Crypto liquidations surpass $900m following Fed Chair’s Jackson Hole speech

Crypto liquidations have hit $940 million as Bitcoin slips briefly below $109,000. This mass liquidation comes only a few days after the market saw gains following the Fed Chair’s Jackson Hole speech.

- Crypto liquidations cross over $940 million after BTC briefly dips below $110,000.

- The overall crypto market lost $200 billion despite seeing major gains from the Fed Chair’s speech about possibly cutting interest rates.

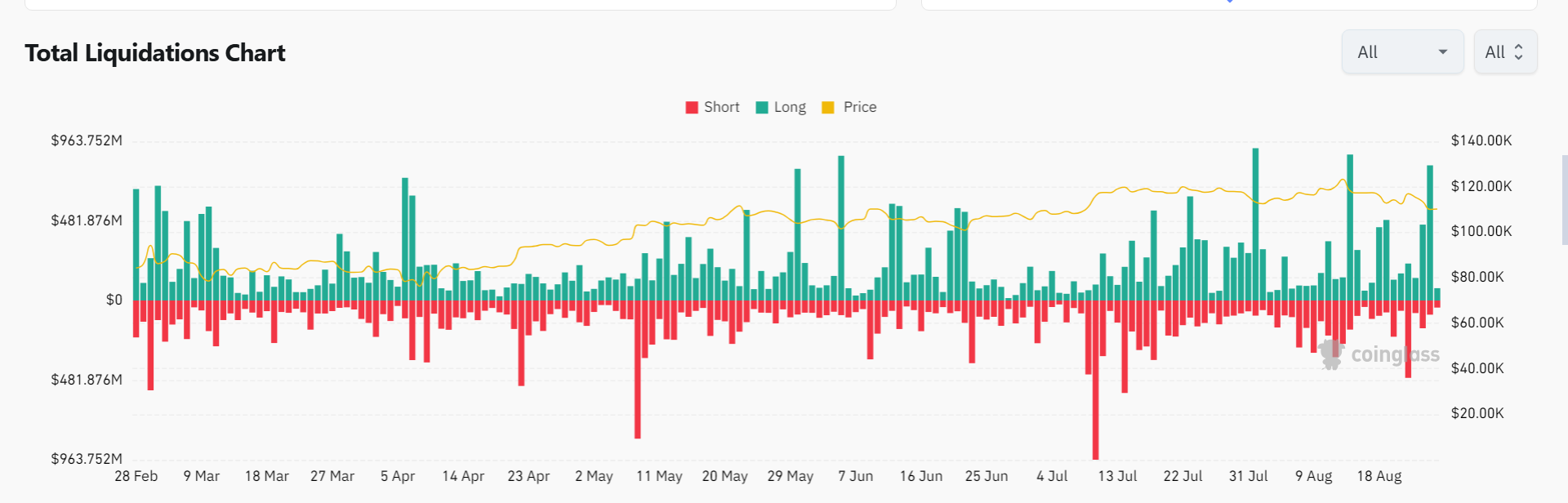

According to data from CoinGlass, the majority of crypto liquidations were long positions; which made up $826.51 million of the total $941 million of liquidations.

As Bitcoin (BTC) briefly dipped below the $110,000 threshold, Bitcoin positions made up the second largest portion of liquidations on the board. Based on the 24-hour heatmap, Bitcoin liquidations have hit $277.21 million or nearly 30% of the total crypto liquidations.

This wave of liquidations comes only a few days after a late-week dovish signal from Fed Chair Jerome Powell, which triggered gains of $594 million for the crypto market. However, the hype was apparently short-lived as BTC has fallen off its $110,000.

On August 22, at the Jackson Hole, Federal Reserve Chair Jerome Powell hinted at possible interest rate cuts ahead as he stated that there was currently a high level of uncertainty that is making it difficult for policymakers.

This move sparked major gains in the crypto market as Bitcoin climbed to a weekly high of $116,960 as it nearly touched the $117,000 level. However, the victory ended too soon as BTC avalanched down to the $109,000 range.

What could high crypto liquidations mean for the market?

Crypto liquidations hitting $941 million could indicate extreme volatility and over-leveraging by traders within the wider crypto market. Considering liquidations are triggered by price swings that close long and short positions, such a large-scale wipeout points to an imbalance between bullish and bearish sentiment, with cascading liquidations accelerating the downward move.

This is evident through the overall crypto market cap losing $200 billion or around 2.2% of its market cap. On August 26, the crypto market cap fell from its $4 trillion high and stands at $3.8 trillion. Meanwhile, Bitcoin has yet to recover from its fall from grace; it hangs precariously at the edge of $110,000 as it currently trades at $110,250.

Ethereum (ETH) is faring slightly better despite a 4.9% dip as it stays within the $4,400 range with a value of $4,429.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.