Coinbase faces headwinds as Bitcoin and ETF interest dips, says JPMorgan

Coinbase may face challenges due to decreasing Bitcoin values and declining interest in Bitcoin ETFs, as per insights from JPMorgan Chase & Co.

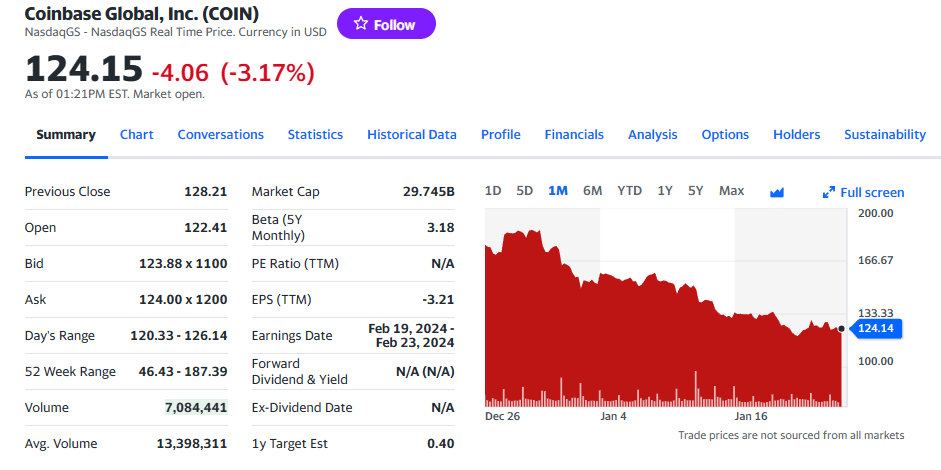

Coinbase’s shares plummeted by 6.2% on Tuesday, as the downturn followed JPMorgan’s decision to issue its first negative assessment equivalent to a “sell” rating on the company since it began tracking the stock in May 2021.

Despite a significant upsurge of nearly 400% by the end of 2023, Coinbase’s shares have mirrored the trajectory of Bitcoin, which saw a remarkable increase in the same period. In 2024, Coinbase’s shares have decreased by 30%, while Bitcoin’s value has fallen by approximately 8%, recently trading under $40,000.

Analysts at JPMorgan anticipate a further decline in enthusiasm for cryptocurrency ETFs. This could result in lower token prices, decreased trading volumes, and fewer secondary revenue opportunities for entities like Coinbase. Analysts also think the ETF hype that drove Bitcoin out of the crypto winter won’t ultimately live up to the bull market expectations.

The outlook on Coinbase is becoming increasingly cautious, with the stock receiving 12 sell ratings, eight buy ratings, and eight hold ratings, as compiled by Bloomberg. Last week, CFRA downgraded its rating to “sell,” citing concerns over intensifying market competition.