Coinbase shares jump 8% as reported revenue beats expectations

Shares of U.S. crypto exchange Coinbase jumped over 8% on Thursday after the company posted stronger-than-expected Q4 earnings.

Cryptocurrency exchange Coinbase saw its shares jump 8.44% to $298.11 on Thursday, Feb. 13, after reporting its strongest quarterly revenue in three years.

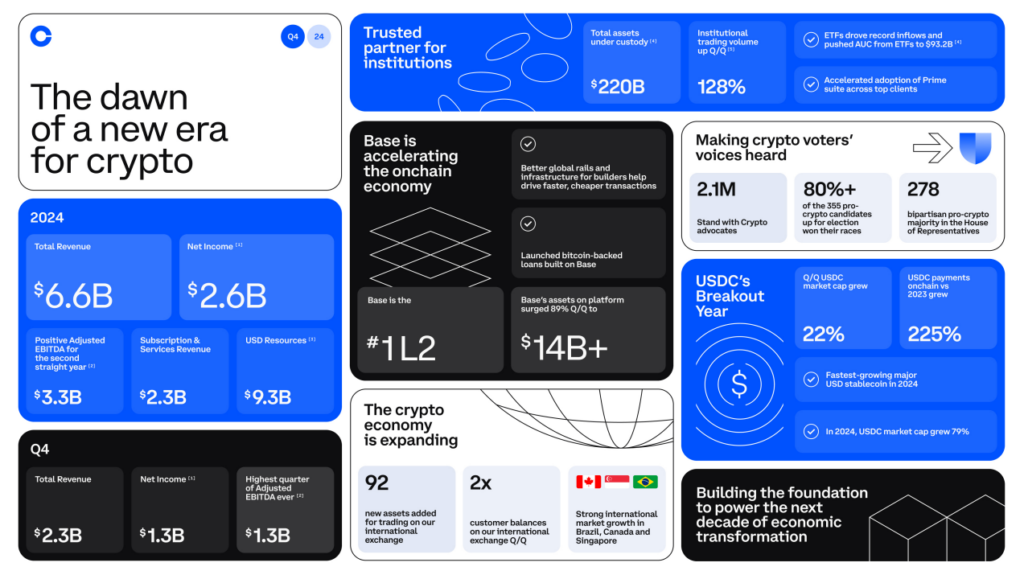

According to its Q4 2024 earnings report, Coinbase generated $2.3 billion in revenue, a 138% increase from 2023, beating the $1.88 billion estimate from LSEG analysts. Net income hit $1.3 billion, while earnings per share came in at $4.68, surpassing both the $2.11 forecast by FactSet and the $1.81 expected by LSEG.

The exchange says its growth was due to rising trading activity and a shift in the regulatory landscape.

“Zooming out, the last few months have demonstrated a sea change in the regulatory environment, unlocking new opportunities for Coinbase and the crypto industry.”

Coinbase

Transaction revenue hit $1.6 billion, up 172% from the previous quarter, while subscription and services revenue grew to $641 million.

Coinbase is upbeat about its future, calling the latest regulatory shifts under the Trump administration the “dawn of a new era for crypto.” The company says it will “double down on what we’ve always focused on: building,” with plans to boost stablecoin adoption, grow its layer-2 network Base, and expand crypto payments.

“At the same time you will see us working hard to bring more people onchain through products like our leading layer 2 platform Base, SmartWallet, and Coinbase Developer Platform.”

Coinbase

Still, challenges remain. Stablecoin transaction fees dropped 9% quarter-over-quarter to $226 million, but Coinbase says partnerships and new products will help balance things out. With a big Q4 behind it, the company sees an “unprecedented opportunity” ahead — if market conditions and regulations stay favorable.