Crypto investment products see $436m inflows as rate cut speculation grows

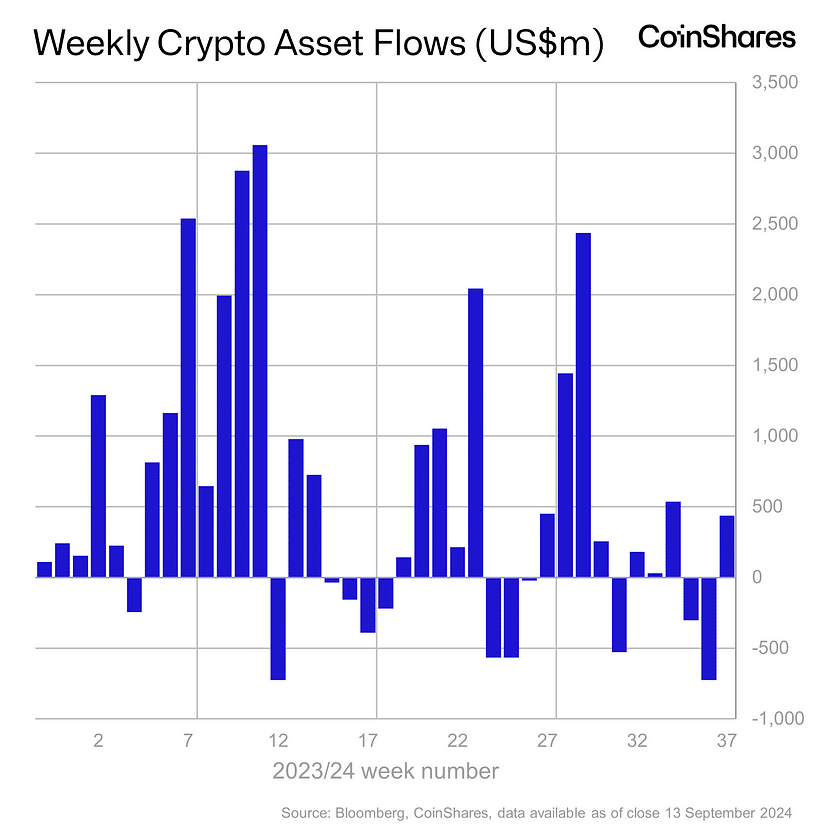

Data from CoinShares shows a reversal in crypto investment trends, with $436 million in inflows following weeks of outflows.

Cryptocurrency investment products experienced their first reversal in weeks, with inflows reaching $436 million after a period of $1.2 billion in outflows.

The surge in inflows, observed towards the end of the week, is attributed to shifting market expectations of a potential 50 basis point interest rate cut on Sept. 18, CoinShares CoinShares head of research James Butterfill noted, adding that the sentiment prompted by comments from former NY Fed President Bill Dudley.

Despite the wave of inflows, trading volumes in exchange-traded funds remained flat at $8 billion for the week, significantly below the year-to-date average of $14.2 billion. Regionally, the U.S. led with $416 million in inflows, while Switzerland and Germany contributed $27 million and $10.6 million, respectively.

As always, Bitcoin (BTC) was the primary beneficiary, reversing a 10-day streak of outflows totaling $1.18 billion with $436 million in new inflows. In contrast, short-Bitcoin products experienced $8.5 million in outflows after three consecutive weeks of inflows.

Meanwhile, Ethereum (ETH) faced continued challenges, recording $19 million in outflows, driven by “concerns over layer-1 profitability following Dencun.” Solana (SOL) marked its fourth consecutive week of inflows, totaling $3.8 million. Blockchain equities also saw a boost, with $105 million in inflows attributed to the launch of several new ETFs in the U.S., the data shows.

The inflows come just weeks after Bitcoin saw a sharp decline in exchange activity, with daily inflows dropping 68% from 68,470 BTC to 21,742 BTC, and outflows falling 65% from 65,847 BTC to 22,802 BTC in early September.