Celestia’s TIA rises amid network upgrade, but faces one key risk

Celestia, the modular data network, has risen for three consecutive days after developers provided an update about an upcoming upgrade.

Celestia (TIA) token rose to $6.28, up 60% from its lowest level this year, bringing its market cap to $1.3 billion. It remains 72% below its all-time high of $21.10.

Celestia has made several important headlines in the past few weeks. In September, it raised $100 million from Bain Capital, Robot Ventures, and Placeholder. This fundraising brought its total funding to $155 million, making it one of the best-funded players in the crypto industry.

The fundraising occurred as developers and the community worked to scale the network to handle 1-gigabyte blocks.

In a statement this week, Celestia Labs unveiled the results of the Mammoth Mini testnet, which will implement 88 MB blocks with an average of 27 MB/s of permissionless data throughput. This is a significant step as the network moves towards 1 GB blocks and above, given that the network currently handles 2 MB blocks every 12 seconds.

The Mammoth Mini testnet will now transition to a public testnet, followed by its mainnet in 2025, pending community approval. Cryptocurrencies often perform well ahead of major updates.

The Mammoth Mini upgrade follows the Shwap upgrade, which was implemented a few months ago. Shwap makes data sampling 12x faster and reduces storage requirements by about 16.5x.

The big risk that could affect Celestia’s price is the upcoming large token unlock scheduled for Oct. 31. The network will unlock 175.74 million tokens worth $175 million, accounting for 16.3% of the total supply. Token unlocks can lead to dilution, which affects existing holders, especially those earning through staking.

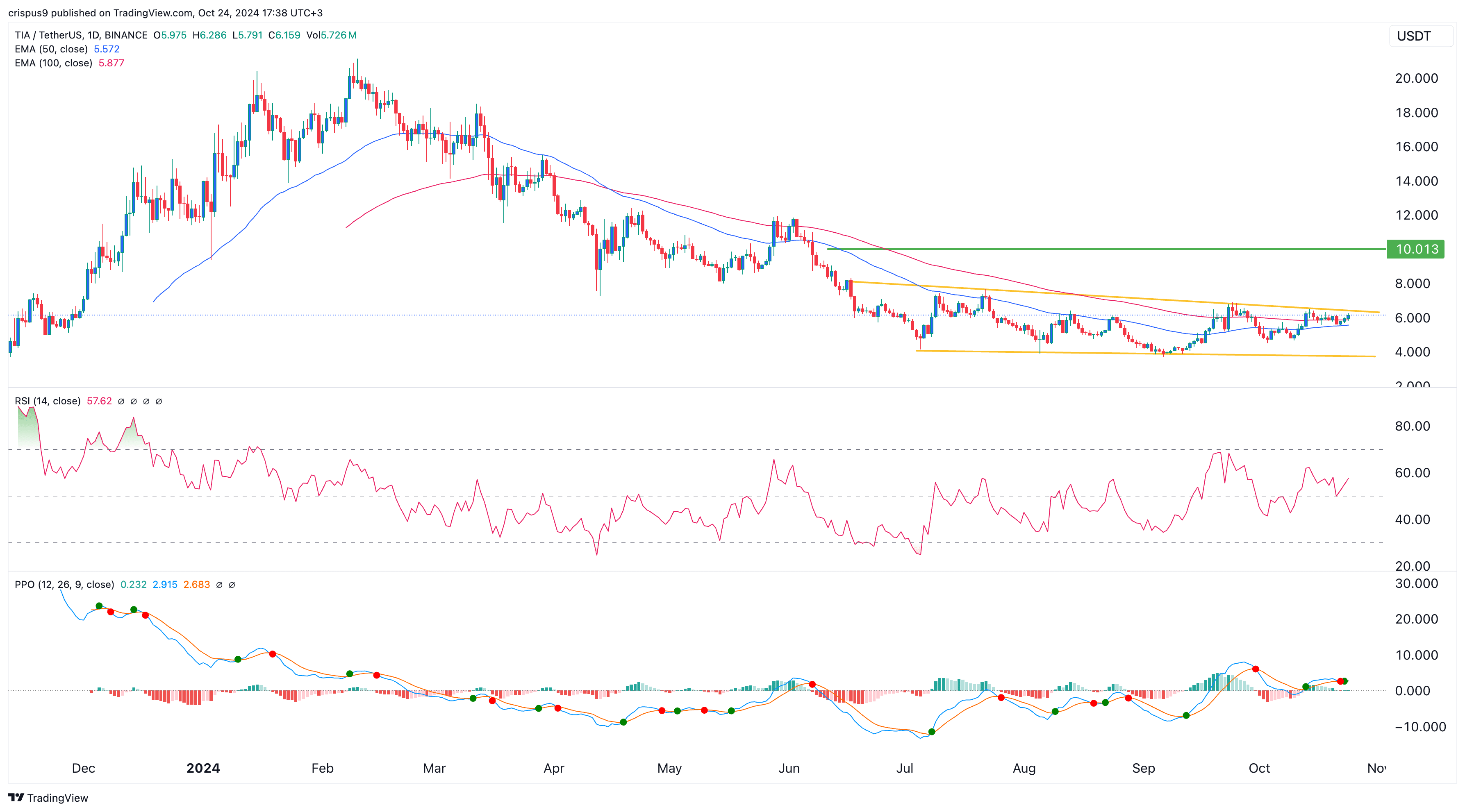

Celestia rose to a key resistance

The daily chart shows that the TIA token was trading at $6, coinciding with the upper side of the descending trendline. This trendline connects the highest swings since June this year.

Celestia has moved above the 100-day and 50-day Exponential Moving Averages. Additionally, the Relative Strength Index has risen above the neutral point at 50, while the Percentage Price Oscillator has crossed the zero line.

Celestia has also formed an inverse head and shoulders pattern. Therefore, a break above the trendline could lead to further gains, potentially reaching the psychological level of $10.