Circle IPO delivers 4x return for Sigil Fund

Sigil Fund is betting on stablecoins and says Circle is the only investment on the market that enables it to do so.

Stablecoins are becoming mainstream, according to Sigil Fund, an early backer of Circle. On Tuesday, June 10, Sigil Fund shared details of its investment in the USDC stablecoin issuer. The financial firm told investors it had already achieved a 4x return on its $5 billion pre-initial public offering investment.

“Sigil Core invested in Circle in July 2024, well before its public debut. On IPO day alone, this position delivered a +9% gain to the fund’s NAV — and the total return has now reached ~4x within a year,” Sigil Fund.

The Circle IPO was wildly successful, highlighting that traditional investors have an appetite for crypto businesses. The company began trading on June 4 with a share price of $31. By June 10, it was trading at $115.25, marking a 271% price increase in less than a week.

Why Sigil invested in Circle

Sigil Fund explained its investment in Circle was driven by its belief in the strategic importance of stablecoins. According to the fund, stablecoins are “the silent backbone of crypto,” bridging traditional finance (tradFi) and decentralized finance. Additionally, Sigil noted that even big tech firms are exploring the possibility of issuing their own stablecoins.

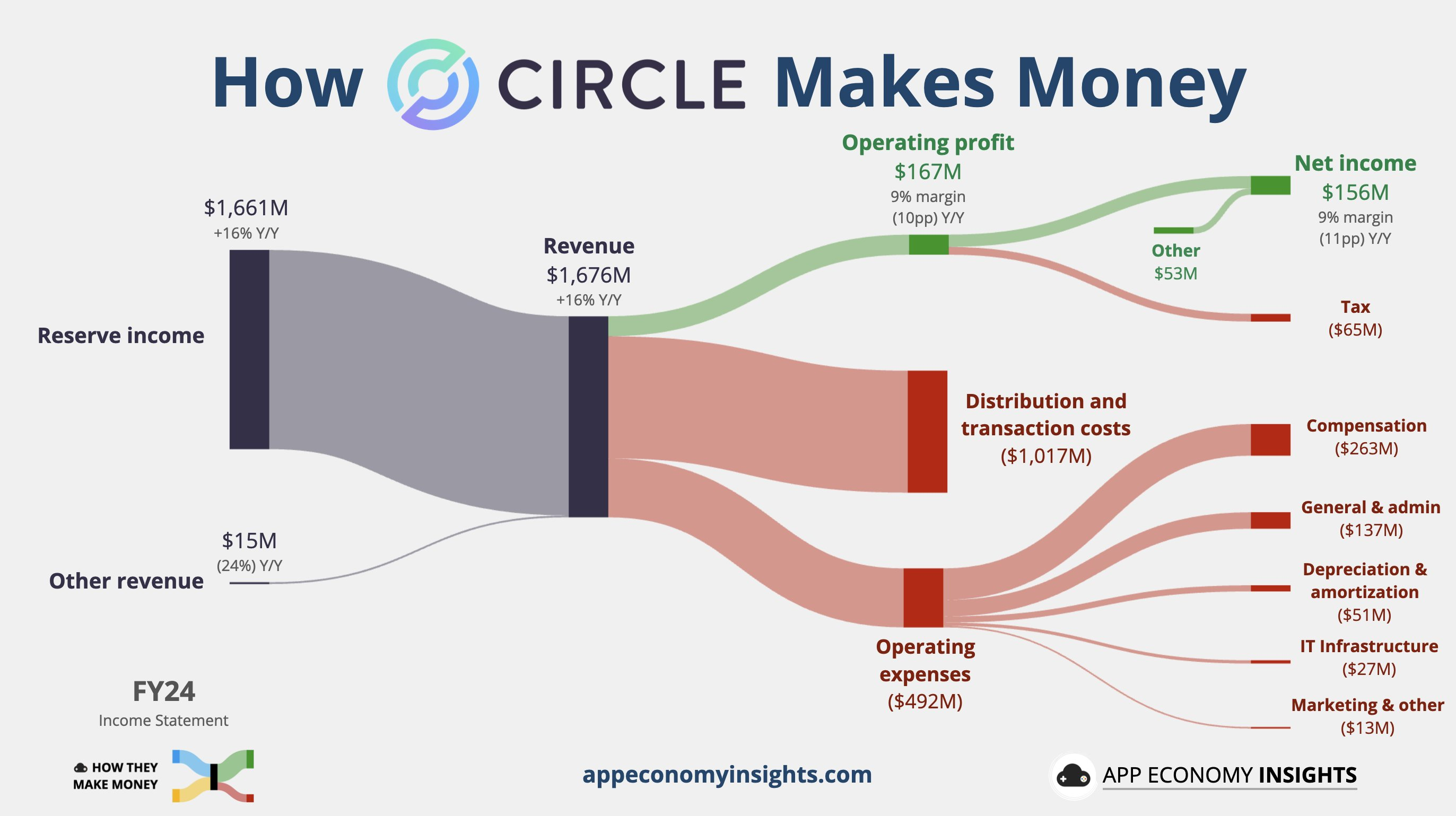

Circle earns revenue primarily from the reserves backing its stablecoins on a one-to-one basis. These reserves are mostly held in short-term Treasuries and repo agreements, both of which generate yield. As a result, the more stablecoins Circle issues, the greater the potential total return.

Currently, Circle holds $33 billion in reserves, including $11 billion in short-term Treasuries and $16 billion in repo agreements. This structure generates $1.46 billion in net revenue for the firm. As the USDC market cap increases, so too will Circle’s revenues and profits.

According to Sigil Fund, Circle remains the only “clean investable” option on the stock market for exposure to stablecoins. For example, Tether, the largest stablecoin issuer, is a private company, meaning there are no Tether shares available for public investment.