Celestia’s TIA up 14%, but weak fundamentals and sell pressure threaten rally

TIA rose by as much as 14% today as bulls managed to stage a reversal that ended weeks of downtrend.

According to data from crypto.news, Celestia (TIA) rose to an intraday high of $1.68 on July 7 before settling at $1.65 when writing with a market cap of $1.15 billion.

TIA’s rally today follows closely after it broke out of a descending channel pattern on the daily chart.

A descending channel, characterized by lower highs and lower lows within two parallel downward-sloping trendlines, typically signals sustained bearish pressure.

A breakout towards the upside of a descending channel pattern is generally interpreted as an early indicator of trend reversal in technical analysis. This technical confirmation likely contributed to increased buying activity and the token’s sharp intraday appreciation.

There’s also noticeable hype around the upcoming Lotus upgrade, the fourth major version of the Celestia protocol, which would reportedly reduce token inflation, introduce revised staking mechanics, and enhance network interoperability.

These developments are widely viewed as positive catalysts for long-term network utility and user growth. As of now, the Lotus upgrade is live on Celestia’s Mocha testnet, with deployment to Mainnet Beta expected in the coming weeks.

Bearish overhang persists despite today’s rally

On-chain data for Celestia presents a more cautious picture.

According to DeFiLlama, the total value locked in Celestia’s DeFi protocols has declined by over 95%, falling from a peak of $64.28 million in March 2024 to just $2.31 million at present.

Similarly, daily chain fees, often a proxy for user engagement, have dropped from $3,400 in March to a current average of around $200, reflecting reduced on-chain activity.

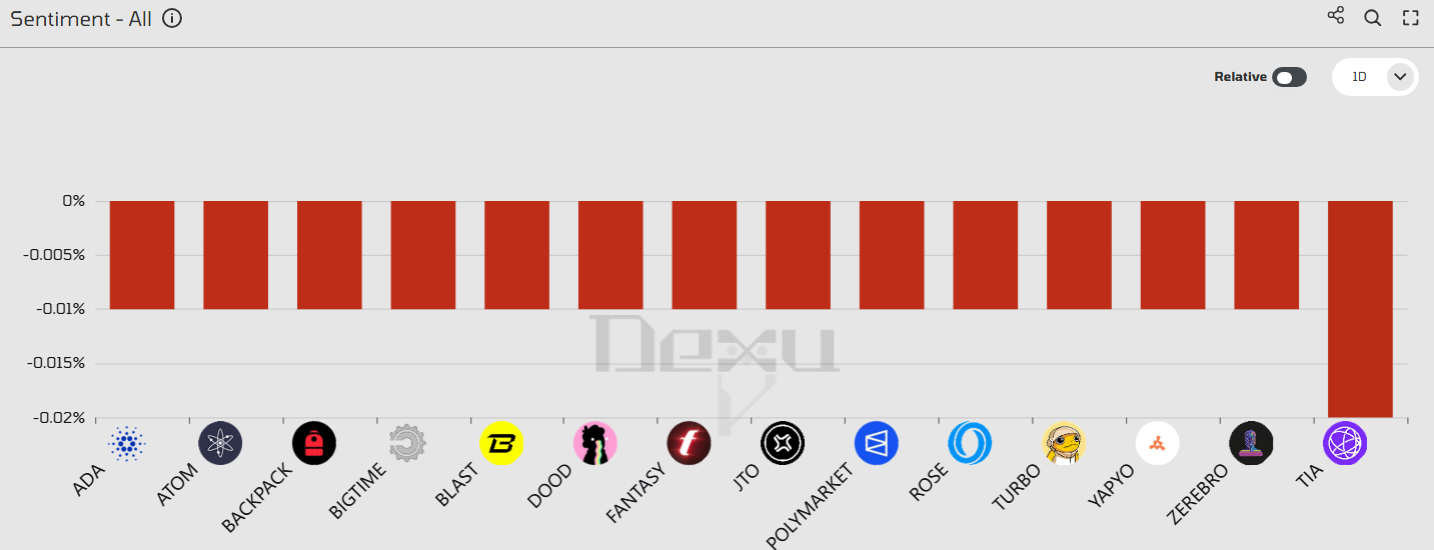

Sentiment indicators also remain subdued. According to data from social analytics platform Dexu AI, TIA ranks among the lowest in social sentiment across major crypto assets, suggesting a lack of positive engagement from the broader retail community.

It contrasts sharply with the price rally, raising questions about the sustainability of the current uptrend in the absence of stronger fundamental or community-driven support.

Investor concerns are further exacerbated by continued sell pressure from early backers. Notably, Polychain Capital, one of Celestia’s earliest institutional investors, has reportedly sold over $242 million worth of TIA tokens since the project’s TGE. While the firm still holds around 44.7 million TIA, valued at approximately $63.9 million, any further liquidation from this wallet could negatively impact the price through increased circulating supply.

It is also important to note that, despite today’s rebound, TIA remains down approximately 92% from its all-time high, meaning the vast majority of holders are currently underwater. Such a dynamic raises the risk of profit-taking pressure should the token continue to recover.

Many investors may opt to exit positions near breakeven, further limiting upside momentum in the short term.

TIA price analysis

On the 1-day USDT chart, the MACD line has crossed above the signal line, signaling an initial recovery in trend momentum. However, for a full bullish confirmation, both the MACD and the signal line would need to rise above the zero axis, indicating a transition from negative to positive momentum on a broader scale.

Meanwhile, the Relative Strength Index currently stands at 49, hovering just below the neutral 50 mark. The reading suggests that while bearish pressure has weakened, buyers have yet to assert full control. A decisive move above 50 would strengthen the case for a continued bullish reversal.

Given these mixed momentum signals, the short-term outlook hinges on whether the current bullish sentiment among investors remains sustained. If so, a daily close above $1.68, which marks today’s intraday high, could act as a technical trigger for further upside.

The next key resistance levels to monitor include the June 5 swing low at $1.93, followed by the psychological round number of $2.00.

Conversely, if buying momentum weakens and price fails to hold above immediate support, a pullback toward the $1.31 level remains a plausible scenario. This would place TIA back within its recent consolidation range, delaying any meaningful trend reversal and keeping the token in a broader sideways structure.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.