Chainlink surges amid high exchange inflows and social volume

Chainlink’s (LINK) price has constantly risen since Sept. 11, after the asset hit a local bottom of $5.7 with a market cap of $3.1 billion.

LINK is up by 5% in the past 24 hours and is trading at $6.56 when writing. The asset’s market capitalization rose to $3.65 billion with a 24-hour trading volume of around $198 million.

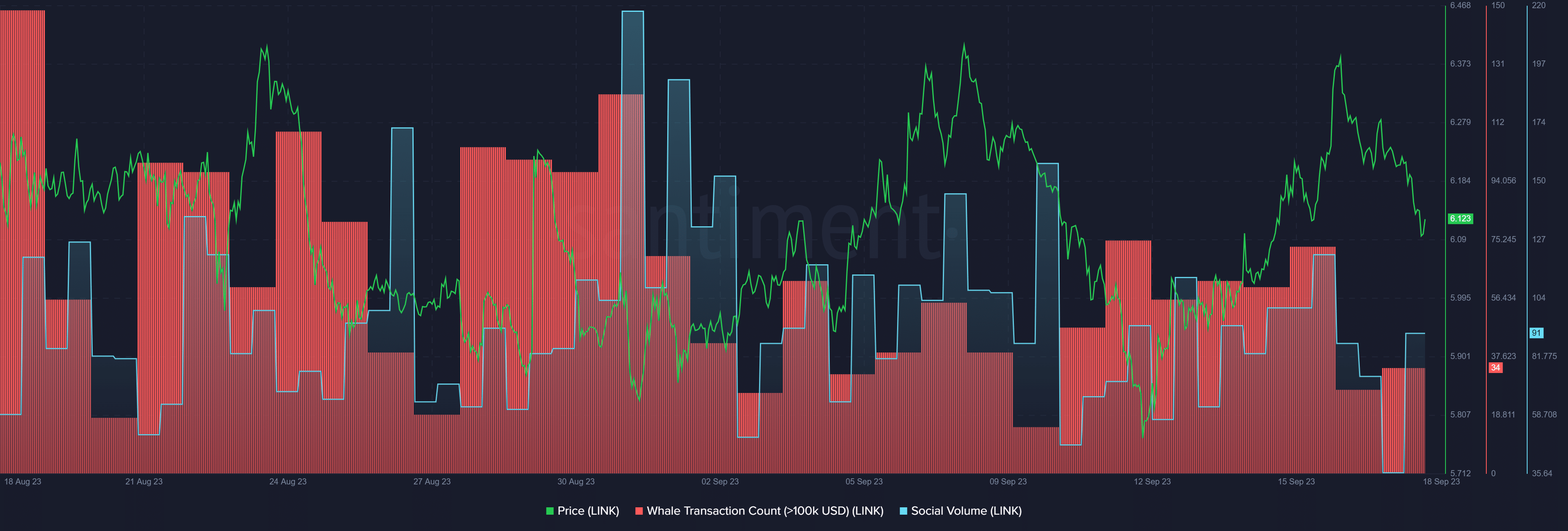

According to data provided by the market intelligence platform Santiment, the recent surge in LINK’s price has triggered a high social volume — marking a 150% rise in the social trend after dropping for three consecutive days.

Moreover, transactions consisting of at least $100,000 worth of LINK increased by 27% in the past 24 hours, reaching 34 daily transfers, according to Santiment.

The movements come while on-chain data shows an inflow of 15.7 million tokens, worth roughly $103 million at the time of writing, to Binance. The transactions came from four addresses, cumulatively unlocking 18.75 million LINK on Sept. 16.

Of this tally, the remaining 3.05 million coins were sent to a multi-signature address labeled “0xD50f.” These transactions made the Chainlink price go for a dive from $6.36 to $6.1 in around 36 hours.

Furthermore, Santiment data shows that Binance’s LINK balance has reached 77.4 million after the 15.7 million transaction. Kraken and KuCoin follow Binance with 12.5 million and 2.3 million tokens, respectively.

Last week, Australia’s “Big Four” bank ANZ partnered with Chainlink to adopt its cross-chain interoperability protocol (CCIP) to facilitate cross-chain transactions to both public and private blockchains.

In June, the blockchain teamed up with the financial transaction giant SWIFT to integrate blockchain technology in the banking sector.