Bitcoin, Ethereum in the green as Fed gears up for interest rate decision

The Federal Reserve’s final meeting of 2025 kicked off on Tuesday, Dec. 9, with the central bank expected to announce its last monetary policy decision of the year at 2:00 p.m. ET on Wednesday.

- The Fed is expected to announce a 0.25% rate cut on Wednesday, marking its third reduction of 2025.

- Historically, Bitcoin tends to rally after rate cuts.

- Despite volatility, both Bitcoin and Ethereum showed positive movement ahead of the announcement.

Investors are anticipating a 0.25% rate cut, marking the third such reduction of the year, with data from the CME Group showing a 90% probability of the cut.

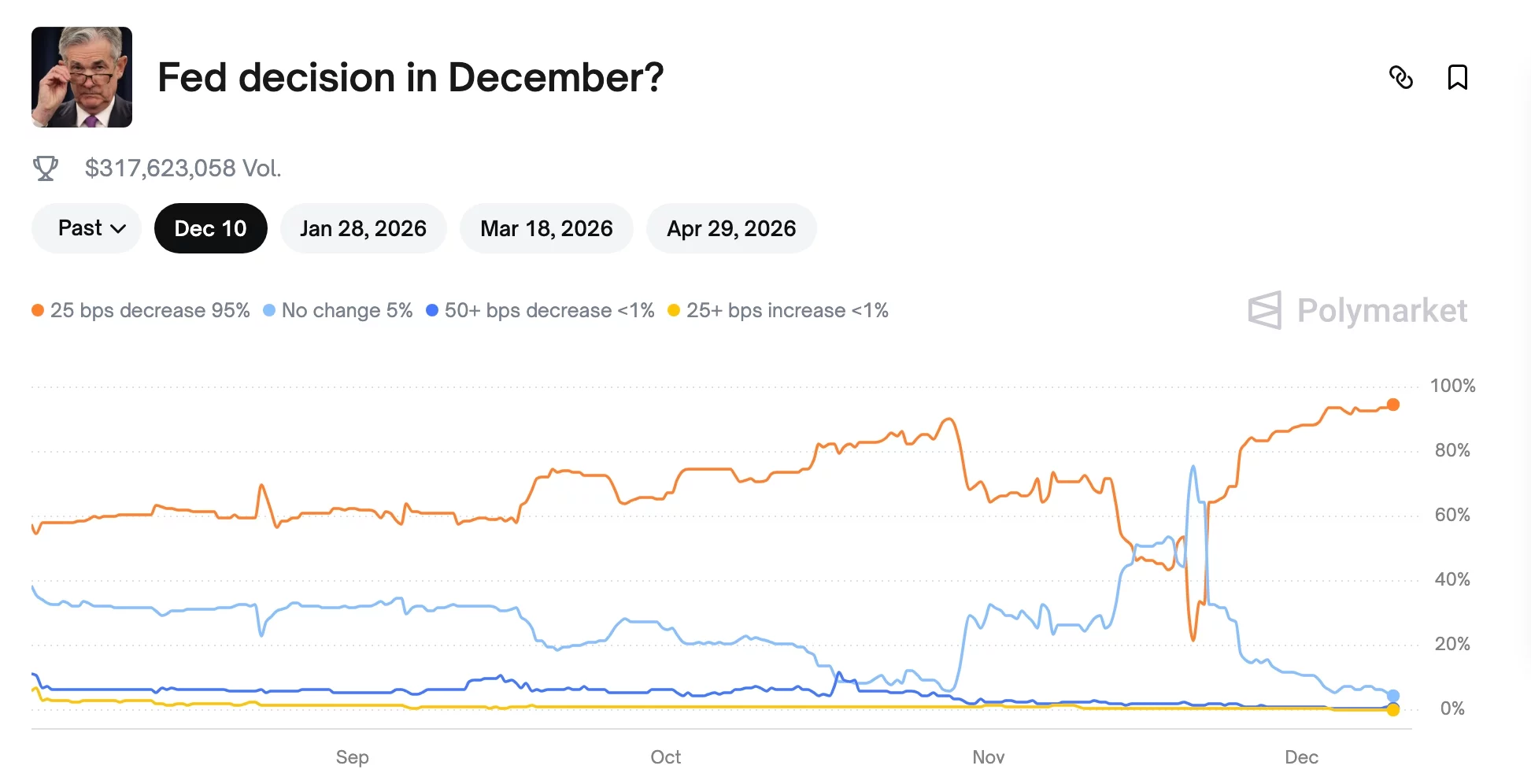

Polymarket gamblers also lean toward a 0.25% rate reduction, driven by ongoing concerns about the labor market. See below.

Historically, Bitcoin has reacted positively to rate cuts, as lower interest rates make non-yielding assets like the cryptocurrency more attractive, often weakening the dollar in the process.

However, recent market reactions have been more mixed, with Bitcoin and other assets showing initial dips after cuts in 2025, suggesting that investors are increasingly focused on Fed communications, particularly Jerome Powell’s tone, and broader liquidity conditions rather than just the rate change itself.

Despite the volatility, Bitcoin and Ethereum were both showing positive movement at last check, with analysts predicting that further cuts in late 2025 or early 2026 could lead to rallies despite the current market turbulence.

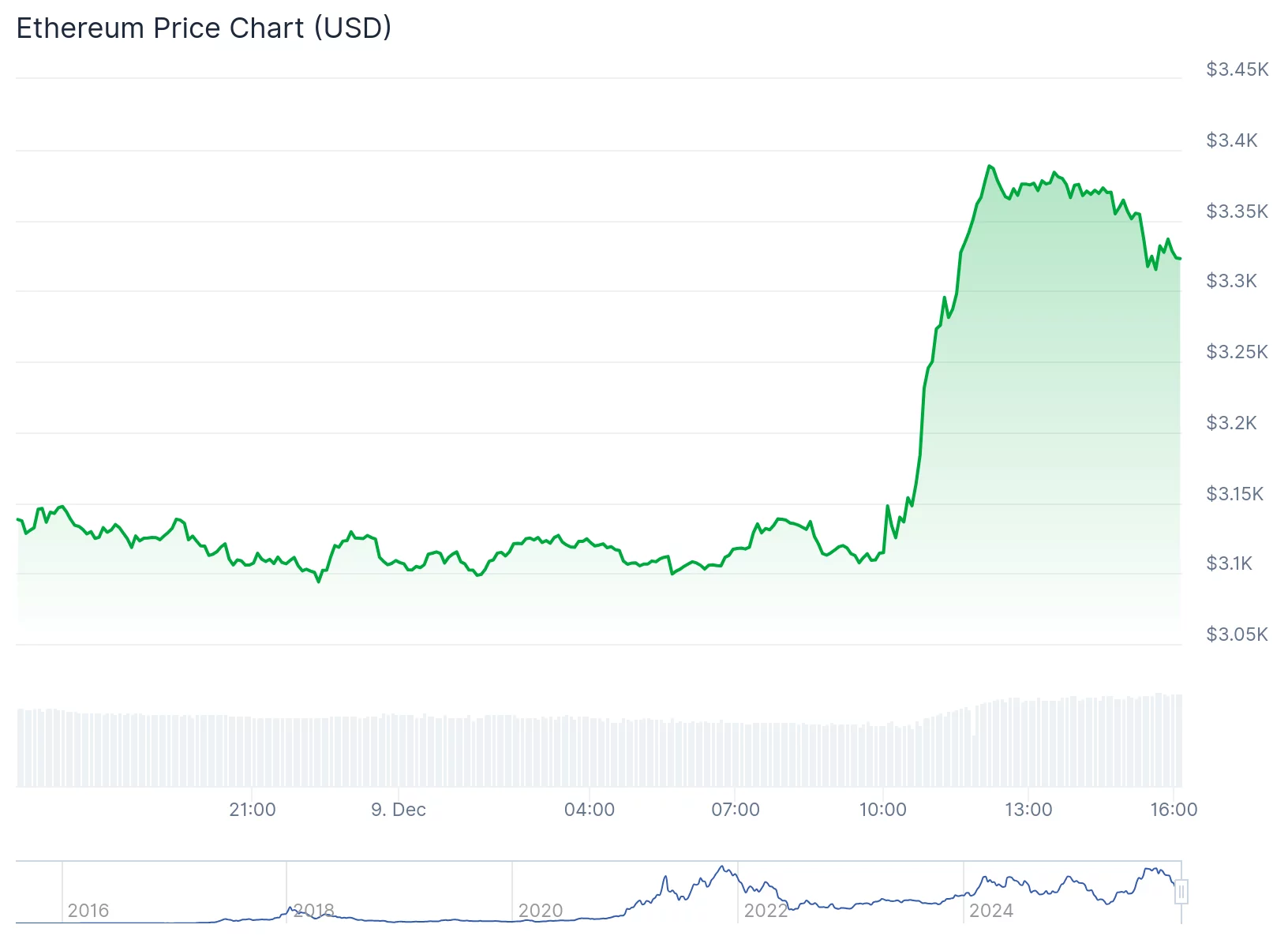

At last check Tuesday, at about 4 p.m. EST, Bitcoin was up about 2.6% for the day. Ethereum was up about 6%. In contrast, altcoins (as of midday Tuesday) were in the red. See below.

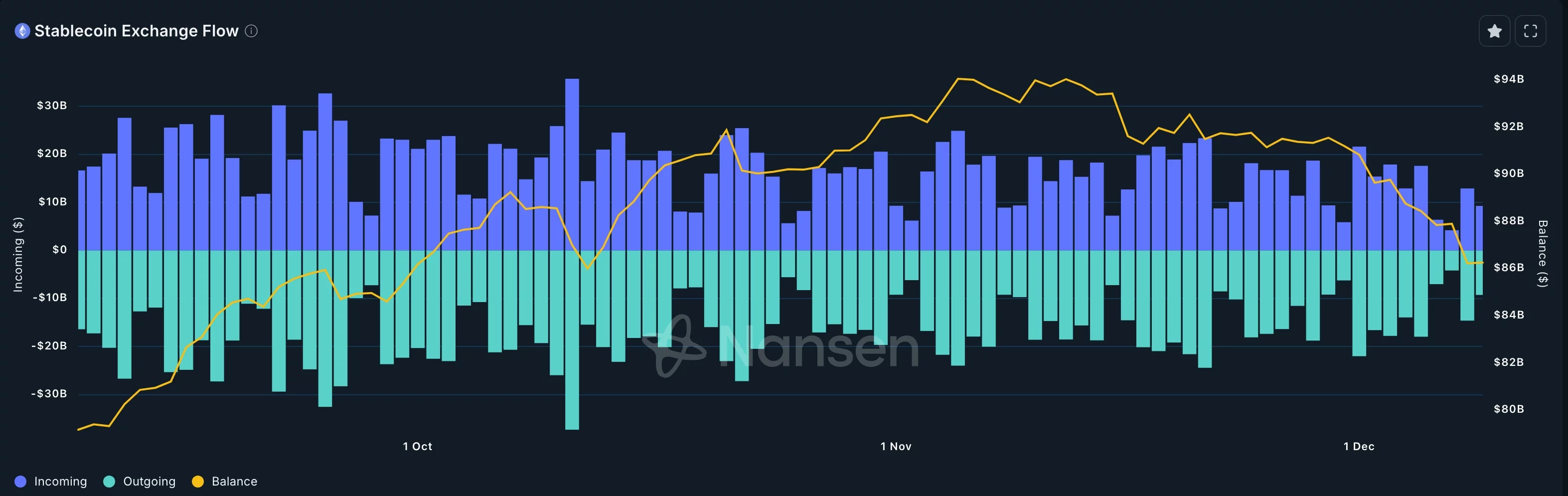

Stablecoin outflows

Data compiled by Nansen shows that the balance of stablecoins in exchanges has plunged to $86 billion, its lowest level since October. They have been in a freefall after peaking at $94 billion on Nov. 6 this year, a sign that investors have embraced a risk-off sentiment.

The ongoing stablecoin trends have coincided with the market’s deleveraging. Data compiled by CoinGlass shows that the futures open interest fell by 0.3% in the last 24 hours to $130 billion.

Falling futures open interest and a flattened funding rate are signs of weak demand in the futures market, which recently dominated the crypto trading industry.

Federal Reserve interest rate decision ahead

There is a likelihood that Bitcoin and other altcoins will drop after the cut for three main reasons.

- First, the interest rate cut has been priced in by market participants, meaning that investors may sell the news.

- Second, the Fed may deliver a hawkish interest rate cut, signaling that it will hold rates steady for a while as it monitors incoming data.

- Third, a rate cut may trigger inflation in the U.S., prompting the Fed to either keep rates steady for a while or even hike them in 2026. This fear explains why US bond yields have risen over the past few weeks, with the 10-year yield rising to 4.18%.

The ongoing crypto market pullback confirms out warning on Monday that the rally was likely a dead-cat bounce, a situation where an asset in a free fall rises and then resumes the downtrend.