Crypto experts deliver exciting Bitcoin price forecasts

Bitcoin price has remained in a tight range in the past few weeks. It peaked at $71,935 last week, where it found substantial resistance. BTC was trading at $68,000 on Thursday, down by about 8% below its highest point this year.

Analysts are bullish on Bitcoin

Cryptocurrency experts are increasingly bullish on Bitcoin prices. In April, Cathie Wood of Ark Invest upped her long-term price target to $3.8 million, making her one of the most bullish investment pros in the industry.

Most recently, Michael Novogratz, the billionaire founder of Galaxy Digital, said that Bitcoin will end the year at a more reasonable $100,000 level.

In an X post, another crypto expert named CryptoCon noted that the coin will end the year at $91,539.

Robert Kiyosaki of the Rich Dad, Poor Dad, noted that Bitcoin woud surge to $350,000 by the end of next summer.

The bullish case for Bitcoin

Analysts have mostly identified several bullish catalysts for Bitcoin. First, more institutions are buying Bitcoin as evidenced by the performance of the spot Bitcoin ETFs. These funds now hold over 880k coins valued at over $60 billion. MicroStrategy is also seeking to add more Bitcoins.

Second, Bitcoin supply growth has stalled because of the recent halving event. Most Bitcoin mining companies have reported a sharp drop in production. CleanSpark mined 417 coins in May, down from 721 in April.

Similarly, Riot Platforms mined 215 coins in May down from 375 in April while Marathon Digital produced 616 coins down from 850 in April.

At the same time, Bitcoin balances in exchanges have continued falling in the past few months. Therefore, a combination of rising demand and falling supplies is a sign that the coin could continue rising.

Third, the regulatory environment has become clearer in the United States, a move that could see large banks like JPMorgan and Goldman Sachs start offering custody solutions.

Additionally, Bitcoin seems like a better currency than the US dollar as its supply increases and US public debt explodes. Unlike the USD, which has one node and unlimited supply, Bitcoin is a decentralized network with a maximum supply limit of 21 million.

Bitcoin price forecast

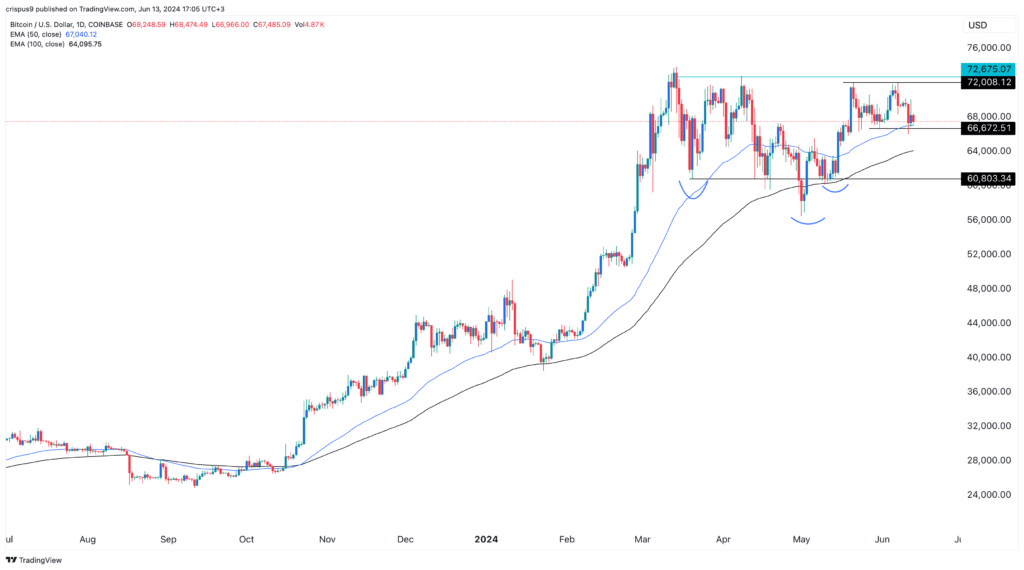

BTC daily chart

Bitcoin’s daily chart is sending mixed signals. On the positive side, it has constantly remained above the 50-day and 100-day Exponential Moving Averages (EMA). It has also formed what looks like an inverse head and shoulders pattern, a popular bullish sign. This pattern means that the token will have a bullish breakout, to possibly $80k, if it moves above the year-to-date high.

On the other hand, Bitcoin has formed a small double-top pattern at $72,000. In price action analysis, this is one of the most popular bearish signs in the market. A volume-supported drop below its neckline at $66,672 will point to more downside to $60,800 (March 20th low)