Chainalysis: Stablecoins account for 70% of Brazil’s exchange outflows

Stablecoin transaction value on Brazil’s local exchanges has surged well beyond Bitcoin, reflecting a sharp rise in their use for B2B cross-border payments.

Brazil‘s stablecoin market is thriving, as Latin America becomes the second-fastest-growing region with a year-over-year growth rate exceeding 42%, according to data from blockchain analytics firm Chainalysis.

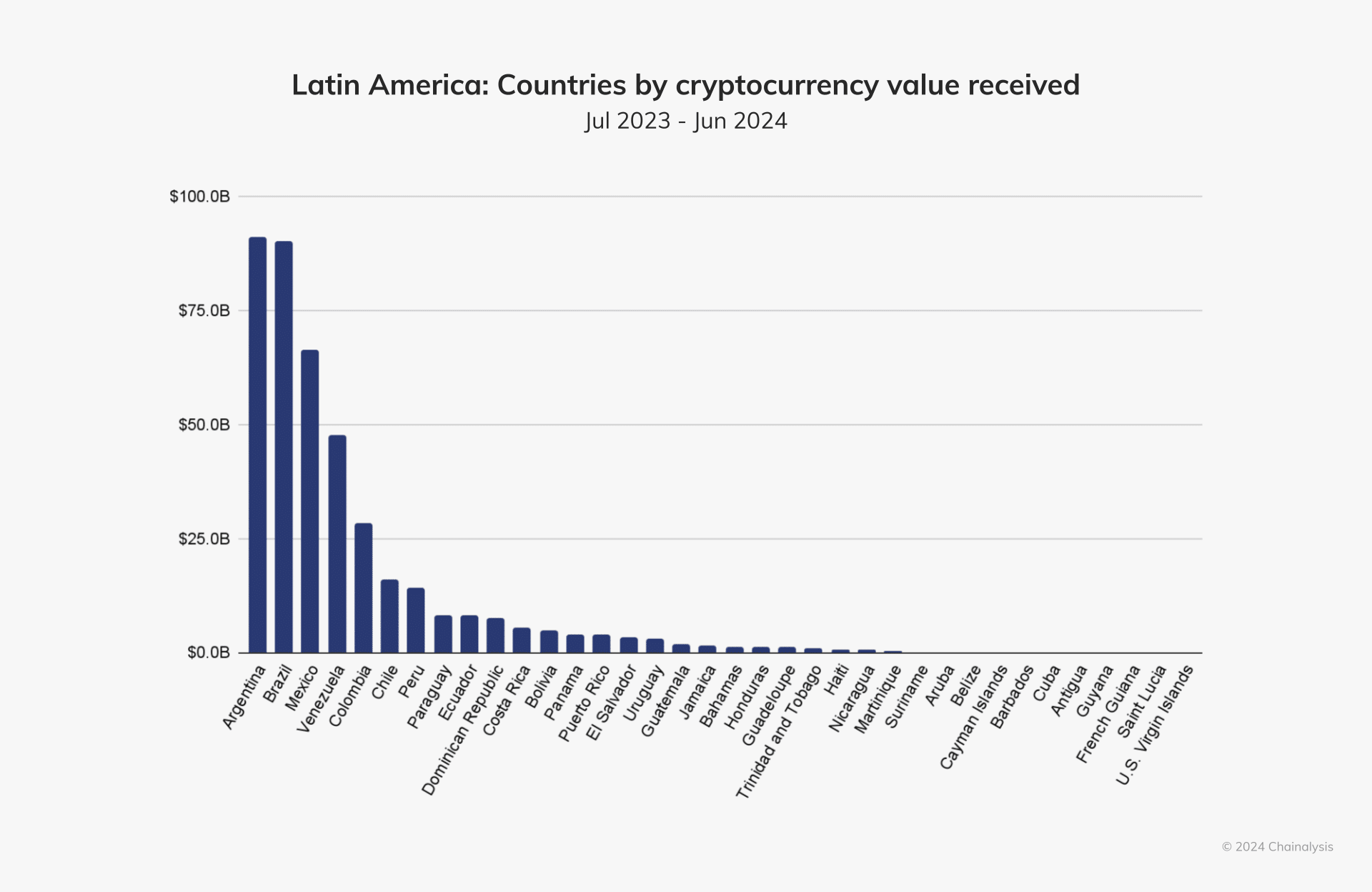

Data from the New York-headquartered firm shows that between July 2023 and June 2024, Brazil received nearly $90.3 billion in crypto, trailing closely behind Argentina. While Bitcoin (BTC) remains popular, stablecoins have emerged as a preferred option on local exchanges, driven by demand for U.S. dollar exposure amid local currency instability.

Chainalysis notes a year-over-year increase of 207.7% in stablecoin transaction value on Brazilian exchanges, far outpacing other cryptocurrencies like Ethereum (ETH).

Despite economic challenges, such as a weakening Brazilian real and slowing growth, there are still “opportunities for crypto growth, especially as regulators open their approach to the technology,” the firm explained. As exchanges like OKX and Coinbase continue expanding in Brazil, stablecoins are poised to remain a dominant force in the country’s evolving crypto landscape, Chainalysis notes.

However, Latin America is not the only region witnessing a booming demand for stablecoins amid economic turbulence. As crypto.news reported earlier, stablecoins have emerged as a vital component of Sub-Saharan Africa‘s crypto economy, accounting for approximately 43% of the region’s total transaction volume.

Ethiopia, Africa’s second-most populous nation, has seen retail-sized stablecoin transfers grow by 180% year-over-year, fueled by a recent 30% devaluation of its local currency, the birr.