Crypto markets were in red for a week: navigating April’s storm

As April ends, the crypto market has declined, with major players like bitcoin (BTC) and ethereum (ETH) experiencing substantial slumps.

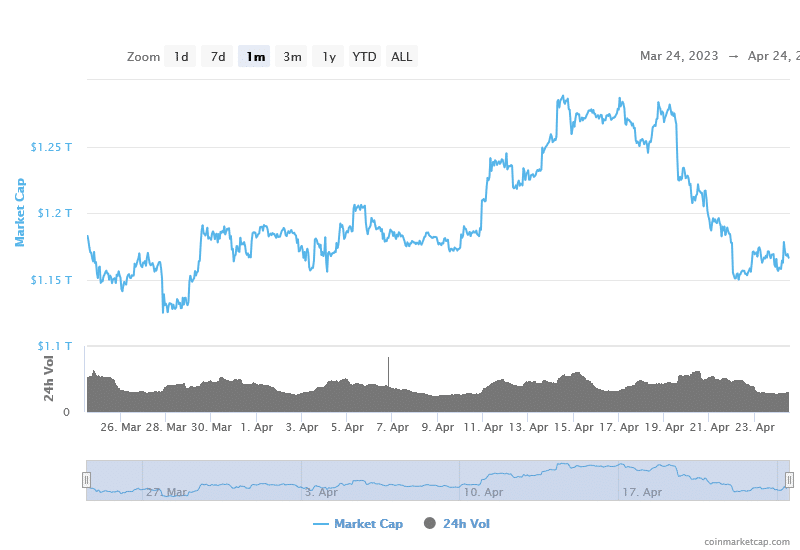

As of April 24, the global crypto market cap has shrunk to $1.6 trillion, down about 1.3% in the last 24 hours.

Let’s dive deep into the factors contributing to the market’s decline and its implications for the future.

Markets in red

As of April 24, BTC’s market price is $27,677, erasing all monthly gains and returning to late March levels. BTC has declined nearly 8% in the last seven days, marking one of the most significant slumps this year.

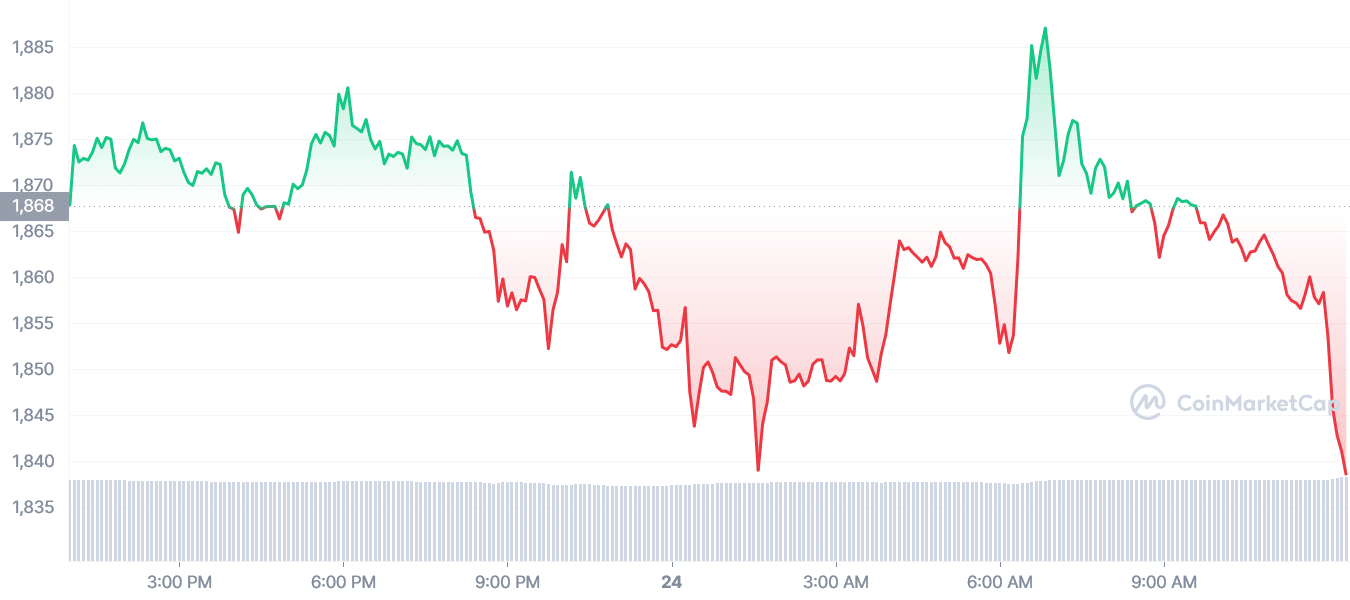

ETH has taken an even harder hit, with its CMP at $1,857, down from its 90-day high of $2,137. In the past week, ETH has declined by 11.5%.

Meanwhile, injective protocol (INJ) and woo network (WOO) suffered 30% and 23% slumps, respectively, trading at $6.69 and $0.24, respectively.

What’s causing the slump

Bitcoin prices enjoyed a profitable first quarter in 2023, boasting year-to-date (YTD) gains of over 67%.

However, April has proven less favorable, with bitcoin’s price falling aggressively during the month. Bearish speculation has returned as bullish sentiment dissipates.

One of the reasons could be Coinbase‘s potential exit from the US market due to unclear crypto guidelines and the regulatory crackdown that might have negatively affected the crypto market over the weekend.

Meanwhile, three of the US-based exchanges, including Bittrex, Paxful, and Beaxy, have also decided to exit the US markets amid regulatory concerns, adding fuel to the fire.

Mixed predictions and fundamental data

While expert opinions on the future of crypto vary, it’s crucial to analyze underlying data such as whale activity and social dominance to predict market direction.

According to data, the trend for long-term BTC holders has reached an all-time high, signifying a major milestone and further strengthening the bullish thesis for BTC price.

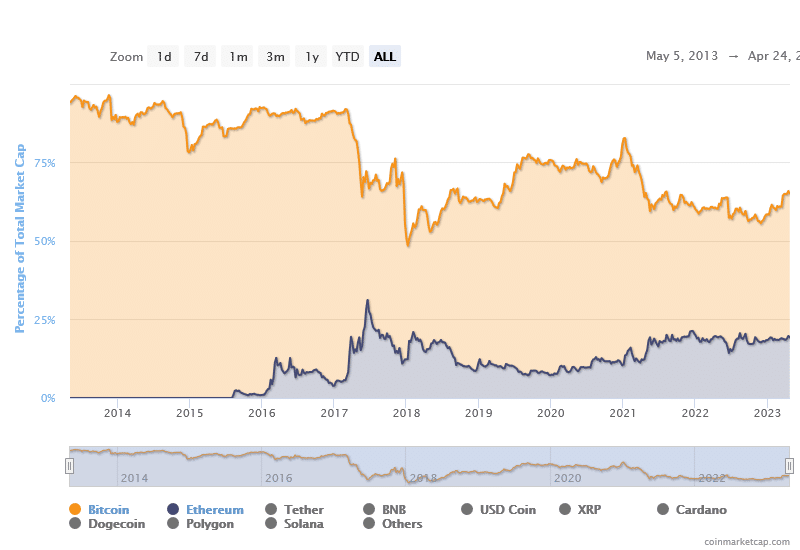

Moreover, bitcoin’s dominance has risen since the collapse of central crypto-friendly banks on March 11, which may signal a long-term bullish trend if it continues to rise.

Navigating the storm

The mixed signals from market indicators do not guarantee a bitcoin rally but don’t necessarily point to further losses.

External and internal factors can significantly impact bitcoin’s price. If market abnormalities occur, BTC may drop to $26,000, the next area of support.

Investors and traders should closely monitor macroeconomic events and crypto-industry uncertainties as they navigate the stormy April crypto market.