Crypto OTC spot trades boomed 95% in H1 2024: report

Institutional demand for crypto OTC services and other enterprise offerings has surged alongside digital asset prices and the arrival of Wall Street.

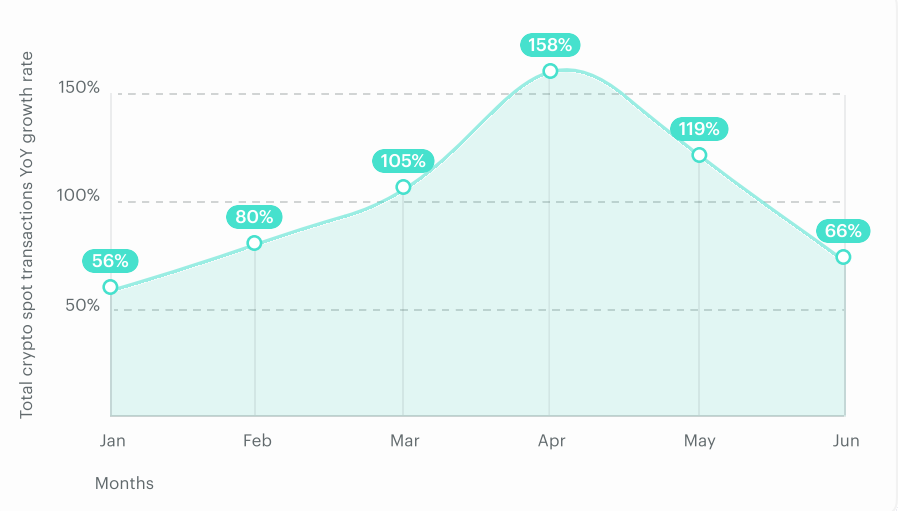

According to Finery Markets, institutional over-the-counter (OTC) spot transaction volume jumped by around 95% year-over-uear in the first six months of 2024. The data was analyzed from over two million trades executed via brokers, OTC desks, and hedge funds, among others.

Massive growth was noted during this year’s second quarter. Volume increased 110% year-on-year (YoY) in Q2 and peaked at 158% in April.

Bitcoin rally spurred Institutional crypto interest

At the time, spot Bitcoin (BTC) ETFs had traded for over three months, and Bitcoin had raced to a new all-time high in March. Speculation around spot Ethereum (ETH) ETFs also gripped crypto markets as the next move for Wall Street stakeholders.

Finery Markets analysts stated that BTC’s ATH charge and spot ETF flows most likely galvanized institutional demand for crypto products. More is expected on this front, as the impacts of ETF markets typically take up to nine months for TradFi players to fully adopt new offerings.

Interest in blockchain-based digital assets appears evident as crypto-to-crypto trade rose 50% year-over-year, while crypto-to-fiat activity plunged 12% since the year began.

The trend indicates that investors have stayed within the nascent industry despite recent volatility and short-term price actions. Stablecoins also took a piece of the pie. Per Finery Markets, fiat-pegged tokens like Tether’s USDT nearly tripled in transaction volume year-over-year

Ethereum ATH inevitable

Experts from the capital markets data provider predict Ethereum will see similar price strength as Bitcoin did following spot BTC ETF approvals in January.

Institutions are already anticipating the green light for spot Ether ETFs before summer’s end, as U.S. Securities and Exchange chair Gary Gensler suggested during a June Congressional hearing. ETF veterans like Eric Balchuns also surmised that spot Ethereum funds will debut as soon as next week. Ahead of the widely anticipated development, Ethereum trading volumes have ascended around 32%