Charts suggest bitcoin is undervalued

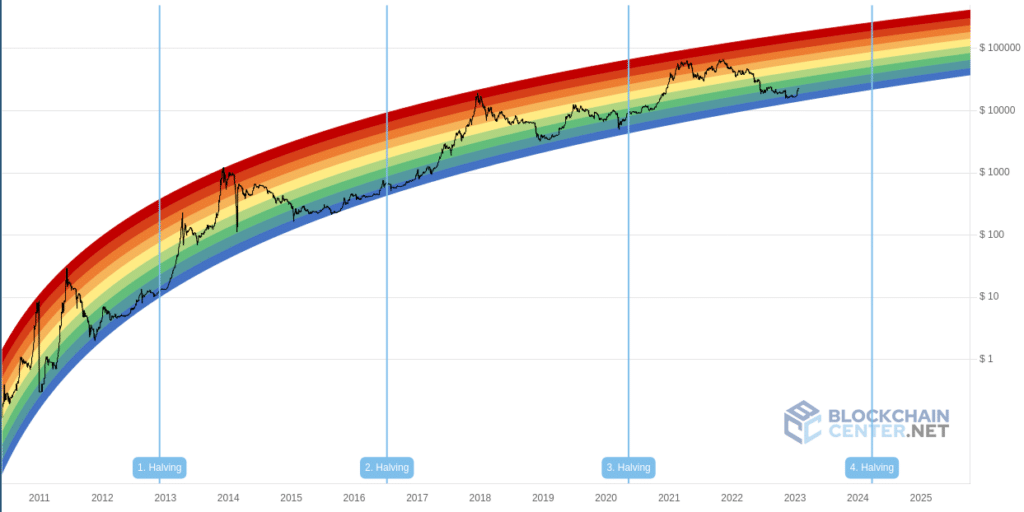

A very friendly-looking bitcoin (BTC) model called the “Bitcoin Rainbow” chart would have you believe that bitcoin is severely undervalued — but what do the fundamentals say?

Blockchain Center’s Bitcoin Rainbow chart is currently screaming “BUY!” after BTC’s price started to come out of the “basically a fire sale” area where it had consolidated for some time.

Still, the website explains that the team “fitted two curves” one of which “is the best fit for all of bitcoin highs (red) and one that includes only the lows (blue).”

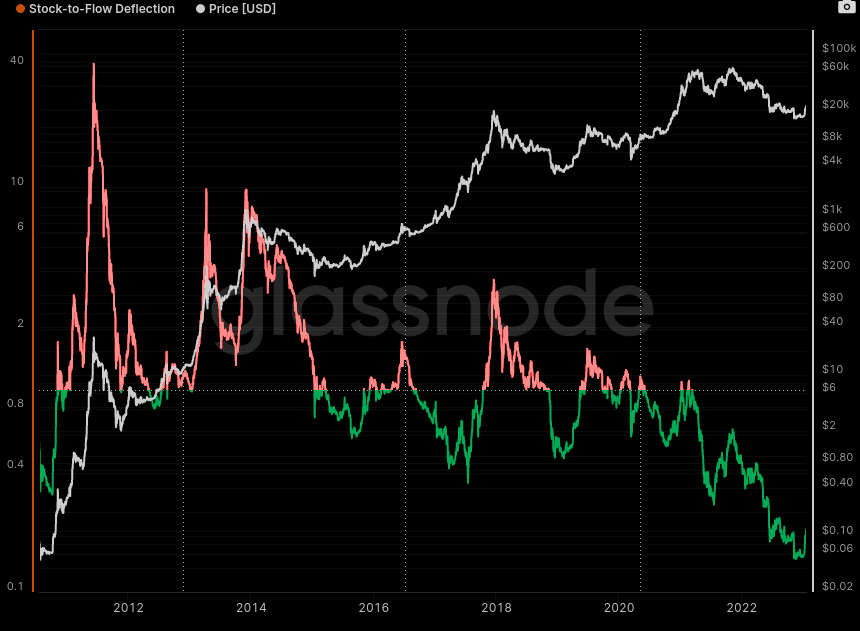

Another popular bitcoin model — the stock-to-flow model (S2F) — has an arguably more solid base, but despite this BTC’s price has recently ventured far from the value estimated by the model. According to Glassnode’s S2F deflection model, bitcoin is currently worth only about 0.2 of what it is worth according to the model.

Looking at the exponential S2F chart, the model has historically predicted bitcoin’s price to an astonishing degree of precision.

According to Buy Bitcoin Worldwide’s S2F chart, the model currently estimates bitcoin to be worth $109,500. During a December 2022 interview, the model’s pseudonymous creator PlanB suggested that bitcoin could be headed higher and that the stock-to-flow model has not yet been invalidated.

PlanB suggested that the original version of the model is the one he trusts the most, not more optimistic later models.

“If we assume that the old model, the original 2019 model is correct, the $55,000 model, then the next halving could lead to prices somewhere — and I’m making a very wide range, some people don’t like it — but somewhere between $100,000 and a $1 million.”

PlanB.

The stock-to-flow (S2F) chart is a metric that compares the current stock of bitcoin (the total amount of bitcoin currently in circulation) to its annual production flow (the number of new bitcoins mined each year). The ratio of stock to flow estimates the value of bitcoin and other scarce assets.

The chart is based on the idea that the value of an asset is directly proportional to its scarcity.

According to the stock-to-flow model, the halving events that occur roughly every four years — when the rate of new bitcoin mined is cut in half — directly affect the price of bitcoin. The current stock-to-flow ratio suggests that bitcoin is still undervalued and is expected to reach a new all-time high in the future.

While over the last few months, bitcoin has ventured further than ever from its estimated price into the negative, its price has in the past ventured much further into the positive. In fact, Glassnode’s aforementioned chart shows that on June 8, 2011, bitcoin was worth nearly 41 times the value estimated by the S2F model.

Looking at other fundamentals, Glassnode data also shows that bitcoin’s percent of supply last active five or more years ago just reached a new all-time high of 27,772% — a sign that BTC accumulation for long-term holding is ongoing.