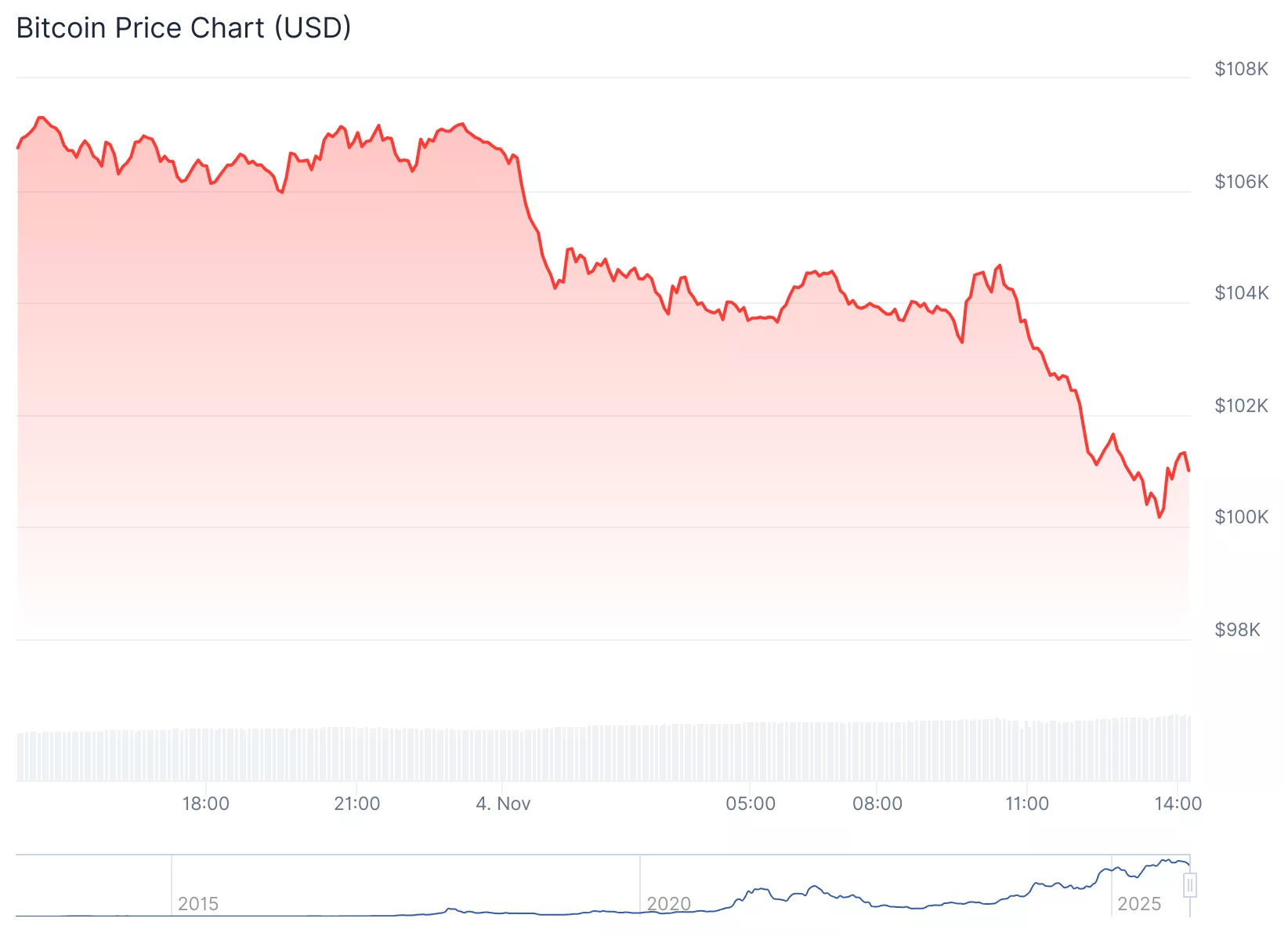

Crypto market bleeds $300b as Bitcoin dips below $100k

The crypto market is deep in the red today, losing over $300 billion in a single day as Bitcoin slid under $100,000.

- Crypto markets lost over $300 billion in a single day as Bitcoin hovered $99,954.

- Bitcoin and Ethereum ETFs have seen $1.4 billion in outflows today.

- The U.S. dollar’s rise to a four-month high against the euro likely signals a “risk-off” environment.

Why?

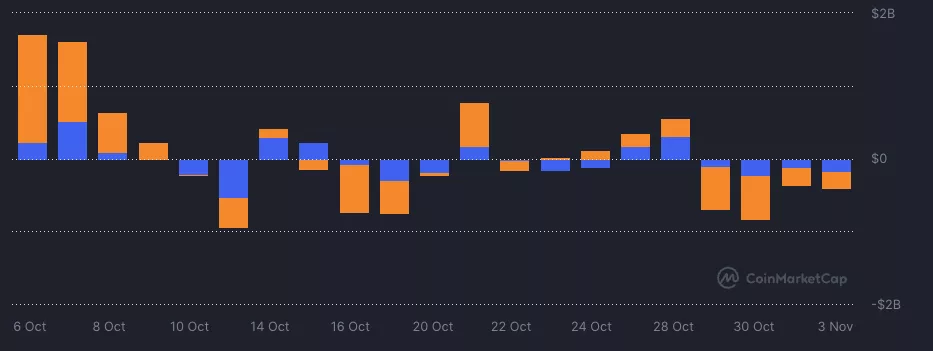

Bitcoin fell below $105,000, a key support for weeks, to $99,954. The drop came amid significant ETF outflows and a spike in liquidations. See the chart below.

Both Bitcoin and the total crypto market cap were down 6%. Bitcoin was trading at $100,800 while the crypto market cap stood at $3.36 trillion, losing more than $300 billion in 24 hours.

The market dip coincided with a wave of liquidations, which reached $1.3 billion on November 4, with long liquidations dominating at $1.1 billion.

Also, the U.S. dollar’s rise to a four-month high against the euro likely influenced investor sentiment. A stronger dollar often signals a “risk-off” environment, where investors seek safety in traditional assets, such as U.S. Treasuries and the dollar itself, reducing demand for riskier assets like Bitcoin.

Additionally, uncertainty around further Federal Reserve rate cuts makes traditional investments more attractive, tightening global liquidity and curbing speculative flows into Bitcoin.

Over the past few days, Bitcoin and Ethereum spot ETFs are on track for their fifth consecutive day of outflows. Spot outflows totaled $189,500 for Bitcoin (BTC) and at $135,700 for Ethereum (ETH).

When will crypto markets go up again?

After a volatile October, crypto markets may be consolidating for November. Lacie Zhang, research analyst at Bitget Wallet, told crypto.news that markets may be entering a “recalibration phase” after which further gains are possible.

“Market data and technical signals suggest Bitcoin may trade within a $94,000–$118,000 range in the near term. The lower bound represents a healthy retracement zone consistent with subdued ETF inflows,” Zhang said.

If Bitcoin holds above key resistance levels, markets may once again regain confidence. This could enable a new rotation from Bitcoin and Ethereum to altcoins.