CoinShares: Trump tariffs and DeepSeek shake up ETF inflows

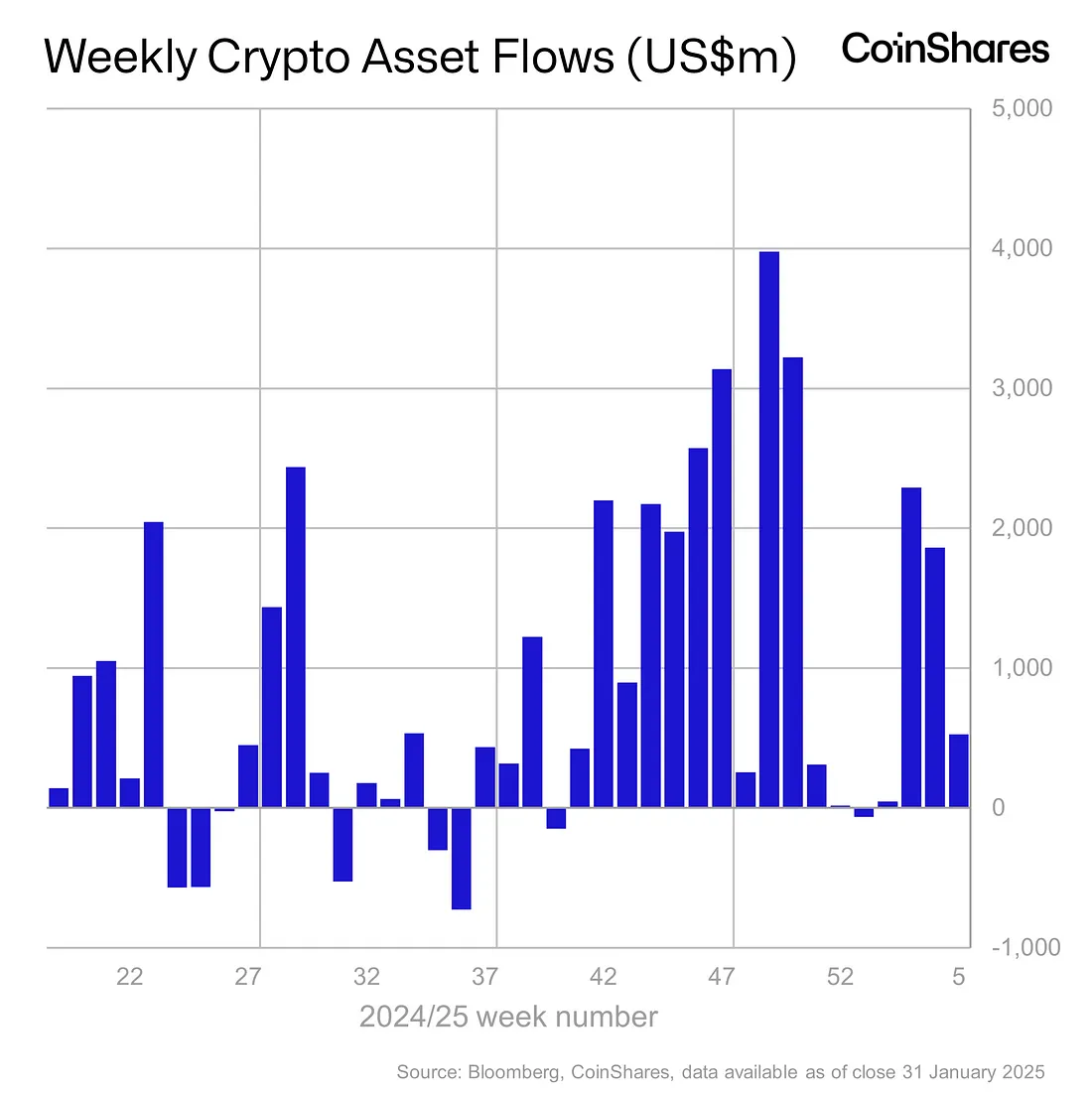

Weekly inflows have fallen from the billions to $527m last week, mostly due to volatile investor sentiments such as DeepSeek and tariffs.

Crypto investment products saw inflows of $527 million, balanced by outflows of nearly the same amount. This number is a far cry from the inflows that came in a week prior which reached nearly $2 billion.

According to the CoinShares research report, intraweek flows reflected volatile investor sentiments. Broader market concerns, such as the emergence of China’s DeepSeek AI company, has triggered outflows of up to $530 million.

However, the market managed to bounce back with over $1 billion in inflows in the later half of the week, offsetting the outflows. CoinShares’ Head of Research James Butterfill explained that the sell-off, while quite large, is not unexpected. This is due to the $44 billion in inflows seen in 2024 paired with the $5.3 billion inflows year-to-date and the significant price gains of several cryptocurrencies.

The U.S. continues to lead in inflows by country with $474 million, bringing the year-to-date to $5 billion. Europe saw similar trends with $78 million inflows last week and $93 million in year-to-date inflows, led by Switzerland and Germany with $57.9 million and $22.3 million in inflows respectively.

On the other hand, Canada saw outflows of $43 million, possibly due to the looming threat of trade tariffs from the U.S, which have been put in effect on Feb. 1.

Bitcoin (BTC) remains the biggest contributor for inflows with $486 million, while short-Bitcoin products saw a second week of inflows amounting to $3.7 million. A major development occurred with XRP (XRP) emerging as the second best performing altcoin, seeing nearly $15 million inflows last week and year-to-date inflows of $105 million.

On the other hand, Ethereum (ETH) saw zero net flows, plummeting earlier in the week. Butterfill attributes this fall to Ethereum’s greater exposure to the technology sector and the global market, making it susceptible to volatile market sentiment. As for smaller altcoins, Solana (SOL) saw inflows of $4.6 million, Chainlink (LINK) saw $3.1 million, and Cardano (ADA) added $1 million.

Additionally, CoinShares also noted that blockchain equities have also experienced year-to-date inflows of $160 million as investors see more buying opportunities amidst the current price drops.