CORE surges 70%, key indicator shows signs of incoming selloff

CORE, the native token of the layer-1 Core ecosystem, emerged as the top gainer among the leading 100 cryptocurrencies while a key indicator shows signs of overbought.

CORE is up 70% in the past 24 hours and is trading at $2.8 at the time of writing — a level not seen since March 2023. The asset’s market cap surged to $2.45 billion, making it the 54th-largest cryptocurrency.

Notably, CORE is still down by 58% from its all-time high of $6.47 on Feb. 8, 2023.

Moreover, CORE’s daily trading volume rallied by 145%, reaching $433 million. According to data from CoinMarketCap, 40% of CORE’s trading volume comes from OKX, with investors having high confidence in their trading positions.

On the other hand, the token is currently hovering in the overheated zone which could ultimately put it in the bearish zone.

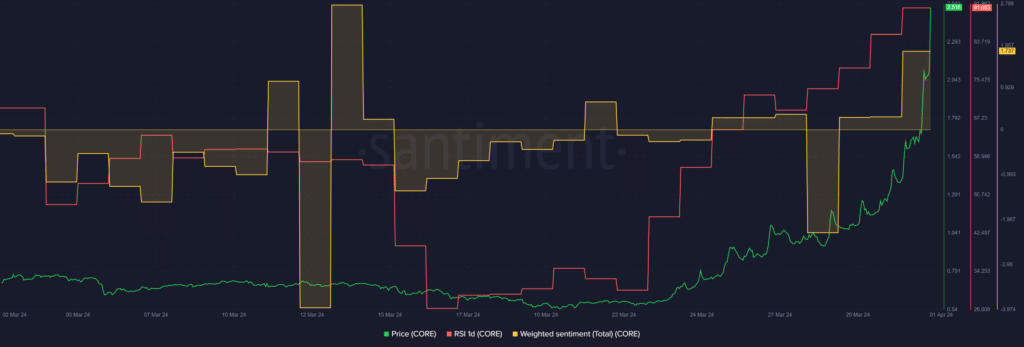

According to data provided by Santiment, the CORE Relative Strength Index (RSI) surged from 30 on March 22 — when the asset’s bullish momentum started — to 91 at the reporting time.

The indicator shows that CORE is roaming in the overbought zone or might even witness whale manipulation. In these conditions, high price volatility would be expected since investors might take short-term profits due to uncertain market conditions.

Despite the high RSI, the ratio of investors with positive sentiment about CORE is slightly higher than the negative sentiment. Per Santiment, the asset’s weighted sentiment is standing at 1.71.