CoinShares: Net inflows surge to weekly record at $5.95b

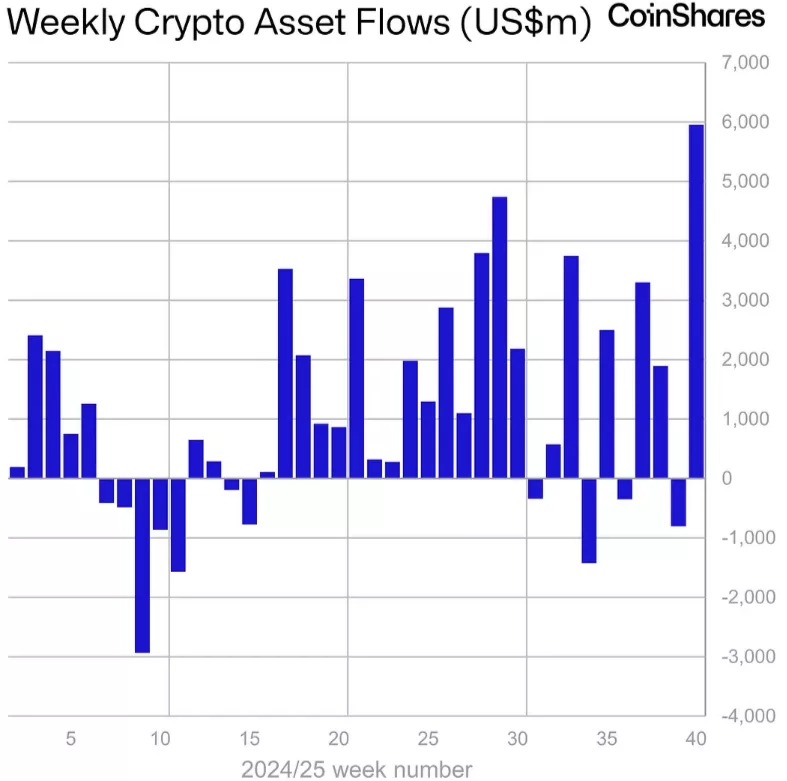

CoinShares recorded a net inflow of $5.95 billion in digital asset investment products, marking the largest net weekly inflow in history. Bitcoin and Solana also broke records with their inflows.

- Digital asset products saw record inflows of $5.95 billion, reversing last week’s outflows and pushing assets under management to a new high.

- The U.S leads the charge with $5 billion, driving total crypto assets under management to an all-time high of $254 billion

- In terms of asset type, Bitcoin led with $3.55 billion inflows, while Ethereum and Solana reached year-to-date inflow records of $13.7 billion and $2.5 billion.

According to CoinShares’ latest report on Digital Asset Fund Flows, digital asset investment products saw a surge in net inflows last week, reaching as high as $5.95 billion. Based on the report, this was the largest recorded inflows ever seen in a single week.

This development marked a major turn-around for digital asset products, considering it saw outflows nearing $1 billion in the week before. However, investors managed to flip the switch within just a week.

Head of CoinShares Research, James Butterfill, believes the recent wave of investments into digital asset products can be attributed to low employment data combined with trader concerns regarding the recent U.S. government shutdown.

“We believe this was due to a delayed response to the FOMC interest rate cut, compounded by very weak employment data, as indicated by Wednesday’s ADP Payroll release, and concerns over US government stability following the shutdown,” said Butterfill in the report.

This assessment was further strengthened by the fact that net inflows coming from the U.S. dominated the total by a significant margin. The U.S. alone saw $5 billion inflows last week, setting a new weekly record for inflows. Not only that, Switzerland also broke its weekly record with $563 million inflows last week.

Meanwhile, Germany saw its second largest weekly inflows at $311.5 million. All the other countries on the list saw positive funds flowing in last week, with the exception of Sweden which saw outflows of $8.6 million.

Overall, positive price action on the crypto market drove total assets under management to a new all-time high at $254 billion.

CoinShares: Bitcoin inflows reach new weekly high

Bitcoin (BTC) broke its own record for largest weekly inflows just last week, which coincides with the asset’s meteoric rise to a new all-time high. According to CoinShares’ latest report, Bitcoin’s weekly inflows saw its largest weekly inflows at $3.55 billion, adding to the year-to-date flows that stand at $27.5 billion. The record-high weekly inflows further propelled BTC to reach its recent all-time high at $125,506.

Although BTC prices reached a new all-time high on the market, the analytics firm noted that investors did not start buying short investment products backed by the assets.

Much like Bitcoin, Solana (SOL) also reached a new record high for weekly inflows, with the asset reaching $706.5 million last week. This brings the year-to-date inflows for Solana to $2.5 billion.

On the other hand, Ethereum (ETH) saw inflows reaching as much as $1.48 billion. Although it was not a weekly record, it did push the asset’s total year-to-date inflows to a new high of $13.7 billion. Compared to last year, CoinShares found that ETH net inflows this year has tripled.

While XRP (XRP) saw significant net inflow amounting to $219 million, other altcoins saw modest inflows that did not compare to the other powerhouse assets last week.