Crypto liquidations cross $210m with longs accounting for 85%

The cryptocurrency market has witnessed over $210 million worth of liquidations across the board, with long positions accounting for 85% of this bloodbath amid the latest market turmoil.

Data from crypto analytics resource Coinglass confirms that market participants have suffered a blow from the recent turbulence, which has triggered a 4% drop in the price of Bitcoin (BTC) in the last 24 hours. Specifically, 92,298 traders have witnessed liquidations worth $210.26 million in long and short positions.

The bulk of these liquidations, totaling $178.2 million, are linked to long positions, while short positions have seen liquidations amounting to $32.05 million. With long positions comprising 84.7% of the liquidated trades, sentiment has swiftly transitioned from bullish to bearish, as the market flips red.

Moreover, the current market instability stems from Bitcoin’s retreat from its recent high of $67,183 on April 23. Following this peak, BTC experienced a notable correction, culminating in a 3.2% decline by the end of yesterday’s trading session.

This bearish momentum has persisted, leading Bitcoin to relinquish the psychologically significant $64,000 threshold earlier today. The global cryptocurrency market capitalization has declined by 3.87% over the past 24 hours, now standing at $2.47 trillion, as altcoins venture into bearish territory.

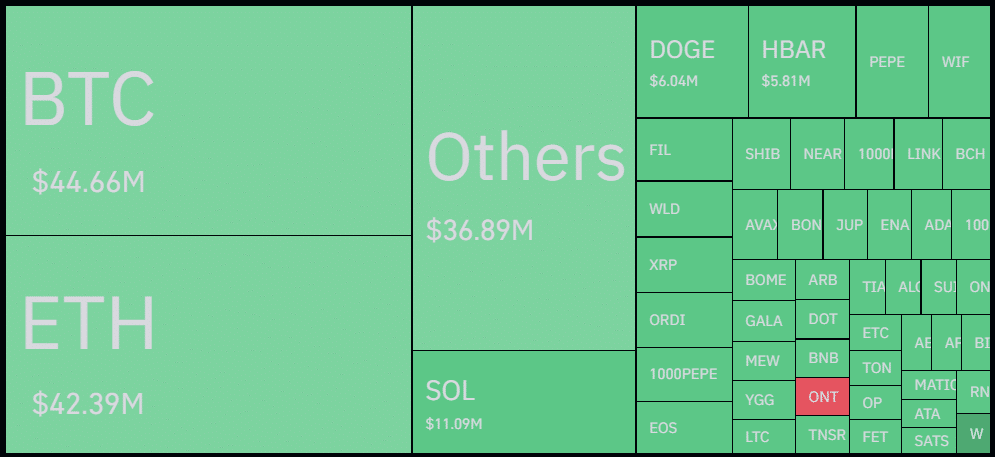

Being the premier cryptocurrency, Bitcoin has witnessed the largest liquidated positions among all crypto assets, totaling $44.6 million within 24 hours.

The liquidation trend was noticeable across the market on April 18 before the most recent Bitcoin halving, resulting in a loss of $247 million. The Bitcoin halving, taking place on April 20, sparked renewed optimism after this downturn, prompting a resurgence of long positions amid the market’s recovery.

Despite the recent increase in liquidations, the derivatives market has witnessed a surge in volume, with trade volume jumping by 30% in the last 24 hours to reach $159 billion at the reporting time. This is due to an increase in short positions, with the long/short ratio now sitting at 0.7832.