Crypto experts divided on the next Bitcoin price action

Bitcoin price has lost momentum and entered a bear market over the past few weeks amid multiple headwinds.

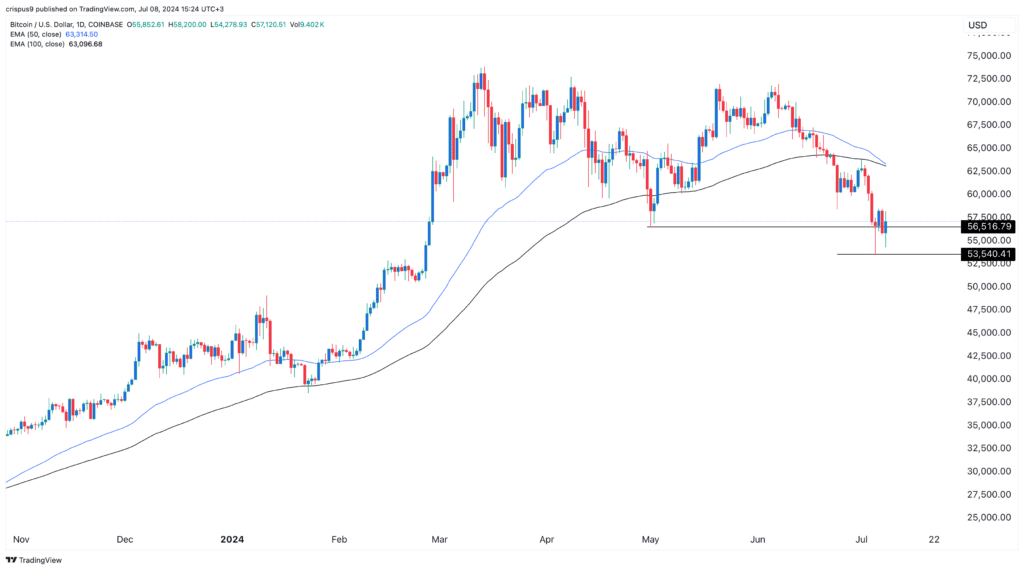

BTC dropped to a multi-month low of $53,540 last week, its lowest point since February. It has since recovered some of those losses and was seen trading at $57,200 on Monday. The recent Bitcoin price movement has led to division among crypto experts. Some believe that Bitcoin is still in a bullish trend and that the recent sell-off will be short-lived.

In a recent statement, a Standard Chartered analyst said that they expect Bitcoin to end the year above $100,000, implying an approximate 75% gain from the current level.

The analysts attributes their view to the ongoing institutional demand and the high probability that Donald Trump will become the next US president. Trump has wooed the crypto community by promising friendly regulations for the industry.

As a result, he has received campaign financing from the Winklevoss Twins and Jesse Powell, the founder of Kraken.

Meanwhile, Ki Young Ju, the founder of CryptoQuant, a leading on-chain analytics company, noted that the bullish cycle remains unchainged. While he expects the coin could drop to $47k, he believes that the bull run will run through next year, when it will rise to $112k.

Analysts have also cited other reasons why Bitcoin’s price could resume the bullish trend. One reason is the high likelihood that the Federal Reserve will start cutting interest rates soon after last week’s jobs data.

The report showed that the economy added over 200,000 jobs, while the unemployment rate rose to 4.1% during the month. As a result, analysts at Citigroup and ING predict the Fed will start cutting in September.

Fed rate cuts are bullish for Bitcoin, especially because of the $6.15 trillion that has been invested in money market funds. Ultimately, these risk-averse could rotate to risky assets like tech stocks and Bitcoin.

Bitcoin price crash could continue

On the other hand, some crypto analysts believe that Bitcoin’s price could continue falling. The most common argument was that the coin has dropped below the double top’s neckline pointing to more downside as traders target the key support at $44,000.

Bears also pointed to the ongoing liquidations by the German government, Mt. Gox wallets, whale activity, and Bitcoin miner capitulation. For example, according to LookOnChain, a Bitcoin whale deposited $45.18 million to Binance on Monday and has moved coins worth $468 million since June 27th.

The German government has also continued to move coins to exchanges. As a result, the volume of Bitcoin balances in exchanges has continued rising, which is often a bearish sign.

BTC price action

Bitcoin price chart

The charts make it clear that Bitcoin is battling numerous risks, especially the double-top pattern at $72,000. It has also dropped below the 200-day moving average and has retested the double-top’s neckline at $56,000.

Therefore, the recent rebound could be part of a dead cat bounce that will push Bitcoin prices lower in the near term. If this happens, it could drop to the next key support at $44,000. In the long term, however, there is a likelihood that the coin will rebound to over $100,000.