Cardano price on the edge: is this $500m trading signal a game-changer?

Since March 20, Cardano’s price has consolidated in the $0.61 to $0.64 territory, as market indicators emphasize the risk of ADA slipping into a bearish reversal.

Cardano has underperformed the market average this week, delivering a sideways price movement, while Solana (SOL) and Avalanche (AVAX) have registered double-digit price gains.

On-chain data trends highlight the prevailing bearish catalyst behind the lackluster ADA price performance.

Cardano missing-in-action on dominant market themes

Layer-2 gas fee optimization, memecoin rave, and rising defi activity have emerged as the dominant themes among crypto investors in the past week. Still, the Cardano blockchain network appears to be missing out on all three fronts.

In the defi sector, Solana gained major plaudits as it outpaced Ethereum (ETH) in defi trading volumes. In stark comparison, the Cardano smart contract ecosystem has declined this week.

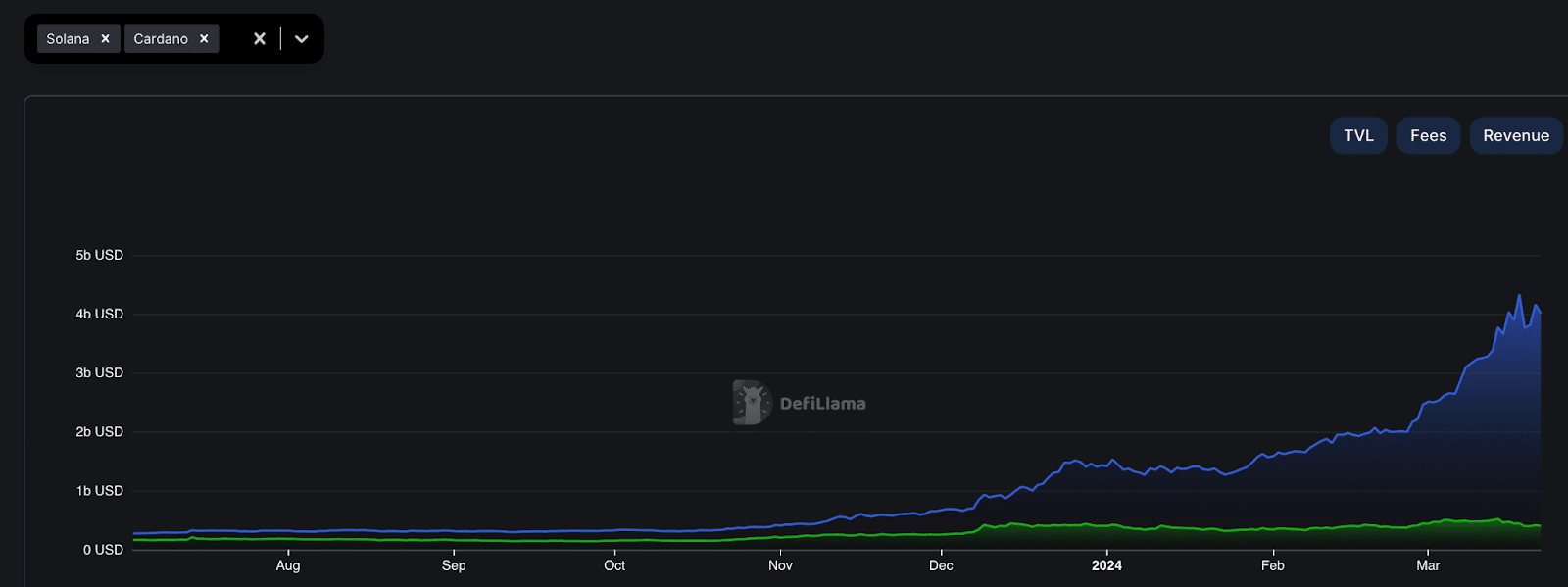

DefiLlama’s total value-locked trends present real-time data on the nominal value of assets deposited on a blockchain ecosystem.

As seen above, Cardano TVL stood at $520 million as of March 14. But at press time on March 22, that figure has now dwindled to $409.9 million, representing a whopping $110 million decline over the past week. In comparison, Solana defi TVL has grown by over $200 million during that period.

Such a large decline in defi participation on a Layer-1 blockchain network often suggests a bearish outlook for the underlying native token.

It signals a downtrend in demand for defi services hosted on the network, which has seen ADA lose market share to the likes of Solana and vibrant Layer-2 networks like Arbitrum (ARB) and Optimism (OP) buoyed by the transaction fee optimization executed by the Dencun upgrade.

This absence in Cardano defi traction has played a pivotal role in the ongoing ADA price pullback.

Traders closed $500m ADA futures contracts in 30 days

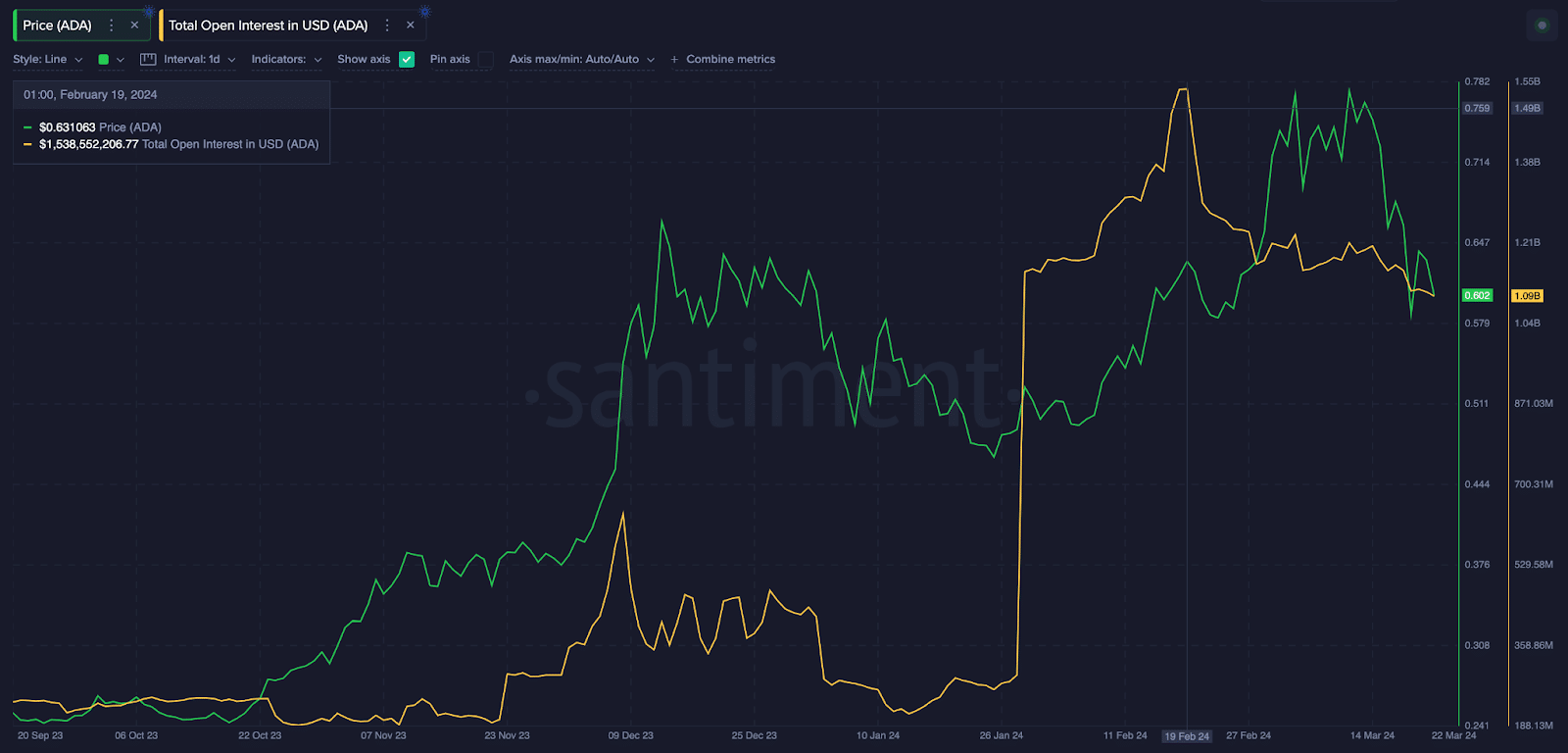

Looking at more market data, Cardano speculative traders appear to have also taken a cue from the recent trends and begun to lean bearish. Santiment’s open interest data presents the total value of active futures contracts on a specific cryptocurrency.

The chart below shows how ADA open interest has declined over the last 30 days.

Cardano’s open interest in the derivatives markets has declined by $500 million over the past month, dropping from $1.5 billion on Feb 19 to $1.1 billion at press time on March 22.

The $500 million decline in ADA open interest is another critical factor contributing to the bearish sentiment across ADA markets. Typically, falling open interest amid a price consolidation phase signals that traders are bracing for a more bearish outlook.

Also, ADA’s current flat price action presents limited opportunities for traders to profit from significant market fluctuations. Hence, speculative traders may liquidate more positions in the coming days.

Cardano (ADA) price forecast: $0.60 support is at risk

With low defi demand and existing market participants rapidly making $500 million capital outflows in the past month, Cardano’s price looks set for a significant downswing toward $0.50 as March 2024 draws to an end.

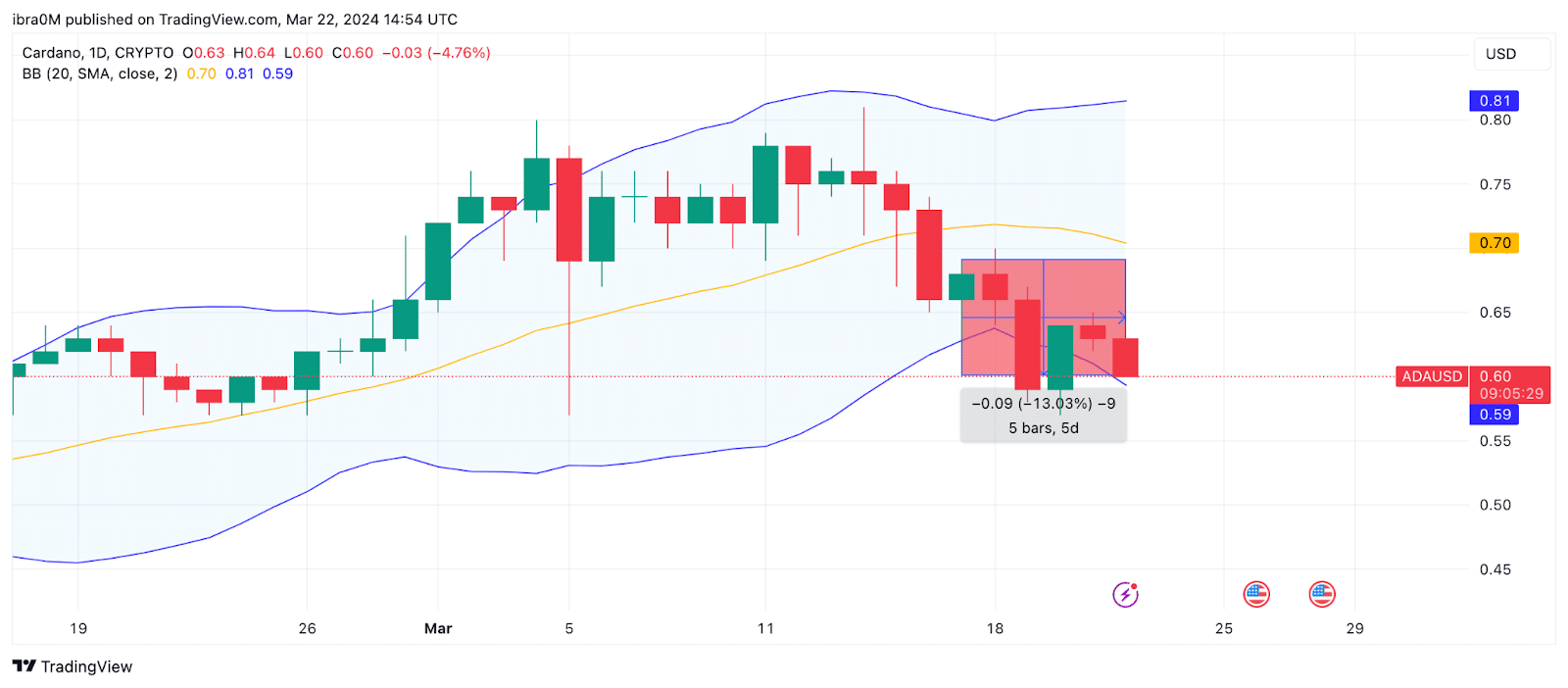

The ADA price is currently hanging precariously above $0.61, down 13% weekly. However, the lower limit of the Bollinger band technical indicator shows a major support buy-wall at the psychological support of $0.60.

If traders keep closing out positions, ADA prices will likely break below $0.60 and tumble towards $0.55 in the weeks ahead.

On the upside, for the market to swing positive again, ADA bulls will have to stage a break above the 20-day Simple Moving Average price of $0.70.