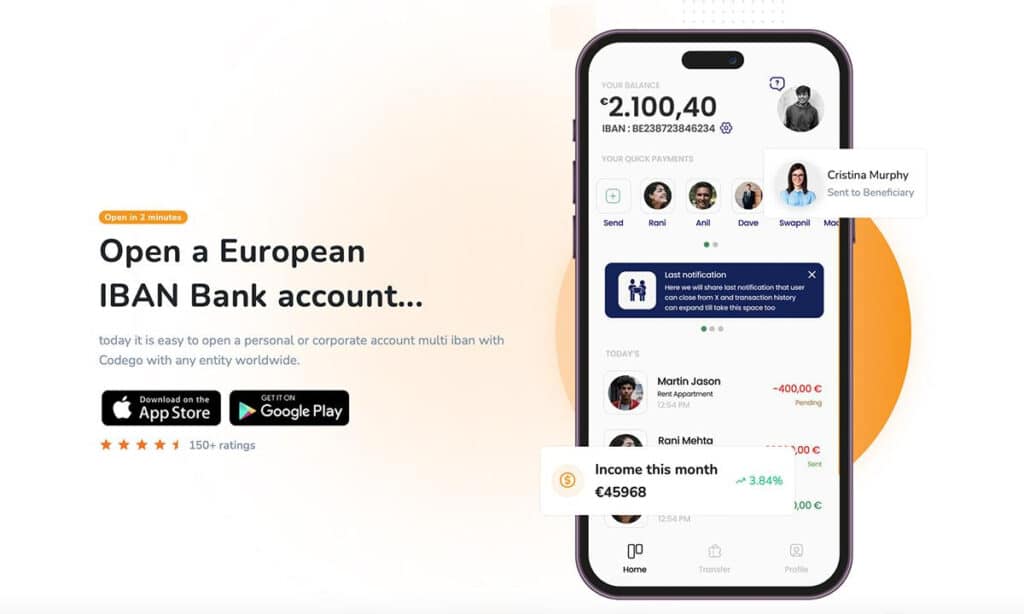

Codego Group launches CodegoPay – payment app with IBANs, Cards, and crypto-EUR conversions

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Milan, Italy, Jan. 11, 2024, Chainwire

Codego Group – a company issuing white-label crypto cards – launched CodegoPay, a payment solution that supports IBANs, cards, and crypto. The app makes it easy for anyone to open a personal or corporate European IBAN bank account with any entity worldwide.

Crypto-friendly banking services are on the rise, and Codego Group meets this high demand with a new payment solution.

CodegoPay enables users to send and receive instant SEPA/SEPA payments from virtual asset exchanges in real time. The company ensures high-security standards by following rigid anti-money laundering and transaction monitoring rules.

However, it does not limit the users’ accounts for investments or trading, enabling residents of any state (except sanctioned countries) to use the app.

A CodegoPay personal account comes with several benefits and utilities, such as:

- Users can open a European IBAN with a prestigious European banking entity quickly and easily.

- Engage in secure SEPA/SEPA INSTANT transfers across 33 countries.

- High safety standards with biometric authorization payments.

- A Direct Debit IBAN feature to automate recurring transactions.

- Low-cost operations thanks to CodegoPay’s guarantee for some of the best fees on the market

- No setup costs or monthly fees.

- 3 types of CodegoPay personal accounts, depending on the country of residence’s risk level (Low, Medium, and High).

The CodegoPay team developed its product to be more than a crypto-friendly IBAN. For instance, personal account users can buy and sell cryptocurrencies directly from the CodegoPay dashboard with their own IBANs.

More importantly, they can convert crypto assets like Bitcoin to EUR directly within the app. As a result, users no longer require accounts on crypto exchange platforms, as they can rely on CodegoPay to have their banking account and crypto wallet in the same place.

Alternatively, users can open a dedicated CodegoPay Business Bank Account in Europe to send and receive instant SEPA/SEPA EURO payments. The app’s smart routing system enables safe and instant EUR transfers in the EU and EEA. Moreover, the company ensures maximum security, and it is EMI-regulated under the National Bank of Belgium as an agent with a European passport.

Opening a CodegoPay Business account is quick and easy, requiring only 10 minutes to complete the process. It is free to set up and enables users to have a multi-IBAN account, including a local BE IBAN and a direct debit IBAN, while paying some of the lowest fees available.

About Codego

Codego provides financial solutions and issues all types of cards, including prepaid, debit, and corporate. It is licensed in several countries as an agent providing wallet custody, exchange services, virtual asset services, and more. The Codego team boasts 12 years of experience in programming, finance, cryptocurrencies, and authentication systems.

Codego Group is present in 12 countries with physical offices and related licenses. While each local company is owned and operated independently, they provide a single comprehensive service, including the experience of financial services, financial platforms, and financial licensing.

Furthermore, it has over 35 redundant service providers, including card processors, issuer cards, banks, and SEPA gateways.

users can learn more about Codego at these links: Website | Twitter | Instagram | LinkedIn

Contact

Salvatore C.

[email protected]

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.