Circle bets on Latin America as stablecoin adoption surges

Fintech companies across Latin America are embracing digital finance solutions, driven by the increasing adoption of crypto and blockchain, Circle says.

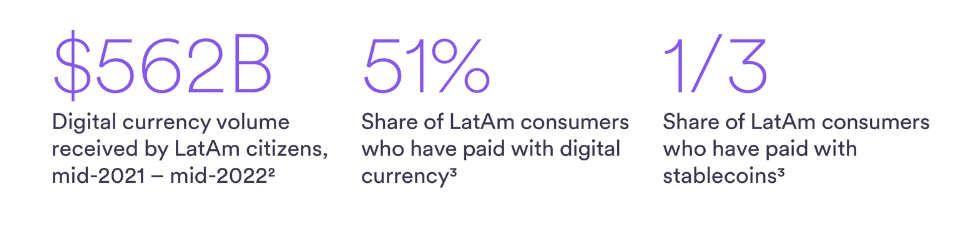

According to Circle‘s latest report titled “Latin America Embraces Digital Finance and the Next Internet Era,” fintech companies in Latin America (LatAm) are increasingly utilizing digital payments as global stablecoin settlement exceeded $7 trillion compared to $14 trillion settled at Visa and Mastercard in 2022.

The U.S.-headquartered company predicts that in the coming years “millions of businesses and billions of people” will turn to “regulated blockchain-based financial services” that will compete with traditional financial institutions.

“Given advances in software development that make it easier to build with and use the blockchain, it will be easy for developers to embed these services in a way that’s invisible to merchants and their users.”

Circle

The report highlights that the region’s fintech landscape is being transformed by the rise of crypto-powered solutions. For instance, Circle refers to Mastercard’s data, which indicate that over 50% of Latin American consumers have made a purchase with digital currency and “one-third have used a stablecoin for everyday purchases.”

Yet, despite the widespread adoption of smartphones, Circle estimates that around 1.7 billion people worldwide remain underbanked, lacking access to basic banking services. Nonetheless, public blockchains can solve this issue by turning internet connected devices into “compliant endpoints” for traditional finance and new financial services “that are completely disrupting traditional process and bureaucracy,” Circle suggests.

In a bid to speed up development activity, Circle recently announced the launch of its own faucet for its U.S. dollar-pegged stablecoin USDC and its euro-denominated coin EURC. The faucet allows blockchain developers to access test USDC and EURC, which can then be deployed on testnets. In this staging area, builders evaluate blockchain applications and hold dress rehearsals ahead of the main deployment.