Coinbase insider sold more than $5m in shares over the last three months

Coinbase reported insider sales of more than $5 million worth of stock, with CFO Alesia Haas as the biggest seller.

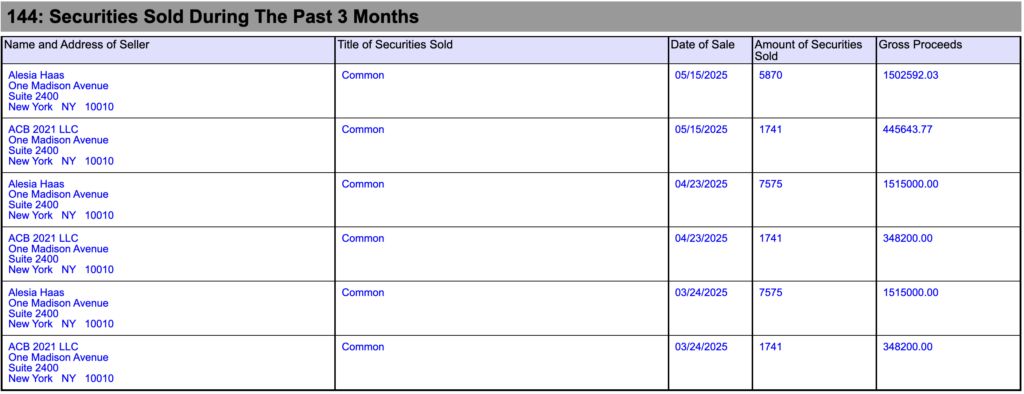

Coinbase insiders continue to offload stock on the market. On Tuesday, June 16, Coinbase filed a Form 144 with the Securities and Exchange Commission, reporting all insider sales. The company disclosed that insiders sold 26,243 shares of Coinbase stock since March 2025. The net proceeds from these sales totaled $5,673,636.

The largest, and possibly only, seller was CFO Alesia Haas. Haas personally sold 21,020 shares in three transactions, one each month since March, netting $4.53 million. On the same dates, ABC 2021 LLC also sold a total of 5,223 shares for $1.14 million.

These sales appear to be a part of routine financial management by the executive. According to Investing.com, Alesia Haas owned 114,866 shares of Coinbase stock in March of 2025 directly. She also owned 15,673 shares through ABC 2021 LLC, of which she is a sole member.

Coinbase executives continue to offload shares

Management of publicly traded companies can freely sell their shares on the market. However, such sales are closely watched by other investors. Large sales, in particular, can sometimes signal that executives are losing confidence in the company or believe the stock is overvalued.

For this reason, the SEC requires that public companies disclose these sales. However, in a fourth quarter of 2024 investor call, Haas denied that these sales reflect a lack of confidence in the company.

“All of our insiders—myself, Brian, Emilie, Paul, those on the phone and all of our insiders—we all have shared long-term conviction in Coinbase,” Haas stated. “It’s important to note that these sales account for a small portion of insiders’ total holdings in Coinbase.”

CEO Brian Armstrong has been one of the biggest sellers of Coinbase stock. Armstrong sold nearly $290 million worth of Coinbase shares in 2021, soon after the company went public.