Crypto bull run hopes rise amid Fed rate cuts optimism, SOFR slips

Hopes of a crypto bull run rose on Monday as Bitcoin and most altcoins jumped to their multi-week highs, following a senior Fed official’s call for more rate cuts.

- The crypto market rally resumed on Monday as hopes of a government shutdown ending rose.

- Fed’s Mary Daly pushed for more interest rate cuts in the coming meeting.

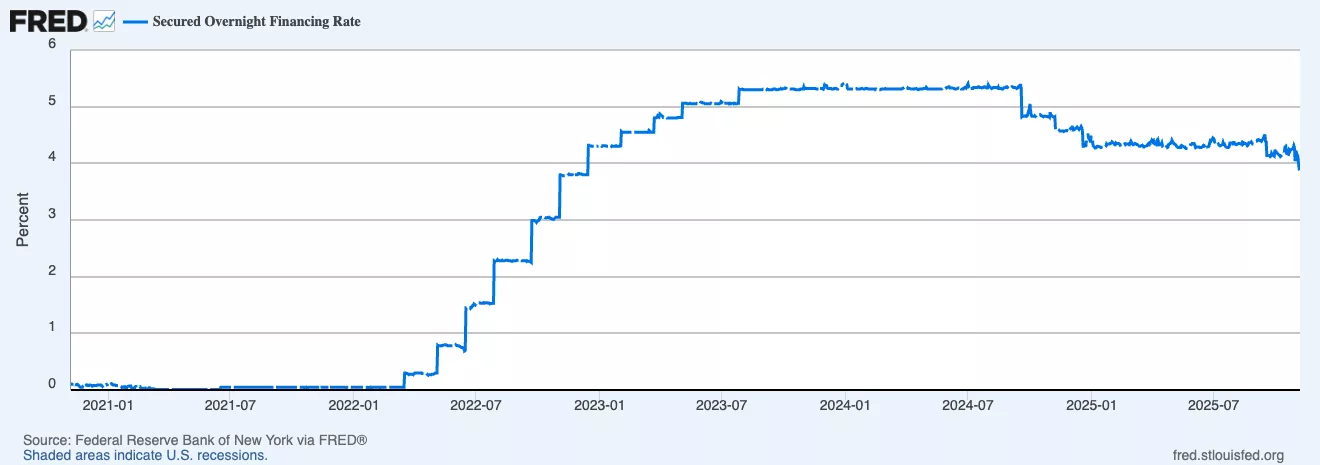

- The closely-watched SOFR interest rate plunged to 2022 lows.

Bitcoin (BTC) price jumped to $106,000, while the market capitalization of all coins tracked by CoinMarketCap jumped by 1.45% to $3.54 trillion. Some of the top gainers in the crypto market were Starknet, World Liberty Financial, Trump Coin, and XRP.

What’s driving the market today

The main reason for today’s crypto market rally is the hope that the US government shutdown is about to end. These hopes jumped after eight Democrats voted with the Republicans to advance a funding package. This means the package has a high chance of passing in the Senate and the House of Representatives.

The end of the government shutdown is important for the crypto market as it will lead to faster altcoin ETF approvals, which will lead to more demand from institutional investors.

Hopes of a crypto bull run also rose after a Federal Reserve official warned on leaving interest rates high for so long. In her statement, Mary Daly said that the bank should avoid the mistake of leaving interest rates high for so long. She said:

“We see a labor market that’s softening and wage growth that is moderating, so you’re really not going to see a lot of pressure coming on the cost side of labor. We don’t want to make the mistake of holding on too long for rates only to find out we’ve injured the economy.”

Her statement came as odds that the Federal Reserve will cut interest rates in December jumped to 73% on Polymarket.

Most importantly, the closely-watched Secured Overnight Financing Rate, commonly known as SOFR tumbled to the lowest level since 2022. SOFR is a rate used by banks and other companies to access financing from the Federal Reserve in the overnight market.

The falling SOFR rate, coupled with the proposed $2,000 stimulus check, means that risky assets like cryptocurrencies and stocks may bounce back as liquidity rises.

Beware of a dead-cat bounce

Still, there is an elevated risk that the ongoing crypto market recovery is part of a dead-cat bounce, a common scenario as of late.

A dead-cat bounce is a situation where an asset in a free fall bounces back briefly and then resumes the downtrend. It is often called a bull trap because it usually attracts inexperienced retail investors.

One warning that this could be a dead-cat bounce is that the Crypto Fear and Greed Index remains in the fear zone of 29.

Another is that Bitcoin and most altcoins remain below their short- and long-term moving averages and the Supertrend indicators, a sign that bears are still in control.

Therefore, a clear crypto bull run will likely be confirmed once the Fear and Greed Index moves into the greed zone and momentum pushes assets above the short- and long-term moving averages.