Crypto sheds $400 billion in a week as Uptober nears — “worst case is $50K BTC”

Can Uptober’s bullish history overcome a $400 billion drawdown, Trump’s tariff shock, and a looming $22 billion options expiry testing fragile support?

- Crypto lost $400 billion in market value from Sep. 18 to 26, pressured by liquidations, fading ETF inflows, and hawkish macro signals.

- Bitcoin slipped from its August high of $124,128 to about $109,000, while Ethereum retreated 22% from its $4,945 peak.

- Uptober’s bullish history of 21% average gains faces challenges from Trump’s new tariffs and $22 billion in quarterly options expiry.

- Analysts outline recovery, retracement, or consolidation scenarios, with support around $101K–112K key, while cautioning the market remains overheated and vulnerable to shocks.

Table of Contents

A $400 billion slide puts crypto’s summer rally to the test

Crypto markets have endured one of their most volatile stretches in recent memory. From Sep. 18 to 26, total market cap slipped from about $4.12 trillion to roughly $3.72 trillion, erasing close to $400 billion in value in just seven days.

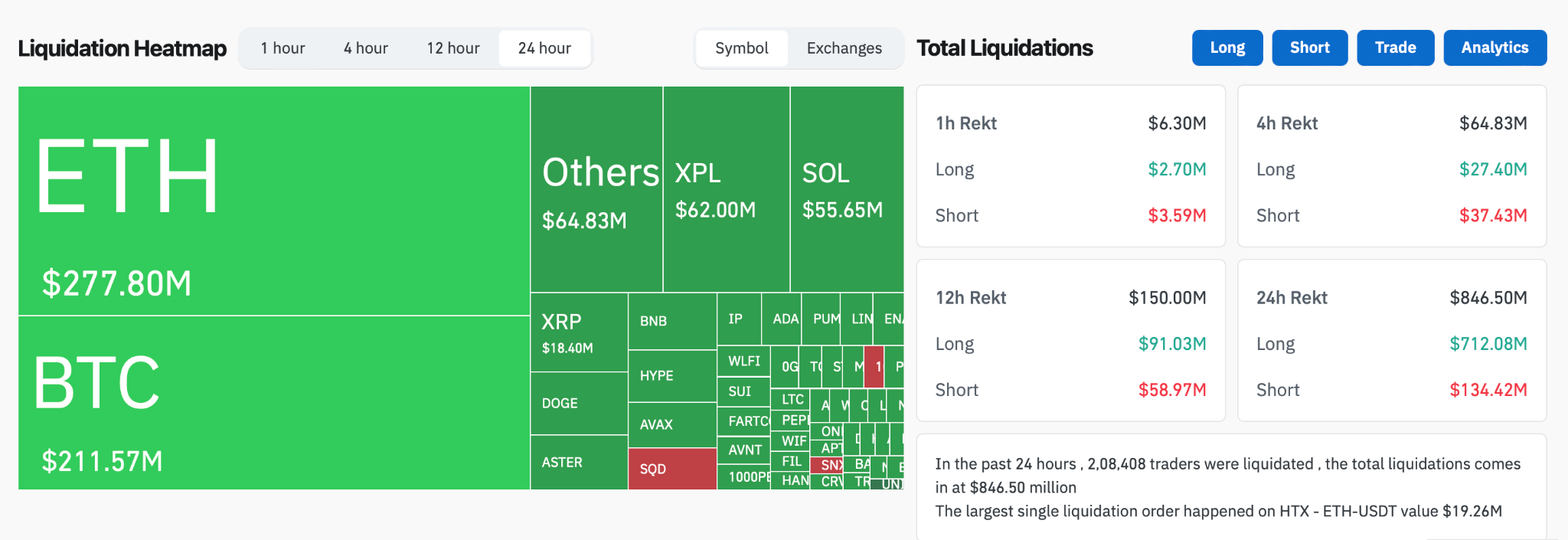

The decline extended beyond spot markets, with CoinGlass reporting about $850 million in derivative liquidations over a 24-hour span as of Sep. 26.

Long positions bore the brunt at $712 million, while shorts accounted for $134 million. Ethereum (ETH) made up about 32% of these losses, Bitcoin (BTC) about 25%, and the remainder spread across altcoins.

Bitcoin, which set a record high of $124,128 in mid-August, now trades around $109,000, a retreat of roughly 12% from its peak. Ethereum has seen an even steeper pullback, falling about 22% from its August high near $4,945 to around $3,880 at present.

These corrections unfolded against a backdrop of shifting macroeconomic signals. In mid-September, investor confidence wavered as the Federal Reserve maintained a hawkish tone, inflation data came in stronger than expected, and the U.S. dollar pushed higher.

On Sep. 25, Reuters reported that upbeat U.S. growth figures further boosted the dollar and challenged expectations that rate cuts were imminent. Equities also lost momentum, creating additional headwinds for digital assets as funds moved into safer positions.

Analysts described the downturn less as a collapse of fundamentals and more as a liquidity squeeze. With leverage built up in long positions, a shift in sentiment quickly triggered forced unwinding and amplified the speed of the sell-off.

The timing of the drawdown also plays into seasonal tendencies. September is historically one of crypto’s weaker months, yet this year it is holding up better than expected, with gains of just over 1% compared with an average decline of about 3.4%.

Even with the current drawdown, Bitcoin remains on track to close the third quarter with returns above 2%, its strongest Q3 since 2022, which raises questions about whether October, often called Uptober, can deliver its usual rebound.

Long-term holders take profits while ETF inflows slow

On-chain indicators show that seasoned investors have begun locking in profits. Glassnode estimates that long-term holders have recently realized about 3.4 million BTC from gains, a level of distribution that often signals cooling momentum.

This selling pressure follows three distinct waves of inflows earlier in the year that lifted Bitcoin’s realized cap by $678 billion, nearly double the increase seen in the previous cycle.

The supply and demand balance has also shifted. ETF inflows, which had previously acted as a steady absorber of new supply, have slowed.

As a result, spot markets saw heavy volumes from forced selling, futures endured large-scale deleveraging, and options pricing tilted toward downside risk.

Market sentiment has softened as well. The Fear and Greed Index dropped to 28 on Sep. 26 from about 52 over the past week.

Despite the pressure, structural growth has not slowed. Chainalysis’ 2025 Global Adoption Index shows Asia-Pacific leading with a 69% increase in on-chain value received over the past year.

Ethereum developers are preparing for the Fusaka upgrade, scheduled for Dec. 3. Testnets across Holesky, Sepolia, and Hoodi are planned for October.

The update aims to improve efficiency, enable state pruning, and potentially reduce gas fees, which could boost confidence in both Ethereum and related layer-2 ecosystems.

Institutional and corporate interest is another strong theme in 2025. More than 200 companies have announced plans to add crypto to their treasuries. Regulators, particularly in the U.S., are monitoring this trend for disclosure and insider trading concerns.

Meanwhile, stablecoin issuers are pursuing scale. Reports indicate that Tether is exploring a capital raise of $15–$20 billion, a move that would lift its valuation toward $500 billion and place it among the largest privately held financial companies worldwide.

Uptober optimism meets Trump’s tariff risks

October has traditionally been a month of optimism in crypto markets. Historical backtests show that Bitcoin has delivered average gains of about 21% in October, making it one of the strongest months of the year, second only to November. Yet in 2025 that optimism faces more obstacles than usual.

On Sep. 25, President Trump announced a new round of tariff escalations scheduled to take effect on Oct. 1. The measures include 100% tariffs on pharmaceuticals, 50% on kitchen cabinets and bathroom vanities, 30% on upholstered furniture, and 25% on heavy trucks.

Exemptions are available for pharmaceutical firms with U.S. production facilities. In parallel, Trump floated the idea of cutting interest rates toward 2%. While the policy is being presented as a national security initiative, markets interpreted it as an escalation in trade frictions.

Early reactions were visible in Asia and Europe, where pharmaceutical stocks sold off on fears of 100% import duties. The concern is that rising trade barriers could weigh on risk appetite and divert capital away from high-beta assets such as crypto.

A recent precedent offers a sense of how markets might react. On Apr. 2, Trump announced the “Liberation Day” tariffs, a broad package of reciprocal duties intended to reset trade balances.

The outcome was a sharp drop in global equities, an uptick in volatility, and stress in sectors tied to industrials and technology. Crypto also lost momentum during that period as investors pulled back from risk.

Analysts caution that a repeat of those conditions remains possible if the newly announced tariffs escalate further or if major trading partners respond with countermeasures.

Another near-term factor is the expiry of quarterly options. Estimates from multiple sources, including Deribit data, indicate that $22 billion worth of Bitcoin and Ethereum options are set to expire on Sep. 26.

Such expiries can amplify volatility because large notional positions force dealers and traders to adjust hedges around key price levels. Quarter-end expiries are often more influential, and with support zones already under pressure, hedging flows and liquidity rotations could accelerate moves in either direction.

Analysts remain split, but overheating keeps risk elevated

Analysts are divided on what comes next for Bitcoin. Market analyst Ansem outlined three scenarios, assigning a 60% probability to a gradual recovery path beginning in 2026, a 20% probability to a deeper correction toward the $80,000–90,000 range, and a 15% probability to an earlier breakout.

He also flagged a severe recession as a tail risk, estimating just a 5% chance that prices could fall as low as $50,000.

Meanwhile, analyst Ted Pillows noted that Bitcoin is holding just above its support region. If that base remains intact, he sees scope for a rally toward $112,000. A breakdown, however, could bring a retest of the $101,000 level before any reversal attempt.

Historical comparisons are also shaping sentiment. James Van Straten pointed to September 2024, when Bitcoin dropped 11%, moved sideways for two weeks, and then broke higher in mid-October.

He noted that the rebound hinged on the market holding its September low, a factor traders are watching closely again.

The common thread is that the market remains overheated after a year of strong inflows, leaving conditions vulnerable to shocks from macro or policy shifts. You should approach current conditions with caution and avoid committing more than you can afford to lose.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.