Cronos faces key vote, VVS DEX volume spikes

Cronos is in the red following the community’s proposal to undo a major token burn that incinerated 70 billion tokens in 2021.

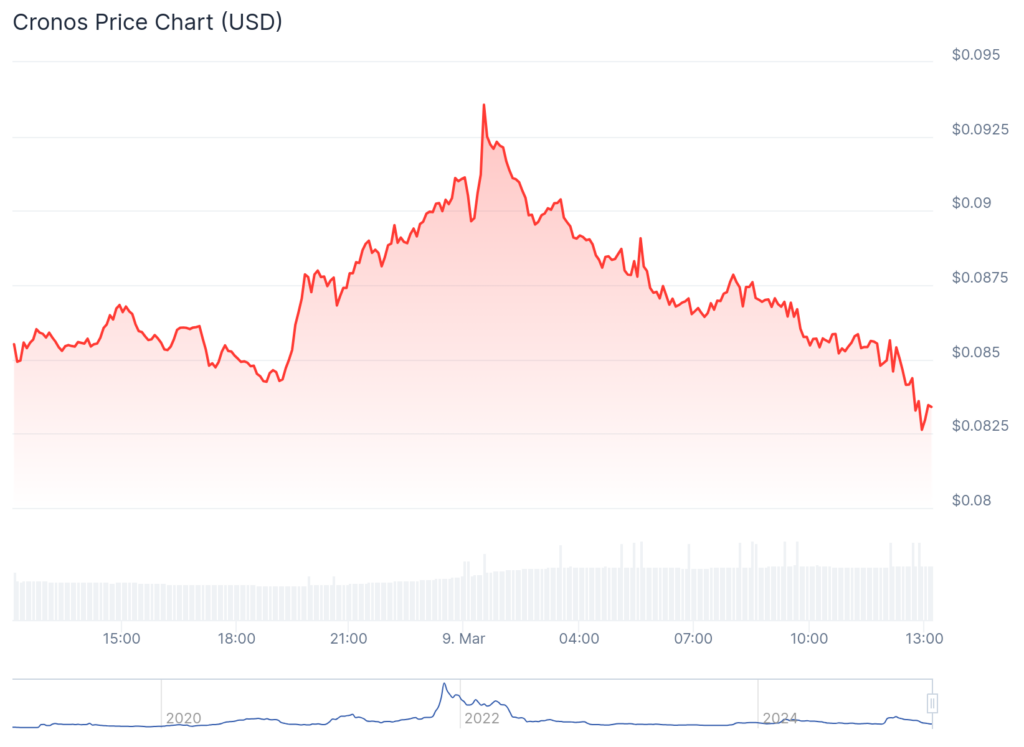

At last check Sunday, Cronos (CRO) — formerly known as the Crypto.com Coin — is in the red. See below.

The downturn comes as third-party data shows that the volume of tokens handled in its decentralized exchange protocols like VVS Finance has jumped.

According to DeFi Llama, the weekly volume soared by 140% to $123.2 million, bringing the cumulative total to $13 billion. Most of this volume was from VVS Finance, the biggest DEX network on Cronos, which handled $92 million in the past seven days.

This growth explains why the VVS token has jumped by double digits in the past few days.

Second, there are signs that the Cronos community will reject a recently unveiled proposal they believe will lead to more dilution.

Their goal is to now re-issue the 70 billion tokens, which will bring the total tokens in circulation to 100 billion. These new tokens will be allocated to the Cronos Strategic Reserve, which will be subject to a new 5-year lockup.

Cronos aims to use these funds to grow the network, including by investing in ETFs backed by CRO.

However, users have blasted the move, noting that it will lead to more dilution as more tokens are added to those in circulation. It also means that the developers can engineer more token issuances in the future.

Voting data shows that the voting outcome will be close. 50.92% of voters have supported the new proposal, while 48.56% have rejected it. A lot can change before the voting period ends on March 17.

For the proposal to go on, the proponents need to win with enough quorum. Quorum now stands at 23.50%, against the required 33.40%.

Cronos price technical analysis

The daily chart shows that the CRO price bottomed at $0.0700 this month. This was a notable level in November and August last year.

The rebound happened as the two lines of the falling wedge pattern neared their confluence levels. Also, the Relative Strength Index and the MACD indicator have pointed upward.

Therefore, more Cronos price gains will be confirmed if it rises above the 50-day moving average at $0.1. Such a move will lead to more gains, potentially to the key resistance level at $0.1400, the highest swing on April 30.