Cardano price ‘seeing most bearishness’ as altcoins rebound

Cardano has risen after bottoming at $0.3174 earlier this month

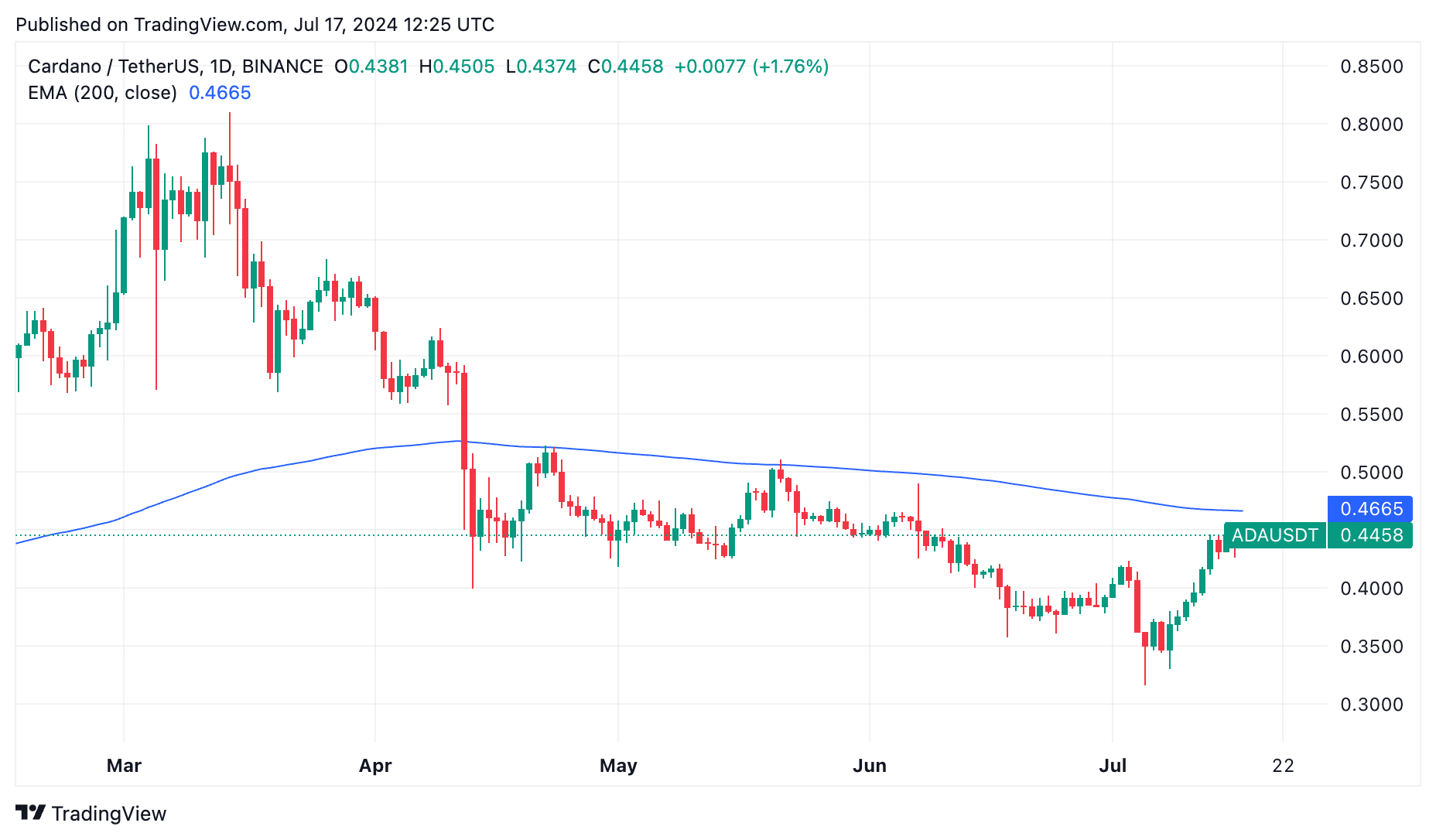

Cardano (ADA) has has bounced back by 40% from its lowest point this month but remains 45% below its highest point this year. Despite being one of the largest cryptocurrencies, Cardano has faced intense pressure in recent months, with its market cap falling from over $90 billion in 2021 to $15.9 billion on Wednesday.

External data indicates that Cardano’s interest among developers and investors has waned recently. According to DeFi Llama, the number of monthly developer commits dropped from 3,380 in May to 3,300 in June, and currently stands at less than 2,000 this month.

Additionally, the amount of money locked in Cardano’s DeFi applications has decreased from a record high of 633 million ADA in December 2023 to 538 million ADA on Wednesday. Its TVL of $247 million is much smaller compared to newer blockchains like Base, Blast, Sui, Mode, and Aptos.

Unlike Solana, BNB Chain, and Ethereum, Cardano has no major meme coin or decentralized exchange (DEX). Minswap, its biggest DEX, handled less than $1 million in transactions in the past 24 hours, whereas Solana’s Raydium processed $851 million.

Cardano also has a limited market share in the declining NFT market as it handled sales worth $1.6 million in the last 30 days. The number of Cardano addresses has dropped to less than 30k, and the amount of stablecoins is less than $20 million.

Cardano’s sentiment is waning

Sentiment among traders has been falling recently. The daily volume of Cardano has remained below $500 million since July 5th. In contrast, smaller meme coins like Pepe and Dogwifhat are handling over $700 million daily. The same trend is observed in the futures market.

Data by Santiment shows that interest among traders has dropped to the lowest level in months. Most traders are mostly concerned about the coin’s underperformance and lack of developer activity.

Cardano also has one of the lowest staking yields in the market. Data by StakingRewards shows that it has a staking yield of less than 3%.

Technically, Cardano remains below the 200-day moving average, suggesting that the ongoing recovery may be short-lived.

On a positive note, the crypto fear and greed index is about to flash green as hopes of a Federal Reserve rate cut rise. Therefore, ADA price will likely rise if Bitcoin sustains its rally and crosses the year-to-date high of $73,400.