Cathie Wood predicts Bitcoin’s $2t market cap will soon flip gold after hitting $100k milestone

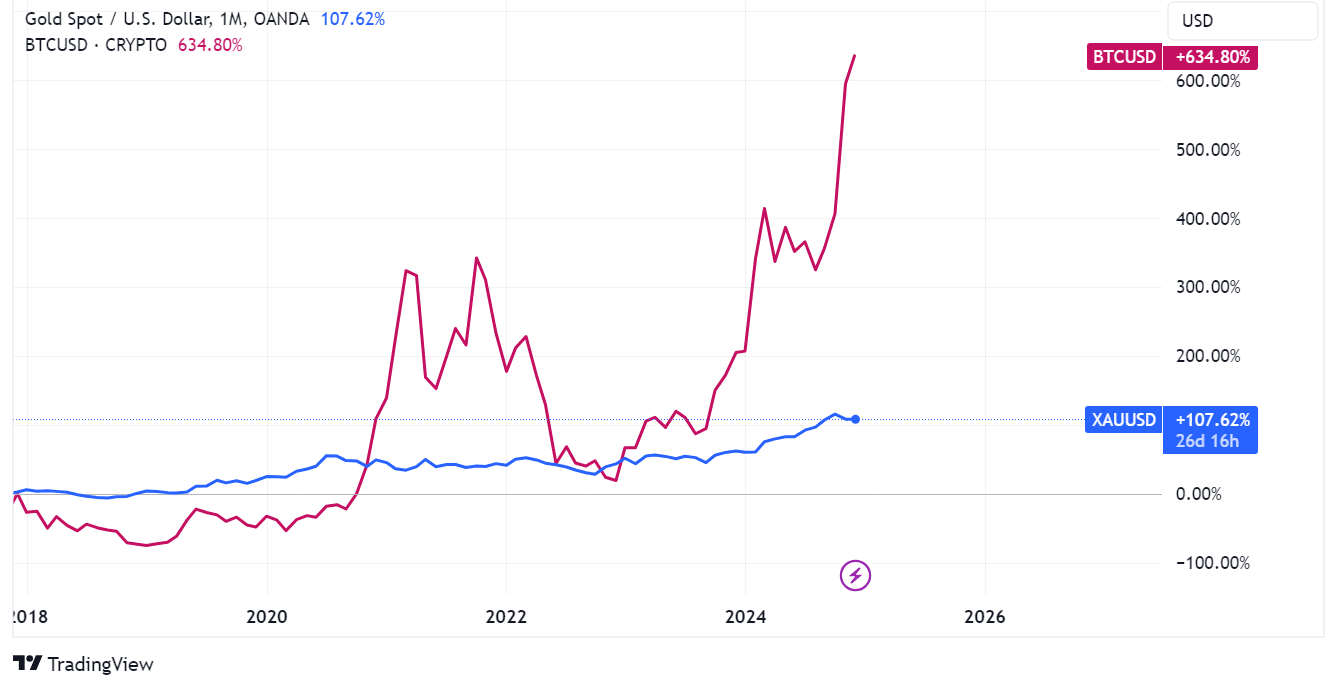

Founder and CEO of ARK Investment Management, Cathie Wood believes Bitcoin is ‘bigger’ than gold, predicting BTC’s $2 trillion market cap could one day surpass gold’s $15 trillion over time.

In a recent post on Dec. 5, Cathie Wood reacted to the Federal Reserve Chair Jerome Powell’s comments on Bitcoin (BTC), describing the cryptocurrency with the largest market cap as a virtual version of gold.

Wood stated that ARK Investment Management believes Bitcoin is “a much bigger idea” than gold. She drew comparisons between gold’s value and Bitcoin’s.

Gold, a commodity that’s been on the market much longer than Bitcoin, has a market cap that stands at around $15 trillion. Meanwhile, Bitcoin’s market cap just reached $2 trillion. Therefore, she concluded Bitcoin is still in its early stages, and has the potential to surpass gold’s market value.

“At $2,700, gold is a $15 trillion market, compared to Bitcoin at only $2 trillion. Even after breaking through $100,000, Bitcoin still is in early innings,” said Wood in her post.

Bitcoin recently broke through the $100,000 ceiling after going up 5% in the past 24 hours of trading on Dec. 5, based on data from crypto.news. This is the first time in history Bitcoin’s price has ever gone over $100,000. Bitcoin’s market cap followed suit, rising by 5.74% to a value of $2 trillion. At the time of writing, BTC is currently trading hands at $101,690.

Hours before Bitcoin’s monumental jump to $100,000, Fed Chair Jerome Powell publicly dubbed Bitcoin as virtual gold due to how traders have a tendency to use both assets to protect the value of money rather than as a payment option. Thus, he sees Bitcoin as more of a competitor for gold instead of the U.S dollar.

For years, traders have noted how Bitcoin and gold price movements have often gone hand-in-hand, usually with Bitcoin following soon after gold goes up. This is mainly due to both assets’ status as “safe-havens” that protect investors from the volatility of national currencies.

When the state of the current economy dips and worldly currencies begin to plummet, investors often turn to assets like gold and Bitcoin because their value is not tied to one specific currency. Another similarity these assets share is their finite supply as both need to be mined, albeit in two completely different ways, before market circulation.