Cathie Wood’s Bitcoin ETF sets record with $243.5m daily inflow

On March 28, The ARK 21Shares Bitcoin ETF witnessed an unprecedented $243.5 million in investments, marking a significant uptick over five times its usual daily intake, as Bitcoin neared the $72,000 threshold.

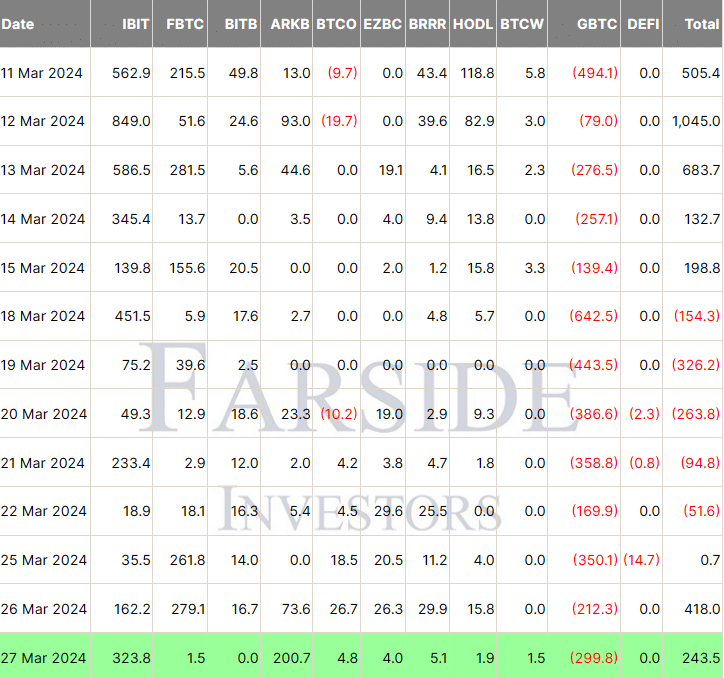

According to early insights from Farside Investors, the inflow on March 27 into the ARK 21Shares Bitcoin ETF surged to four times its average daily inflow of $43.9 million since its debut on January 11.

This influx almost tripled the previous day’s $73.6 million, significantly outpacing the lack of inflow scenario on March 25.

Meanwhile, Blackrock’s Bitcoin ETF (IBIT) saw an even more impressive inflow, with $323.8 million in new investments.

In contrast, other Bitcoin ETFs like Valkyrie Bitcoin ETF (BRRR) recorded $5.1 million, Invesco Galaxy Bitcoin ETF (BTCO) saw $4.8 million, Franklin Bitcoin ETF (EZBC) attracted $4 million, and VanEck Bitcoin ETF (HODL) observed $1.9 million in new investments.

Both WisdomTree Bitcoin ETF (BTCW) and Fidelity Investments Bitcoin ETF (FBTC) reported inflows of $1.5 million, showcasing more modest gains.

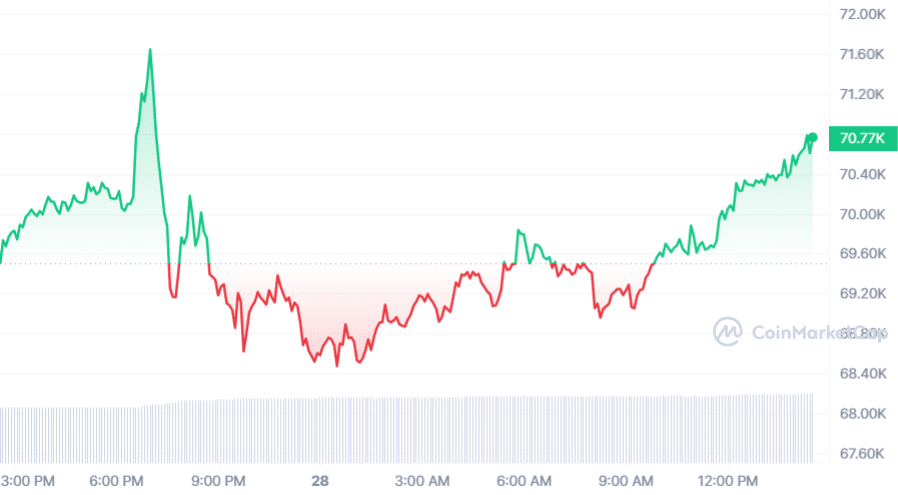

As this occurred, Bitcoin reached a high of $71,670 but dipped below the $69,000 level, eventually settling at $69,698 by day’s end. Currently, Bitcoin is priced at $70,783, according to CoinMarketCap.

Cryptocurrency analysts have started debating that the focus on Bitcoin’s immediate price movements overshadows a more significant trend.

On March 28, through a post on X, crypto analyst Gumshoe shared with his 28,900 followers that the attention is overly concentrated on daily price movements rather than acknowledging the substantial investments flowing into Bitcoin.

“With Bitcoin ETFs experiencing record inflows, the concern over the daily price seems misplaced,” he commented.

On March 27, Bitwise’s Chief Investment Officer Matt Hougan pointed out on X that many professional investors are still barred from purchasing Bitcoin ETFs, notably in the UK where the regulatory environment remains cautious towards crypto.

He suggested that the landscape for Bitcoin ETF investments would evolve gradually over the next couple of years through numerous individual assessments.

As these significant inflows into Bitcoin ETFs reflect a growing institutional interest in cryptocurrency, ARK Invest’s CEO, Cathie Wood, has projected Bitcoin’s price could reach as high as $3.8 million, driven by its growing role in the “financial superhighway.”

Wood contends that the SEC’s cautious approach to institutional Bitcoin investments could inadvertently boost its price.

The launch of these financial products has led to a spike in demand, breaking previous US ETF investment records and stirring renewed interest in Bitcoin, which these funds directly procure and manage.

Industry experts support Wood’s view that the forthcoming Bitcoin halving event in April will lead to a supply shock, bolstering the ongoing demand-driven price rally.