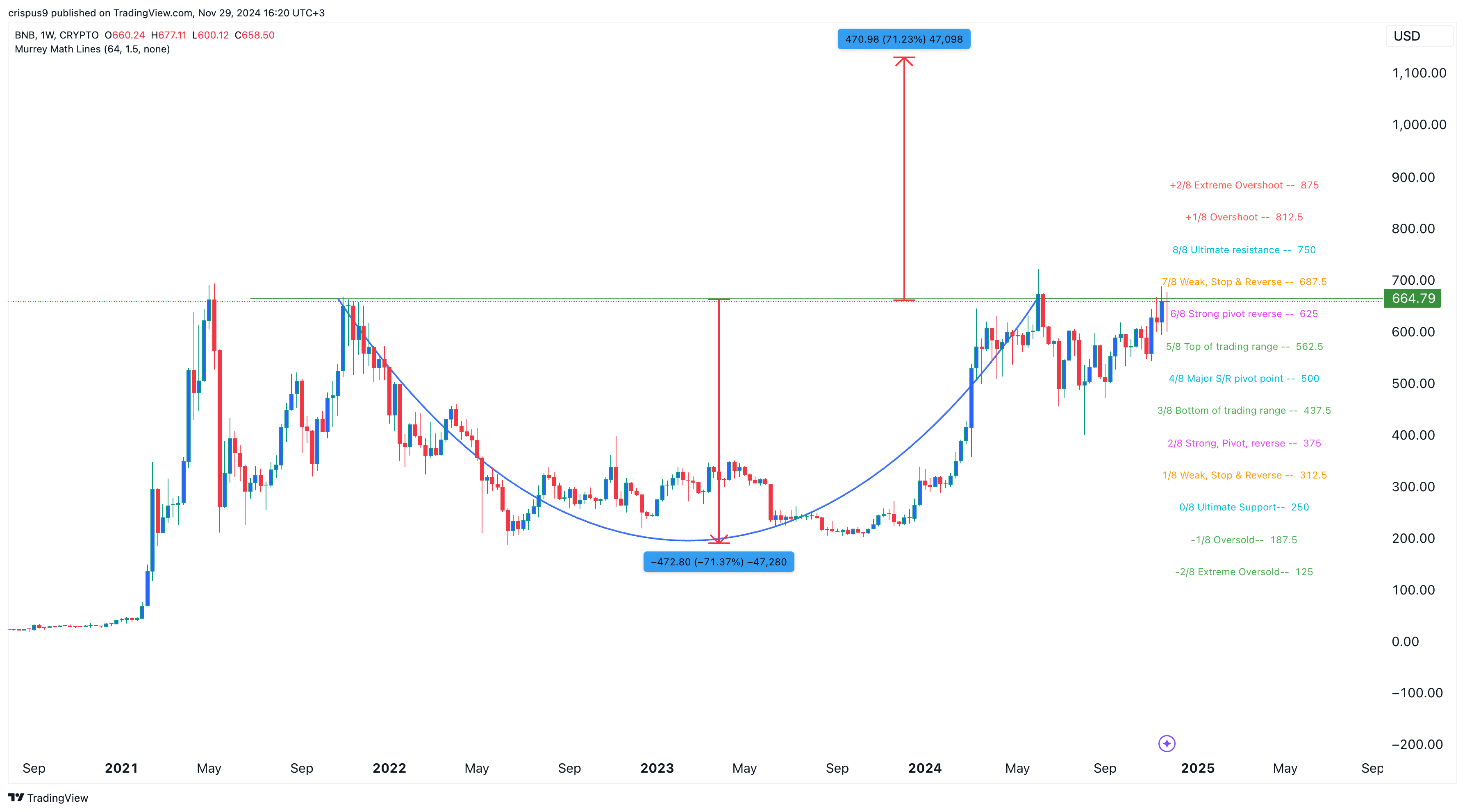

The weekly chart indicates that Binance Coin has potential for more upside in the coming weeks. It has formed a cup and handle pattern since October 2021, with resistance at $665. This bullish pattern includes a horizontal line, a rounded bottom, and consolidation or retracement.

The depth of the cup is around 70%. Applying the same measurement from the $665 level suggests the coin could rise to $1,130 upon a breakout. For this to happen, BNB must surpass critical levels at $875, the extreme overshoot of the Murrey Math Lines, and the psychological level at $1,000.

The invalidation point for this outlook is $437, which marks the bottom of the trading range based on the Murrey Math Lines tool.