Crypto liquidations doubled as market cap fell to 2-month-low

The total amount of cryptocurrency liquidations increased by over two times over the past day as the global market capitalization plunged to its two-month lows.

According to data provided by Coinglass, the total crypto liquidations rallied by 114% in the past 24 hours — currently sitting at $265 million. Data shows that $236 million worth of long positions have been liquidated.

Per Coinglass data, only 11% of the liquidations, worth $29 million, belong to short-position holders. In total, more than 102,000 traders have been liquidated in the mentioned timeframe.

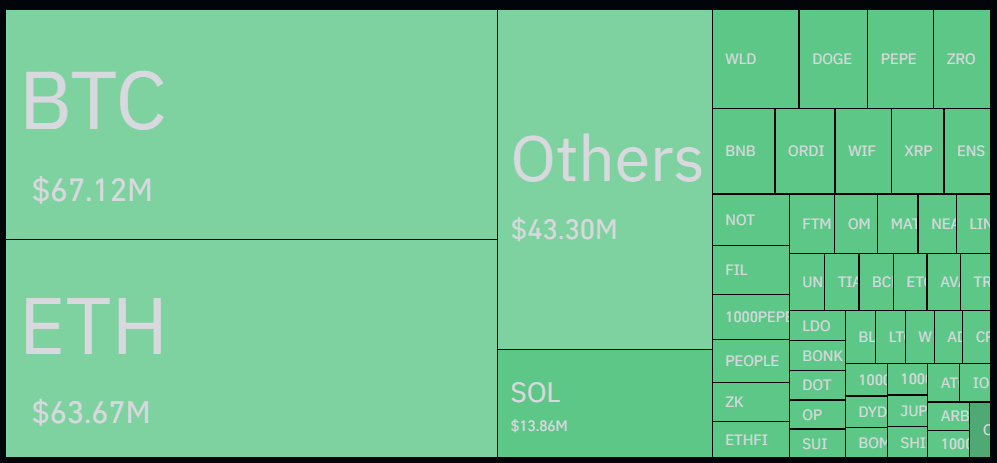

Bitcoin (BTC) is currently leading the chart with over $67 million in liquidations in 24 hours. The asset’s price briefly plunged below the $58,000 mark earlier today, resurfacing FUD (fear, uncertainty and doubt) within the market.

The second-largest cryptocurrency, Ethereum (ETH), isn’t far from Bitcoin with $63.6 million in liquidations. ETH is down by 4.4% in the past 24 hours and is trading at $3,215 at the reporting time.

Binance, the largest crypto exchange by trading volume, witnessed $112 million in liquidations with a 42% share of the total amount. OKX comes in second with $87 million in liquidations.

According to data from Coinglass, the global cryptocurrency open interest decreased by 4.7% in the past 24 hours and is currently hovering around $58.5 billion.

Lower market volatility and liquidations would be expected with sideways movements as the open interest plunges.

Data from CoinGecko shows that the global crypto market capitalization recorded a 3.4% decline over the past day, dropping to $2.29 trillion. This level has not been seen since May 1 when the market saw a short-term bullish momentum.

It’s important to note that market movements are unpredictable amid market-wide FUD. A Glassnode report on July 3 revealed that Bitcoin investors are showing “indecision” as the price remains below the $64,000 mark.