Crypto market rebounds as on-chain data shows mysterious trends

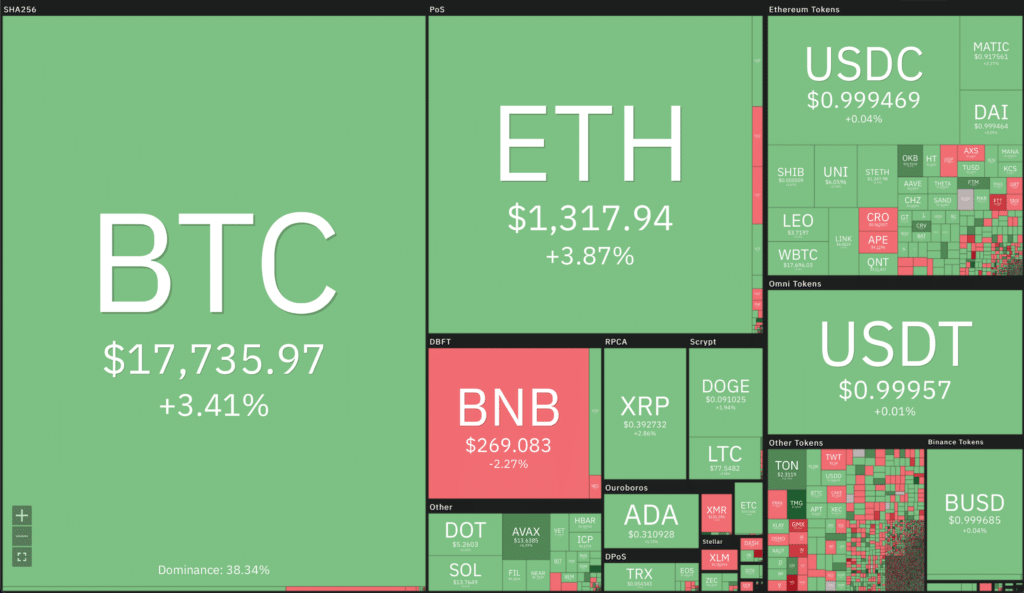

The cryptocurrency market is mostly green today, with all major cryptocurrencies trading higher than they were 24 hours ago.

As of press time, market data shows that all major cryptocurrencies reported gains over the last 24 hours. Bitcoin (BTC) is trading at $17,760 (up 3.41% over the last 24 hours, 4.48% over the last seven days), Ethereum (ETH) is trading at $1,319 (up 3.87% over the last 24 hours, 5.24% over the last seven days) and finally, XRP is trading at $0.3927 (up 2.86% over the last 24 hours, 0.74% over the last seven days.)

In the meantime, on-chain data provided by Glassnode shows that the number of Bitcoin addresses holding at least 0.01 BTC just reached an all-time high of 11,249,943. Bitcoin’s balance on exchanges just reached a 4-year low of 2,276,736 BTC. Both those data points suggest that there is a growing trend to move Bitcoin off exchanges and onto self-custody wallets, even in the retail crowds.

When it comes to Ethereum (ETH), Glassnode data shows that the number of addresses holding at least 0.01 ETH just reached a 4-month high of 22,588,490. At the same time, the number of Ethereum exchange deposits just reached a 4-month high of 8,710.

It all happens in the context of major stablecoin outflows from cryptocurrency exchanges. Binance USD (BUSD) exchange outflow volume just reached a new all-time high of $24,782,627, while USDC exchange net flow just reached a seven-month high of $34,144,686. Lastly, Tether (USDT) exchange net flow reached an all-time low of -87,840,088 USDT.

Those last data points suggest that the cryptocurrency community currently does not trust centralized custodians and wants to flee them while staying on-chain but also avoiding volatility. Still, their trust in stablecoin stability during major market fallout may be misplaced.