Crypto enthusiasm is fading among ultra-wealthy, Goldman Sachs finds

According to Goldman Sachs’ recent survey of family offices, a majority of them, 62%, are not interested in investing in cryptocurrencies – an increase from 39% in 2021.

However, the survey also found that 26% of family offices are currently invested in crypto, which is a significant growth from 16% in the previous year.

Investment strategies of ultra-wealthy

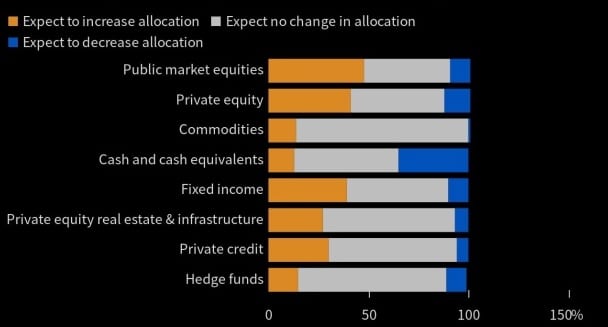

Goldman Sachs Group has recently released its 2023 Family Office Investment Insight Report, which highlights that many institutional family office investors are not holding onto cash. Instead, for the next 12 months, they are “risk-on” and planning to increase allocations to public and private equities while also adding some fixed-income exposure to take advantage of higher rate opportunities.

Conducted between Jan. 17 and Feb. 23, 2023, the survey for the second Goldman Sachs Family Office Investment Insights report, titled “Eyes on the Horizon,” covered 166 institutional family offices with at least $500 million in net worth – 93% – and 72% having at least $1 billion.

The survey goes on to reveal that almost half of the private investment firms that participated plan to increase their exposure to public equities, with 41% looking to increase their allocations to private equity. Meena Flynn, co-head of global private wealth management, stated that “family offices, for the most part, are really ‘risk-on’ for the next 12 months.”

Cash or cash equivalents reign strong

Goldman Sachs’ report also found that, on average, 12% of family office portfolios are currently in cash or cash equivalents, which is higher than other institutional investors’ positioning. Over a third of respondents plan to decrease their cash allocation over the next year.

“With the flexibility to invest across the risk spectrum, family offices have maintained a largely consistent approach to more aggressive allocations as they seek superior returns,” Meena Flynn, the co-head of Global Private Wealth Management, shared.