Crypto market slips as liquidations soar, open interest plunges

The crypto market slipped on Dec. 5, with Bitcoin and most altcoins being in the red as liquidations rebounded and open interest dipped.

- The crypto market came under pressure on Friday, with Bitcoin and altcoins falling by over 2%.

- This decline coincided with the soaring liquidations and falling open interest.

- These tokens also dropped ahead of a $4.5 billion options expiry event.

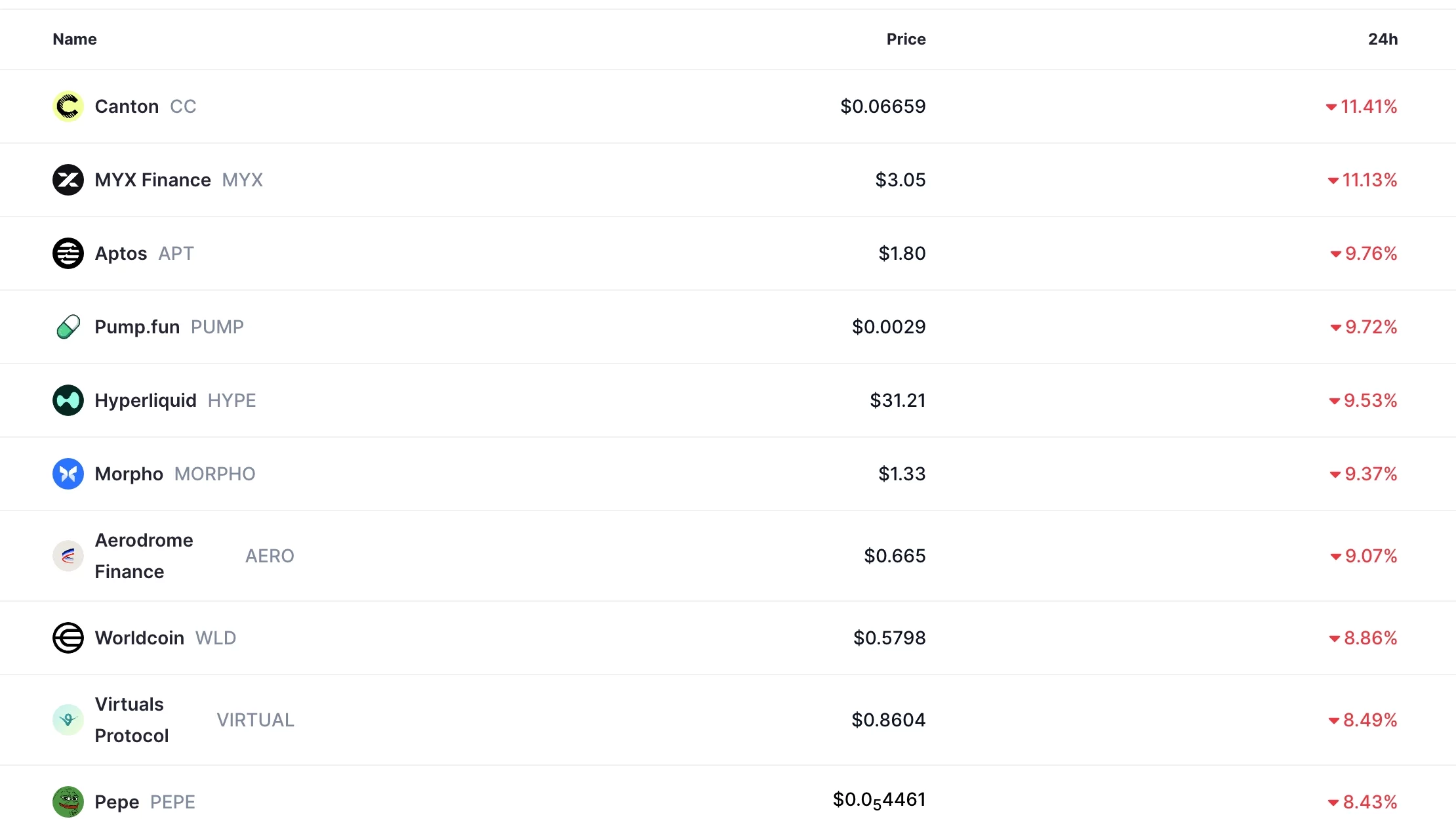

Bitcoin (BTC) moved from over $93,000 earlier this week to below $90,000. Some of the top laggards were coins like Canton, MYX Finance, Aptos, Hyperliquid, Morpho, and Aerodrome Finance.

The crypto market crash coincided with a big drop in daily open interest in the futures market. It dropped by 4.35% to $127 billion, down from the October high of $225 billion.

The open interest has slipped as investors have continued to deleverage after the $20 billion wipeout on October 10. In most cases, crypto prices remain under pressure whenever the open interest is in a downward trend.

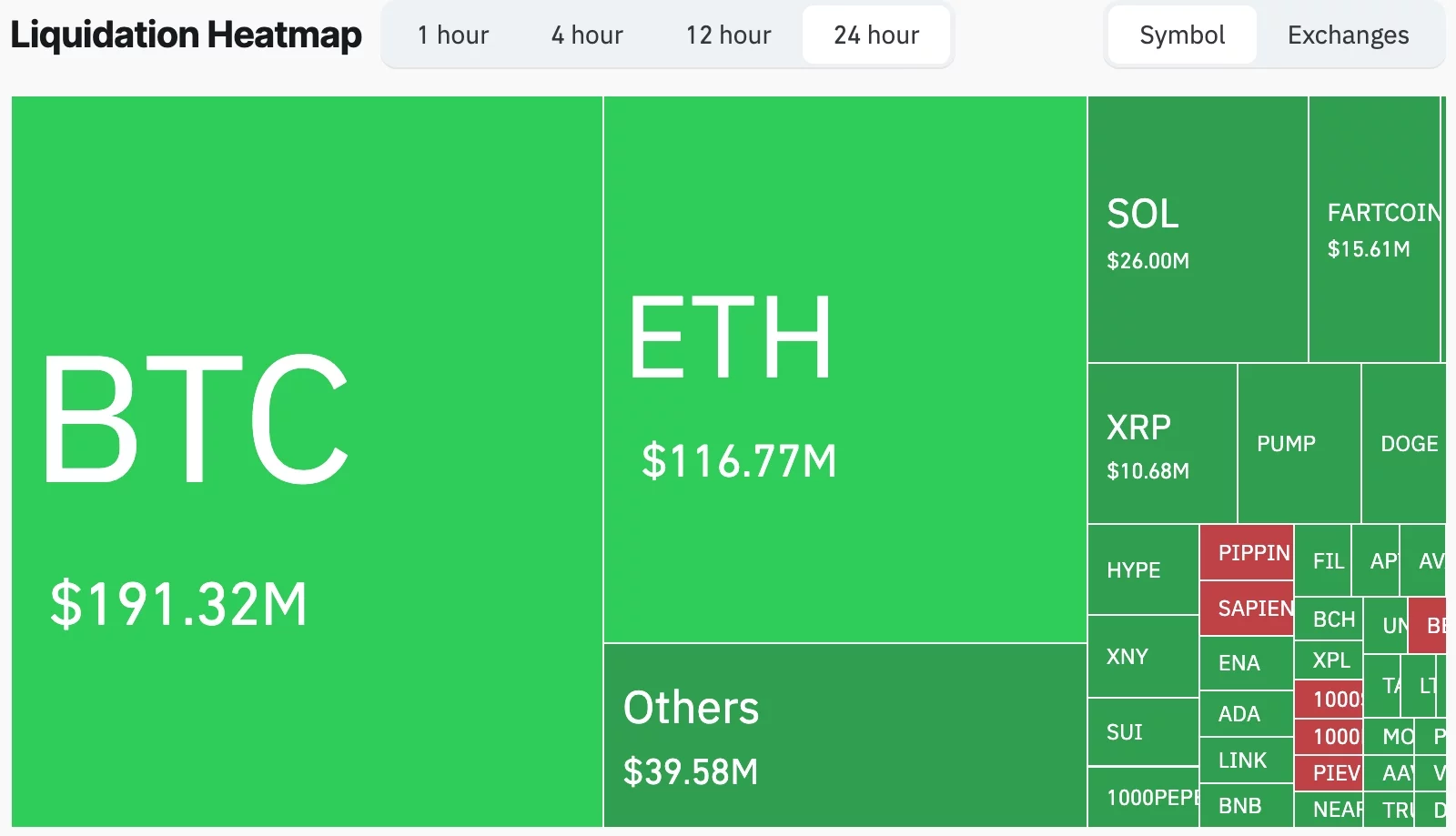

Meanwhile, total liquidations soared by over 75% from a day earlier. They rose to $491 million, with 135,667 traders being wiped out. Bitcoin liquidations rose to $191 million, while Ethereum jumped to $116 million. Some of the other top liquidated tokens were Solana, XRP, and Fartcoin.

Crypto prices normally drop sharply whenever bullish liquidations are rising because it increases the amount of selling.

The ongoing crypto market crash is happening ahead of the options expiry worth over $4.8 billion. Bitcoin positions worth over $3.5 billion will expire with a maximum pain of $91,000.

On the other hand, Ethereum options are worth over $700 million with a maximum pain of $3,050 expiring. Crypto prices often experience substantial volatility ahead of and after a major options expiry event.

The crypto market crash is also happening as investors book profits after the recent rebound, when Bitcoin rose from $80,000 to over $93,000 within less than two weeks.

Looking ahead, the next important catalyst for Bitcoin and other altcoins will be the upcoming Federal Reserve interest rate decision, which will come out on Wednesday next week.

Polymarket data shows that odds of the bank cutting rates by 0.25% have jumped to 93% from last week’s low of below 50%. While a rate cut is bullish for Bitcoin and other altcoins, the bank’s guidance may hit their performance.