Connecticut bans state use and investment in crypto under sweeping new law

Connecticut has enacted a sweeping ban on state-level use, investment, or custody of virtual currencies, blocking any potential creation of a public Bitcoin reserve.

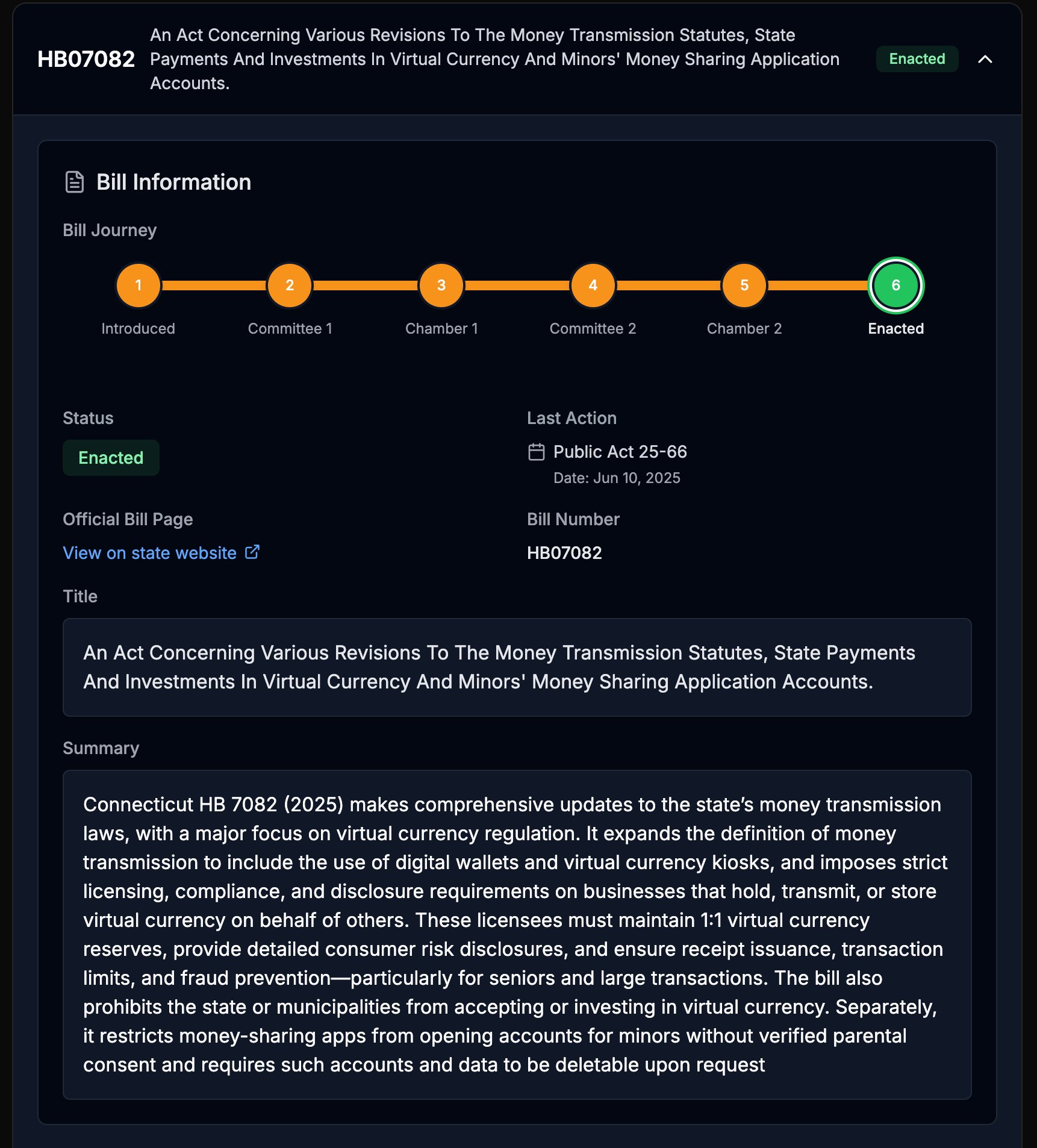

On June 10, Connecticut has enacted HB 7082, a sweeping overhaul of the state’s money transmission laws that includes a strict prohibition on the use of virtual currencies by state entities. The new law, signed as Public Act 25-66 and effective October 1, bars the state and its political subdivisions from accepting payments in virtual currency or from purchasing, holding, investing in, or establishing a reserve of such currencies.

The statute defines “virtual currency” as provided in section 36a-596 of Connecticut’s general statutes, a definition broad enough to cover most cryptocurrencies in use today.

The bill passed unanimously through both chambers of the state legislature, signaling broad bipartisan consensus against state-sponsored virtual currency initiatives, including any form of a sovereign bitcoin reserve.

In addition to the ban, HB 7082 imposes tighter regulations on private-sector money transmitters involved with virtual currencies. It requires businesses that deal in digital wallets or crypto kiosks to be licensed and to comply with strict financial safeguards, including 1:1 reserve backing for virtual currencies held on behalf of customers, detailed consumer risk disclosures, fraud protections, transaction limits, and receipt requirements.

Connecticut’s move stands in stark contrast to the growing momentum in many other U.S. states, where legislatures are actively advancing bills to establish Strategic Bitcoin Reserves. According to the State Reserve Race tracker by Bitcoin Laws, Arizona and New Hampshire have fully enacted SBR bills into law, completing all legislative steps. Texas passed its bill through both chambers but have not yet finalized enactment, awaiting governor’s signature.