Coinbase to store more corporate, customer USDC holdings on Base

Coinbase wants to optimize its management process by storing more of its USDC holdings on Base.

Cryptocurrency exchange Coinbase is planning to store more corporate and customer USD Coin (USDC) balances on Base, a layer-2 solution based on the OP Stack and developed by the exchange. In an X post on Mar. 27, Coinabse vice president of product Max Branzburg said the exchange wants to focus more on Base instead of Ethereum “with lower fees and faster settlement times,” noting that the move will have “no impact to the Coinbase user experience.”

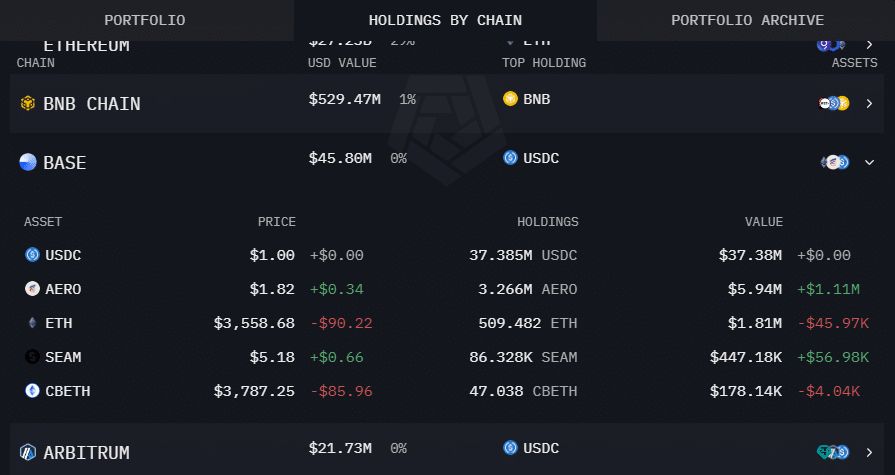

It’s unclear whether the exchange plans to transfer all of its funds in USDC to Base, or when precisely Coinbase intends to start allocating more assets on its network. According to Arkham Intelligence data, Coinbase currently holds less than 1% of its assets on Base, with the Bitcoin network accounting for over 70% and Ethereum for nearly 30%.

Thus far, Coinbase appears to be storing only five tokens on Base, with a total value of $45.8 million. Among these tokens, the tokenized version of USDC dominates, representing over $37.3 million in the stablecoin. However, the exact figures remain unclear as Coinbase does not publicly disclose its addresses.

Branzburg’s announcement coincides with a significant milestone for Base, as the total value locked (TVL) in the network has surged past the $1 billion mark. Data from DefiLlama reveals a rapid increase in liquidity within the Base network since February, with its value soaring from approximately $400 million to over $1 billion in less than a month.