Cosmos ATOM rises as technicals point to a strong breakout

Cosmos price rose for five consecutive days and reached its highest level since March 3 as demand and futures open interest rose.

Cosmos (ATOM) jumped to a high of $4.45 on Saturday, its highest level since March 4 and 32% above its lowest level this year.

The rebound happened as Bitcoin (BTC) and other altcoins bounced back. Bitcoin rose to $84,000, while Ethereum (ETH), Ripple (XRP), and Cardano (ADA) rose by over 1.45% on Saturday.

Cosmos price also jumped as investors bought the dip after it crashed to a crucial support level. According to CoinMarketCap, its 24-hour volume rose to over $153 million.

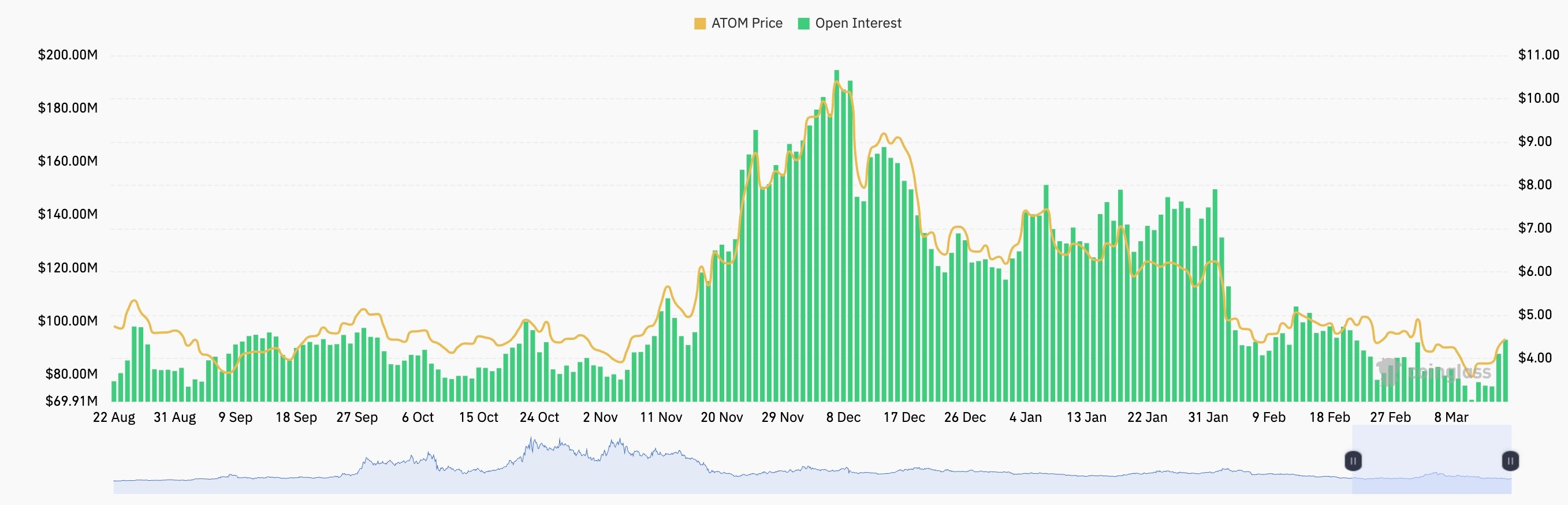

Similarly, the futures open interest rose to $93 million, its highest level since February 2021. Open interest is a figure that looks at the volume of unfilled put and call option orders in the futures ecosystem. In most cases, cryptocurrencies start bouncing back when the open interest is rising.

For starters, Cosmos pioneered the concept of the Internet of Blockchains, which is made up of interconnected and independent blockchains that work seamlessly together. Some key players in the ecosystem are networks like Osmosis, Celestia, THORChain, and Cronos.

Cosmos price analysis

The ATOM price rebounded for technical reasons too. The daily chart shows that the token dropped to a low of $3.4123 this week. This was an important level since it coincided with the lowest swing in September last year — a sign that it has formed a big double-bottom pattern whose neckline is at the December high of $12.2.

Cosmos price also formed a falling wedge chart pattern, which is made up of two descending and converging trendlines. A bullish breakout usually happens when the two lines are nearing their convergence.

There are signs that the token is forming a bullish divergence pattern. The Percentage Price Oscillator (PPO) has risen gradually after bottoming at minus 9.95 earlier this month.

Also, the Relative Strength Index (RSI) has moved slightly above the descending trendline that connects the highest swings since December 13 last year.

Therefore, the combination of a falling wedge and a double-bottom pattern is a sign that the coin will bounce back, possibly to the resistance level at $5.8783, the lowest swing on Dec. 20 last year.

This target is about 32% above the current level. A drop below this month’s low of $3.4 will invalidate the bullish view.