Crypto millionaires population up 95% in one year, survey shows

The number of crypto millionaires nearly doubled in 2024, reaching 172,300 as spot Bitcoin ETFs and other crypto assets surged.

The global population of crypto millionaires has surged 95% over the past year, driven by the rise of spot Bitcoin exchange-traded funds and other cryptocurrencies, according to a new research report by New World Wealth and Henley & Partners.

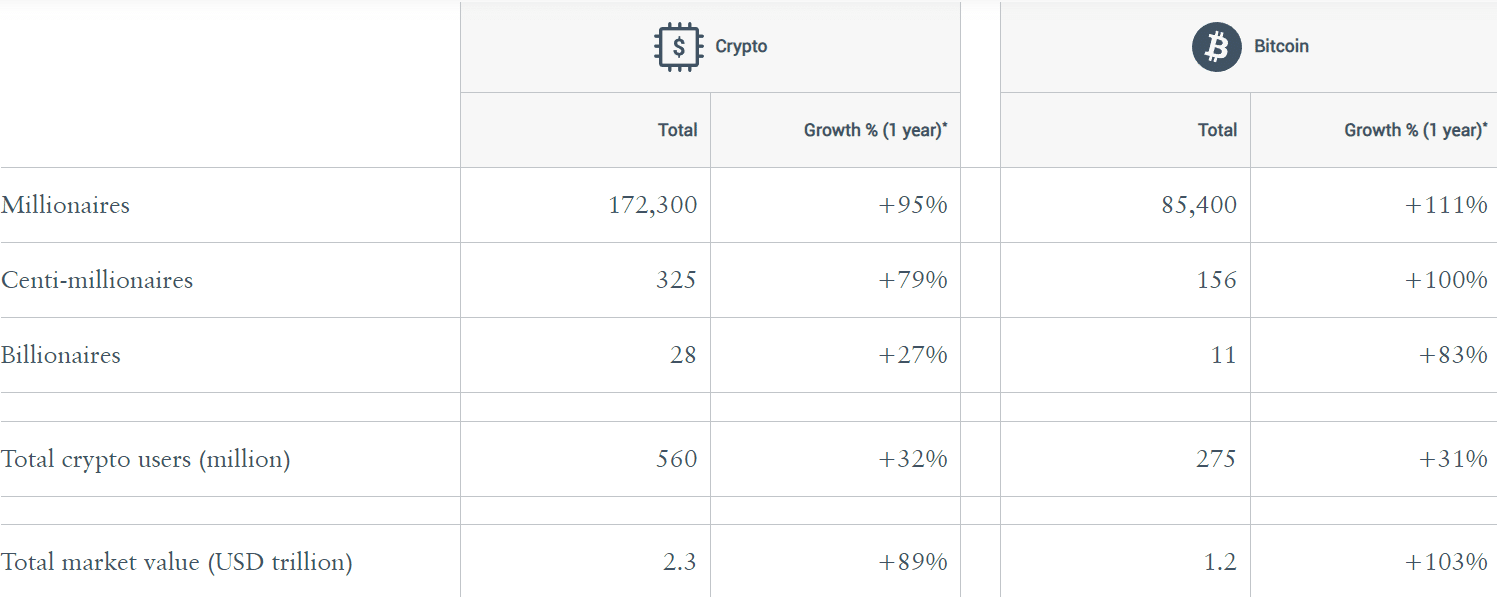

The report reveals that 172,300 individuals worldwide now hold more than $1 million in crypto, nearly doubling from 88,200 in 2023. Data shows that during the same period, the number of Bitcoin (BTC) millionaires more than doubled to 85,400.

Crypto wealth has also expanded significantly, with 325 individuals now classified as crypto centimillionaires —those holding $100 million or more in crypto — and 28 crypto billionaires. The report attributes such a rapid surge to the growth of spot Bitcoin ETFs, which have amassed over $50 billion in assets since their January launch, igniting a surge in institutional participation.

Commenting on the data in an interview for CNBC, New World Wealth’s head of research Andrew Amoils pointed out that of the six new crypto billionaires created in 2023, five owe their wealth to Bitcoin, underscoring its “dominant position when it comes to attracting long-term investors who buy large holdings.”

Investors seeking crypto friendly countries

Crypto is reshaping not just wealth but also the demographics of where the rich live and work. Analysts at Henley & Partners note that many newly wealthy crypto individuals are seeking to relocate to tax-friendly and crypto-friendly jurisdictions, saying they have seen a “significant uptick in crypto-wealthy clients seeking alternative residence and citizenship options.

To rank countries based on their tax and regulatory environments, Henley & Partners developed an index, placing Singapore in the top spot due to its “supportive banking system, significant investment, comprehensive regulations such as the Payment Services Act, regulatory sandboxes, and alignment with global standards.”

Following Singapore, Hong Kong ranks second, with the United Arab Emirates and the U.S. also among the top destinations.