Crypto may see ‘more turbulence’ due to macroeconomic and global concerns, analysts say

Bitcoin and altcoins remain at risk in the short term as macroeconomic and global concerns drive market sentiment, Santiment says.

Crypto investors should brace for more turbulence ahead as major selling pressure from large Bitcoin (BTC) holders has pushed prices lower for seven straight weeks, analysts at Santiment wrote in a March 11 research report. Bitcoin has dropped from its all-time high of around $109,000 on January 19 to a low of $78,000. Santiment points to profit-taking by key stakeholders as a trigger for the decline.

“[…] when key stakeholders finally began to take profit on February 19, 2025, prices immediately began to see much steeper drop-offs. It is especially interesting to see that prices have continued to plummet (falling back to a low of $78K today) even after these high capital BTC wallets began to buy back in one week ago on March 3, 2025.”

Santiment

Macroeconomic concerns, including trade tensions linked to U.S. policies, are adding to market uncertainty, Santiment says, adding that the market “may see a bit more turbulence due to macroeconomic and global concerns, such as equity and crypto traders’ concerns related to Trump’s tariffs and an impending growing trade war.”

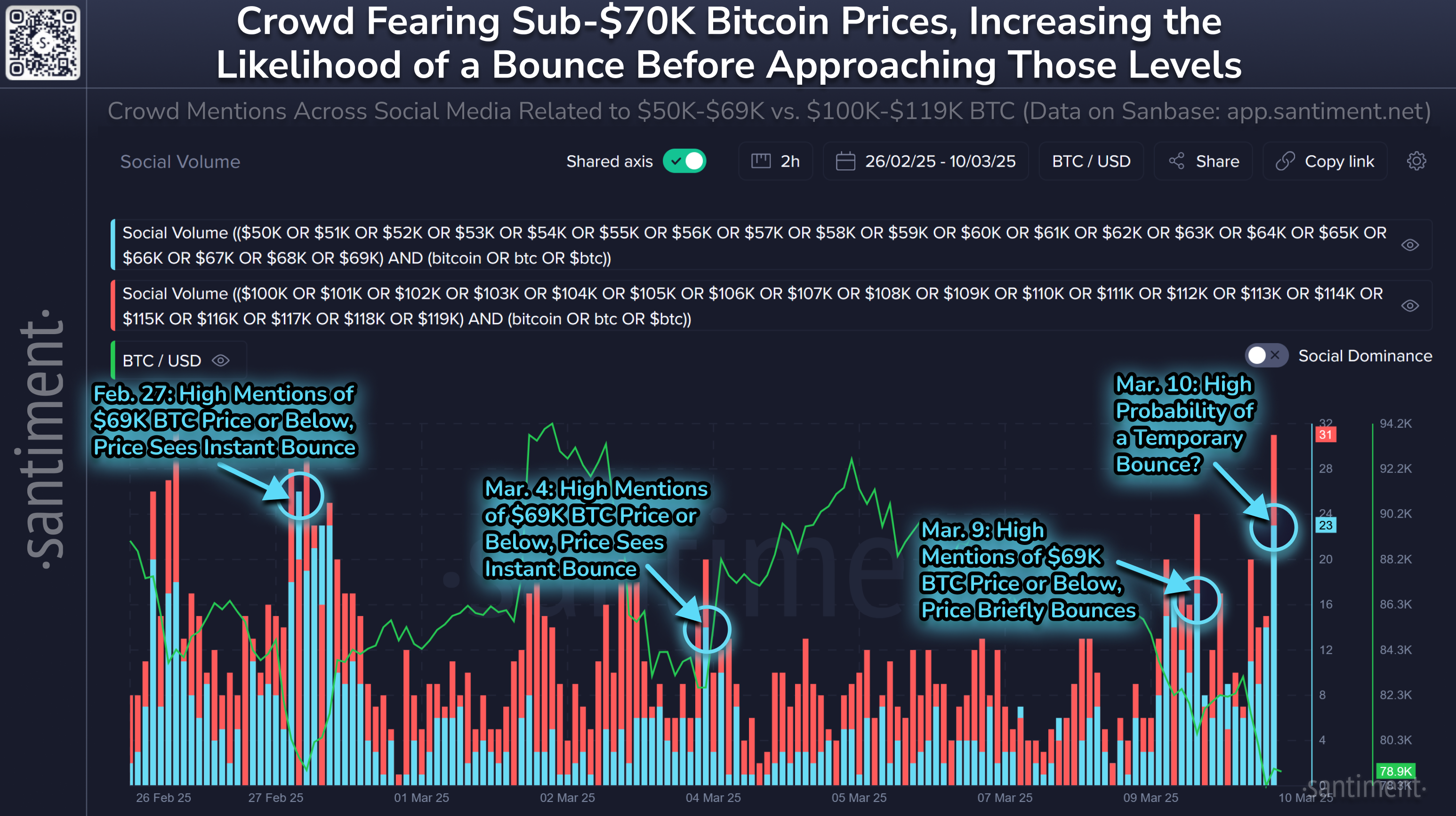

Santiment says the public appears to be expecting a drop to $69,000-$50,000, as mentions of this price range on social media have increased while prices continue to fall. Altcoins have suffered heavier losses than Bitcoin. Over the past 30 days, Ethereum (ETH) has dropped 29%, Solana (SOL) 40%, and Dogecoin (DOGE) 38%.

Despite the downturn, Santiment sees signs that long-term holders are accumulating again. The analysts say the market could start to recover when major Bitcoin holders begin buying again, traders have already taken heavy losses, and fear and uncertainty spread widely on social media.