Coinbase CEO to buy more Bitcoin after Q3 earnings

Coinbase CEO Brian Armstrong shared that the company is going ‘long’ on Bitcoin, revealing that the firm’s BTC holdings have increased by 2,772 BTC and will continue to grow.

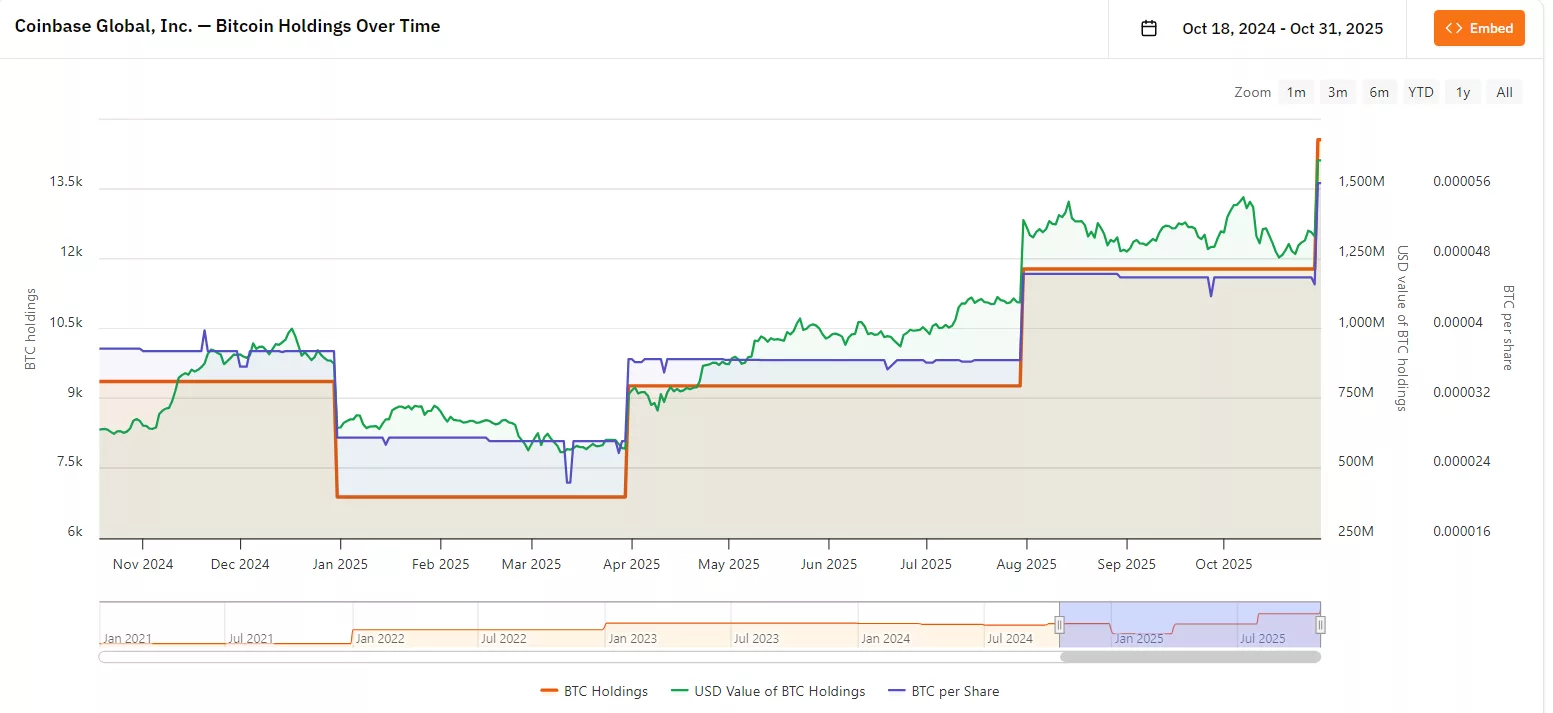

- Coinbase increased its Bitcoin holdings by 2,772 BTC in Q3 2025, bringing its total to around $1.6 billion. The exchange now ranks as the ninth-largest corporate Bitcoin holder globally.

- The exchange’s Q3 2025 revenue surged 25% to $1.9 billion, driven by stronger institutional trading, favorable market conditions, and its expansion into derivatives and international products.

In a recent post shared on X, Armstrong said that the company will continue to purchase more Bitcoin following its revenue surge in the third quarter of 2025. He claims that the company is going “long Bitcoin” and revealed a boost in its holdings this quarter.

“Our holding increased by 2,772 BTC in Q3. And we keep buying more,” said Armstrong in his latest post.

According to data from Bitcoin Treasuries, the total amount of BTC (BTC) held by the exchange has surpassed $1 billion in value after its recent third-quarter addition. On Oct. 31, the company is estimated to hold 14,548 BTC on its balance sheet or equal to around $1.6 billion based on current market prices.

This increase in BTC holdings places Coinbase at number 9 on the top 10 list of corporate Bitcoin holders, beating out firms like CleanSpark, Tesla, Hut8, Block and Galaxy Digital on the board.

On average, each Bitcoin held by the exchange is valued at $71,465. Having held the asset since Dec. 31, 2020, the exchange’s BTC holdings have yielded a profit of 53.47%. Compared to its $84 billion basic market value, the exchange’s Bitcoin holdings represent only a fraction of that number.

At press time, the company’s market Net Asset Value stands at 52.539 based on its basic market cap. With its stock price at $328.51, having dipped slightly by 5.77% in the past 24 hours, this means that the market is valuing the company at about 52.5 times the value of its BTC trove.

In contrast, Strategy, the largest corporate Bitcoin holder in the world, has an mNAV of 1.04x based on basic market value. This means that more of its value is represented in Bitcoin holdings compared to Coinbase.

Nevertheless, conditions might change if Coinbase decides to get braver with their BTC accumulation. Compared to its Q1 and Q2 BTC purchases, Q3 marks the largest amount of BTC bought this year at 2,772 BTC. Meanwhile, the last time the company sold its holdings was at the end of 2024, when it offloaded 2,478 BTC.

Coinbase earnings rise by 25% in Q3 2025

Most recently, Coinbase revealed in its third-quarter earnings report that it has reached a total revenue of $1.9 billion. This number has gone up 25% compared to the previous quarter. Its strong earnings were attributed to favorable market conditions as well as a result of its current expansion strategy.

As of late, the exchange has been expanding on its “Everything Exchange” vision by adding more products to its platform, including derivatives, stablecoins, and institution products. On the other hand, it has cited the rise of Bitcoin and regulatory advancements made by the Trump administration as factors that have improved market conditions.

In addition, the company has also benefitted from more mainstream adoption of crypto among institutional players. This quarter, institutional trading activity on Coinbase rose by 22% from the prior quarter, reaching $236 billion.

The acquisition of Deribit, which generated $52 million in revenue and strengthened Coinbase’s global options and futures operations, subsequently fueled a 122% boost in institutional transaction revenue to $135 million.