Crypto news today: rally at risk as top Fed sends major warning

The crypto market tilted upward today, Sept. 29, as investors started to buy the dip after last week’s plunge. However, this rally could be at risk after a major warning from Beth Hammack, a senior Fed official.

- Cleveland Fed’s Beth Hammack has warned about inflation and interest rate cuts.

- Aster has passed Hyperliquid as the biggest perpetual DEX in terms of volume.

- Stablecoin market capitalization is nearing the $300 billion market cap.

Crypto news today: Beth Hammack warns on inflation

One of the top catalysts for the crypto market recently has been the Federal Reserve, which has started cutting interest rates. However, the pace of cuts may not be as analysts expect, as some Fed officials are still concerned about inflation.

Speaking in a CNBC interview, Beth Hammack of the Cleveland Fed warned that inflation was still a major challenge. She noted that headline and core inflation have remained above the 2% target for four and a half years.

Hammack also believes that the labor market is still strong despite the recent weakness. She cited the unemployment rate, which has remained below 5% this year.

The statement came a few days before the Bureau of Labor Statistics publishes the official jobs numbers. Economists expect the data to reveal that the economy created 59,000 jobs in September after adding 22,000 in the previous month.

Therefore, the crypto market could be at risk if the Federal Reserve slows the pace of interest-rate cuts.

Aster and Lighter overtake Hyperliquid

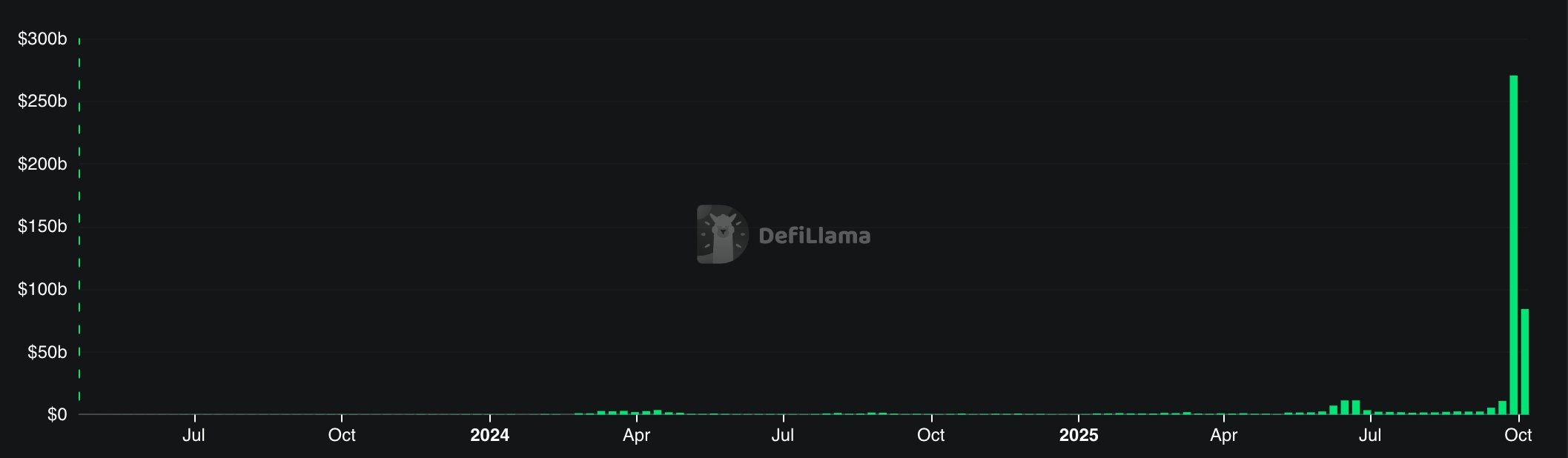

Another important crypto news today is that Hyperliquid is facing substantial competition pressure from Aster and Lighter. Data compiled by DeFi LLama shows that Aster, which is backed by Changpeng Zhao, handled over $84 billion in volume in the last 24 hours, higher than the $5.6 billion that Hyperliquid handled. This volume brought its 30-day volume to $290 billion, higher than Hyperliquid’s $279 billion.

Lighter handled transactions worth over $7.18 billion in the last 24 hours.

Still, it is unclear whether this data is accurate, as it notes that Aster handled $270 billion in volume last week, up from $10 billion a week earlier.

The data also show that Aster’s total value locked jumped to $2.26 billion, up from $346 million on Sept. 1.

Stablecoin supply nears $300b

Another key crypto news is that the amount of stablecoins in circulation is soaring and is about to hit $300 billion.

The supply jumped by $4.15 billion in the last seven days. Tether maintains the biggest market share at $174 billion, while USDC has $73 billion. The other biggest players in the sector are Ethena USDe, Dai, Sky Dollar, and World Liberty Finance’s USD1. This stablecoin growth will likely accelerate after the U.S. passed theGENIUS Act.