Crypto markets on edge as Trump threatens historic tariff hike on China

In an unprecedented move, Trump upped the stakes in the ongoing trade war, threatening to raise tariffs on China to 104% while the crypto market remains on edge.

After the Chinese retaliation to the latest US tariff push, U.S. President Donald Trump is threatening further measures. On April 7, Trump announced on his social media platform Truth Social that China would face an additional 50% tariff if it didn’t remove countermeasures.

Notably, China introduced 34% retaliatory tariffs on all US goods, mirroring the same measure by the United States. Now, Trump has given China an ultimatum to remove its retaliatory tariffs by April 8, or face new measures.

“If China does not withdraw its 34% increase above their already long term trading abuses by tomorrow, April 8th, 2025, the United States will impose ADDITIONAL Tariffs on China of 50%, effective April 9th.” Donald Trump

The combined tariffs on Chinese imports to the United States are currently 54%, taking into account existing tariffs plus Trump’s new measures. If the new tariff takes effect, Chinese goods would face tariffs of 104%. For specific goods, like automobiles and electronics, the tariff rates would be even higher.

Trade war escalates with Trump’s latest threat to China

Since the April 2nd “Liberation Day” announcement, average US tariffs on foreign goods rose to 18.8%. This is the highest level since the Smoot-Hawley Act of 1930, which caused major concern in both stock and crypto markets.

Crypto markets lost $1 trillion in value since February, as risk-off sentiment dominated the markets. Namely, traders fear a rise in inflation, a fall in growth, and employment due to the economic effects of tariffs.

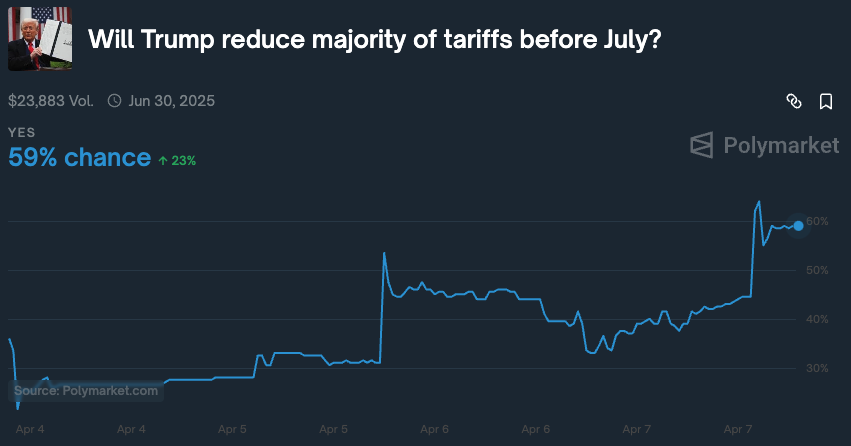

Still, it is not clear how long these tariffs will last, and what the long-term rates would be. Notably, 59% of the traders on Polymarket expect that Trump will reduce the majority of tariffs by July. Just one day prior, on April 6, these odds were at just 33%.

Following the newsof , Bitcoin (B) spiked to a daily high of $81.119, before dropping to $78,321.

Some traders hope that Trump’s tariffs are a bargaining tool rather than a long-term measure. This scenario became more likely once Trump hinted at a possible 90-day pause on all tariffs, except on China, as trading negotiations are ongoing.